预约演示

更新于:2026-02-26

Zerlasiran

更新于:2026-02-26

概要

基本信息

非在研机构- |

权益机构- |

最高研发阶段临床3期 |

首次获批日期- |

最高研发阶段(中国)- |

特殊审评- |

登录后查看时间轴

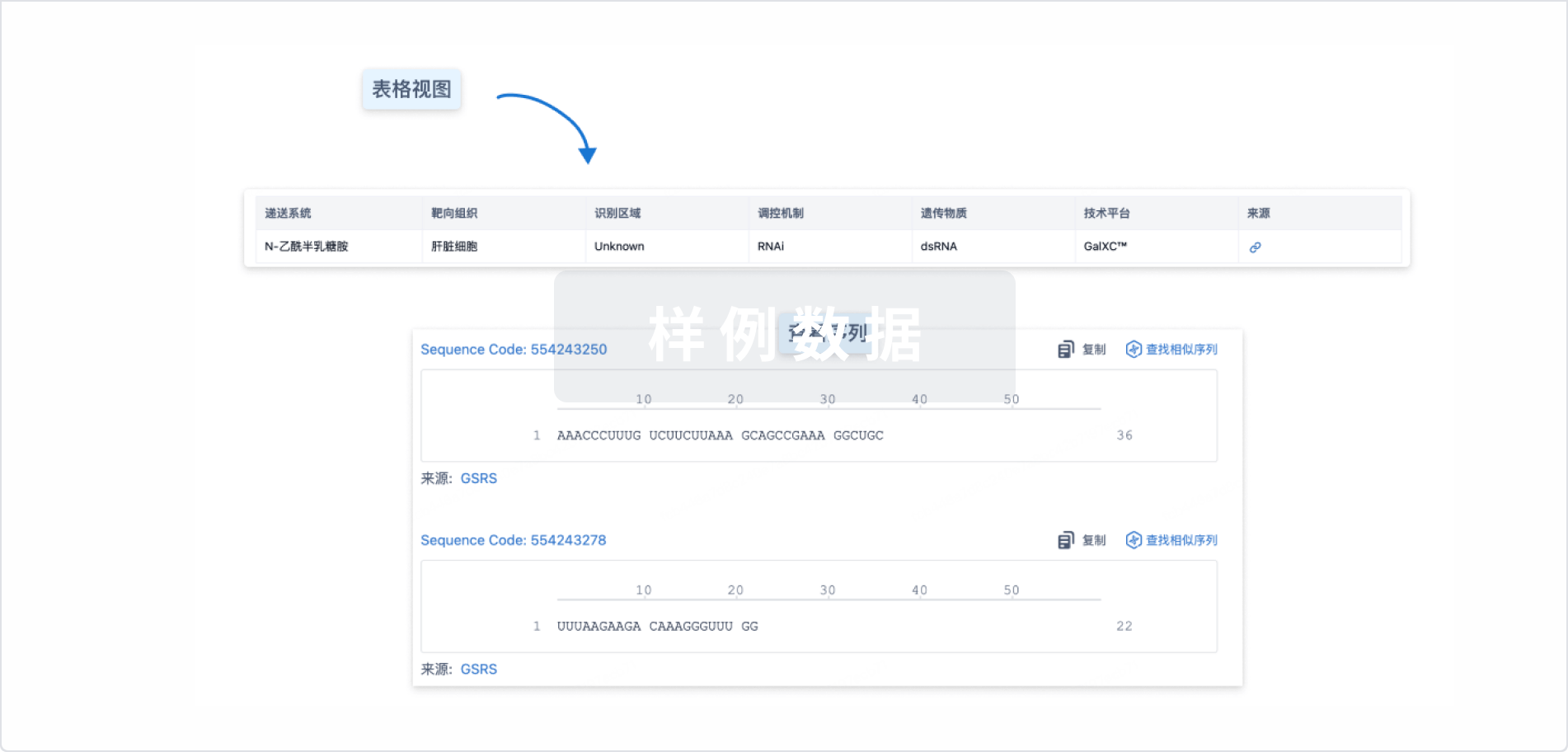

结构/序列

使用我们的RNA技术数据为新药研发加速。

登录

或

Sequence Code 452929085

来源: *****

Sequence Code 452929086

来源: *****

关联

3

项与 Zerlasiran 相关的临床试验JPRN-jRCT2051240068

A Trial to Evaluate the Pharmacokinetics, Pharmacodynamics, and Safety and Tolerability of Zerlasiran in Japanese Subjects With Elevated Serum Lipoprotein(a)

开始日期2024-05-16 |

申办/合作机构- |

NCT05537571

A Multi-centre, Randomised, Double-blind, Placebo-controlled, Phase 2 Study to Investigate Efficacy, Safety and Tolerability of SLN360 in Participants With Elevated Lipoprotein(a) at High Risk of Atherosclerotic Cardiovascular Disease Events

Phase 2 study to evaluate the efficacy, safety and tolerability of SLN360 administered subcutaneously (SC) compared with placebo in adult participants with elevated lipoprotein(a) at high risk of atherosclerotic cardiovascular disease events

开始日期2022-12-13 |

申办/合作机构 |

NCT04606602

A Randomised, Double-blind, Placebo Controlled, First-in-human Study to Investigate the Safety, Tolerability, Pharmacokinetic and Pharmacodynamic Response of SLN360 in Subjects With Elevated Lipoprotein(a)

This study will investigate the safety and tolerability of SLN360 in patients with elevated Lp(a).

开始日期2020-11-18 |

申办/合作机构 |

100 项与 Zerlasiran 相关的临床结果

登录后查看更多信息

100 项与 Zerlasiran 相关的转化医学

登录后查看更多信息

100 项与 Zerlasiran 相关的专利(医药)

登录后查看更多信息

9

项与 Zerlasiran 相关的文献(医药)2025-12-01·Current Atherosclerosis Reports

Highlights of Cardiovascular Disease Prevention Studies Presented at the 2024 American Heart Association Scientific Sessions

Review

作者: Murthy, Nikitha ; Khoja, Adeel ; Inam, Maha ; Epstein, Elizabeth ; Virani, Salim S ; Sheikh, Sana ; Vaughan, Elizabeth ; Mehta, Sandeep ; Minhas, Abdul Mannan Khan ; Slipczuk, Leandro ; Junaid, Vashma ; Chai, Zohar ; Hinkamp, Colin ; Hermel, Melody

PURPOSE OF REVIEW:

Focused review highlighting ten select studies presented at the 2024 American Heart Association (AHA) Scientific Sessions.

RECENT FINDING:

Included studies assessed effects of intensive blood pressure control in patients with type 2 diabetes (BPROAD); decision support system for physicians to optimize early lipid lowering therapies after acute coronary syndrome (ZODIAC); efficacy and safety of zerlasiran, a short interfering RNA targeting lipoprotein(a) (ALPACAR); efficacy and safety of muvalaplin an oral disrupter of the assembly of lipoprotein(a) particles (KRAKEN); safety and efficacy of obicetrapib in patients with heterozygous familial hypercholesterolemia (BROOKLYN); efficacy and safety of lerodalcibep, a third generation PCSK9 inhibitor in heterozygous familial hypercholesterolemia subjects (LIBerate-HeFH_OLE); personalized app-based coaching to improve physical activity in patients with HFpEF compared to standard care (MyoMobile); semaglutide to improve cardiovascular outcomes in patients with a history of coronary artery bypass surgery and overweight or obesity (the SELECT trial); efficacy and safety of plozasiran in adults with genetically or clinically defined familial chylomicronemia syndrome at high risk of acute pancreatitis (PALISADE); and transcriptomic signatures and predictors of evolocumab added to maximum statin therapy based on intra-coronary plaque characteristics (YELLOW III). Research presented at the 2024 AHA Scientific Sessions emphasized innovative strategies in cardiovascular disease prevention and management.

2025-06-01·DIABETES OBESITY & METABOLISM

Comprehensive evaluation of

siRNA

therapeutics on Lp(a): A network meta‐analysis

Review

作者: Hu, Jiaqiang ; Wang, Xingjin ; Qin, Xiaoli ; Liu, Song ; Zhao, Chen

Abstract:

Aims:

To evaluate the efficacy and safety of siRNA drugs that lower Lp(a) in patients with dyslipidaemia.

Materials and Methods:

A network meta‐analysis and systematic review were conducted to compare siRNA drugs targeting Lp(a), based on relevant randomized controlled trials (RCTs). A comprehensive search was performed in PubMed, Embase, Web of Science and the Cochrane Library (up to October 24, 2024). RCTs with an intervention duration of at least 12 weeks were included. Eligible studies compared siRNA drugs that reduce Lp(a), including both Lp(a)‐targeted and non‐targeted agents, with placebo or other siRNA drugs that reduce Lp(a). The primary outcomes were the percentage reduction and absolute reduction in Lp(a), percentage reduction in low‐density lipoprotein cholesterol (LDL‐C), percentage reduction in apolipoprotein B (apo(B)), adverse events and serious adverse events, including injection‐site reactions. The risk of bias was assessed using the Cochrane Risk of Bias Tool (ROB2), and a random‐effects network meta‐analysis was performed using the frequentist approach. Confidence in effect estimates was evaluated using the Confidence In Network Meta‐Analysis (CINeMA) framework.

Results:

A total of 14 trials involving 5646 participants were included. Lp(a)‐targeted siRNA agents, particularly Olpasiran, demonstrated strong efficacy in significantly reducing Lp(a) levels, with the greatest percentage reduction in Lp(a) (mean difference [MD]: −92.06%; 95% CI: −102.43% to −81.69%; P‐score: 0.98). Olpasiran also showed the greatest absolute reduction in Lp(a) (MD: −250.70 nmol/L; 95% confidence interval [CI]: −279.89 to −221.50; P‐score: 0.99). Certain non‐Lp(a)‐targeted siRNA agents, such as inclisiran and zodasiran, also showed modest reductions in Lp(a) levels, reducing Lp(a) by approximately 15%. Lp(a)‐targeted siRNA agents reduced LDL‐C by more than 20% and decreased apo(B) by approximately 15%. In terms of safety, most drugs exhibited favourable safety profiles with no significant differences compared to placebo. However, zerlasiran raised concerns regarding injection‐site reactions and other adverse events when compared to placebo.

Conclusions:

Lp(a)‐targeted siRNA agents have shown robust effectiveness in substantially reducing Lp(a) levels, including both percentage and absolute reductions, with moderate improvements in LDL‐C and apo(B) concentrations. Non‐Lp(a)‐targeted siRNA agents also demonstrate modest reductions in Lp(a) levels. The safety profile is generally favourable, but zerlasiran and inclisiran may increase the incidence of injection‐site reactions.

2024-12-17·JAMA-JOURNAL OF THE AMERICAN MEDICAL ASSOCIATION

Zerlasiran—A Small-Interfering RNA Targeting Lipoprotein(a)

Article

作者: Schwartz, Gregory G. ; Ray, Kausik K. ; Rambaran, Curtis ; Troquay, Roland ; Dorresteijn, Jannick A. N. ; Nicholls, Stephen J. ; Stroes, Erik S. G. ; Rider, David A. ; Wang, Qiuqing ; Navar, Ann Marie ; Szarek, Michael ; Fok, Henry ; Nissen, Steven E. ; Wolski, Kathy ; Romano, Steven

Importance:

Elevated lipoprotein(a) increases the risk of atherosclerotic cardiovascular disease (ASCVD) and aortic stenosis.

Objective:

To evaluate the effects of zerlasiran, a small-interfering RNA targeting hepatic synthesis of apolipoprotein(a), on lipoprotein(a) serum concentration.

Design, Setting, and Participants:

A multicenter trial in patients with stable ASCVD with serum lipoprotein(a) concentrations greater than or equal to 125 nmol/L at 26 sites in Europe and South Africa between January 3, 2023, and April 27, 2023, with last follow-up on July 1, 2024.

Interventions:

Participants randomized to receive a subcutaneous dose of placebo every 16 weeks for 3 doses (n = 23) or every 24 weeks for 2 doses (n = 24) or zerlasiran 450 mg every 24 weeks for 2 doses (n = 45), 300 mg every 16 weeks for 3 doses (n = 42), or 300 mg every 24 weeks for 2 doses (n = 44).

Main Outcome and Measures:

The primary outcome was the time-averaged percent change in lipoprotein(a) concentration from baseline to 36 weeks, with follow-up to 60 weeks.

Results:

Among 178 patients, mean (SD) age was 63.7 (9.4) years, 46 (25.8%) were female, with a median (IQR) baseline lipoprotein(a) concentration of 213 (177-282) nmol/L; 172 patients completed the trial. Compared with the pooled placebo group, the least-squares mean time-averaged percent change in lipoprotein(a) concentration from baseline to week 36 was −85.6% (95% CI, −90.9% to −80.3%), −82.8% (95% CI, −88.2% to −77.4%), and −81.3% (95% CI, −86.7% to −76.0%) for the 450 mg every 24 weeks, 300 mg every 16 weeks, and 300 mg every 24 weeks groups, respectively. Median (IQR) percent change in lipoprotein(a) concentration at week 36 was −94.5% (−97.3% to −84.2%) for the 450 mg every 24 weeks group, −96.4% (−97.7% to −92.3%) for the 300 mg every 16 weeks group, and −90.0% (−93.7% to −81.3%) for the 300 mg every 24 weeks group. The most common treatment-related adverse effects were injection site reactions, with mild pain occurring in 2.3% to 7.1% of participants in the first day following drug administration. There were 20 serious adverse events in 17 patients, none considered related to the study drug.

Conclusions:

Zerlasiran was well-tolerated and reduced time-averaged lipoprotein(a) concentration by more than 80% during 36 weeks of treatment in patients with ASCVD.

Trial Registration:

ClinicalTrials.gov Identifier: NCT05537571

126

项与 Zerlasiran 相关的新闻(医药)2026-02-11

·今日头条

来源:市场资讯

(来源:财信证券研究)

小核酸药物优势明显,有望引领治疗范式升级。小核酸药物基于碱基互补配对原则作用于细胞内的pre-mRNA或mRNA,通过调控蛋白质的表达,从而实现治疗疾病的目的。相比于小分子和抗体药物,小核酸药物具有靶点丰富、特异性强、安全性更高、疗效更久、研发成功率高等优点,有望成为继小分子和抗体之后具有颠覆性的新主流疗法。

小核酸药物肝外递送技术突破,适应症延伸至慢病领域,商业化前景广阔。递送技术对小核酸药物的有效性和安全性起着关键作用。GalNAc递送技术为肝内递送的主流策略,已成功助力6款siRNA疗法获批上市,具有皮下注射给药、作用时效长达数月、高效靶向肝脏等优势,但存在组织局限性。借鉴GalNAc递送的技术思路,Avidity、Arrowhead、Alnylam等海外小核酸龙头企业分别开发出AOC 、TRiMTM、C16等肝外递送技术,成功实现对肺部、肌肉、中枢神经、脂肪等组织的靶向,极大拓宽了小核酸药物的作用范围。伴随着肝外递送技术突破,小核酸药物适应症从罕见病延伸至降血脂、降血压、减重等慢病领域,展现出广阔的发展前景。据瑞博生物港股招股说明书中的统计及预测数据, 2024-2029年,预计全球小核酸药物市场规模由57亿美元增长至206亿美元,期间复合增速约为29.40%。此外,小核酸药物交易活跃度提高,并诞生多笔重磅交易。例如,2025年10月,诺华以120亿美元收购AOC(抗体偶联寡核苷酸)领域的龙头企业Avidity Biosciences;2025年9月,诺华再次携手舶望制药,就多项心血管靶点siRNA资产展开合作,总交易金额超过53亿美元。

国内企业紧跟技术前沿,多项管线推进至临床II期。目前国内临床进展靠前的小核酸药物多为siRNA路线,多处于临床II期及以前阶段,从作用靶点来看,国内临床进展居前的小核酸药物靶点多为HBV、PCSK9、C3、ANGPTL3等。从适应症来看,国内临床进展居前的小核酸药物多集中在肝炎、心血管疾病、血脂异常、肾病等领域。从研发管线数量来看,舶望制药、瑞博生物的在研管线数量居前。

投资建议:维持医药生物行业“领先大市”评级,建议关注小核酸药物研发布局全面、产品创新程度高、研究进展靠前的药企,如恒瑞医药、悦康药业、前沿生物、信立泰等。

风险提示:产品研发及销售进展不及预期风险;行业竞争加剧风险;地缘政治风险;行业政策风险;医疗安全风险等。

1

行业简介

1.1 小核酸药物的发展历程、主要类型及作用机制

1998年,全球首款ASO药物福米韦生(Vitravene)获批,用于治疗巨细胞病毒视网膜炎,标志着小核酸疗法正式应用于临床。而早期的ASO疗法面临包括生物利用度差和脱靶效应在内的重大挑战,这限制了其临床应用。1998年,Andrew Zachary Fire和Craig Cameron Mello发现了RNAi机制(该发现于2006年获得诺贝尔奖),小核酸治疗迎来重大突破。2018年,全球首款siRNA药物Patisiran获批,标志着RNAi疗法正式落地。2019年,GalNAc偶联递送技术药物Givosiran上市,通过高效肝靶向性和缓释特性,系统性解决早期siRNA的稳定性和毒性问题。2020年,降胆固醇药物Inclisiran获欧盟批准,更将适应症从罕见病延伸至心血管慢性病领域,开辟全新市场空间。历经多年的技术发展,小核酸正迎来快速发展阶段,正成为从罕见遗传病到慢性病及癌症等多种疾病的有效治疗方式。截止目前,全球已有20余款小核酸药物获批上市。

小核酸药物,即寡核苷酸药物,是由十几个到几十个核苷酸串联组成的短链核酸,主要通过碱基互补配对原则作用于细胞内的pre-mRNA或mRNA,通过调控蛋白质的表达,从而实现治疗疾病的目的。广义的小核酸药物包括反义寡核苷酸(ASO)、小干扰核酸(siRNA)、微小RNA(miRNA)、核酸适配体(Aptamer)、小激活RNA(saRNA)、向导RNA(sgRNA)等。已获批和在研的核酸药物以ASO和siRNA、Aptamer为主。具体来看,siRNA是短双链RNA分子,当作为外源性治疗药物递送至细胞内时,可通过激活细胞内源性RNA干扰(RNAi)机制特异性降解靶标mRNA,已成为小核酸药物研发的前沿领域。ASO是单链RNA或DNA分子,可以和互补mRNA结合,通过多种机制调节蛋白质水平及功能。适配体则折叠形成特定的三维结构,以高亲和力和特异性结合靶标蛋白,从而阻断蛋白功能。

小核酸药物通过不同的机制发挥作用,调节基因表达和蛋白质水平,进而调控相应的蛋白质功能。小核酸药物的作用机制主要有以下几种:(1)基因沉默,如siRNA和miRNA可以通过与靶mRNA结合,形成RNA诱导的沉默复合物(RISC),对靶mRNA进行切割或抑制其翻译,从而实现基因沉默。(2)基因调控,ASO可以通过与靶mRNA结合,改变mRNA的剪接、稳定性或翻译效率,从而调节基因的表达。(3)免疫调节。一些小核酸药物可以通过激活或抑制免疫系统中的特定分子,调节免疫反应,发挥治疗作用。

siRNA药物的作用机制。siRNA疗法的生物学机制是荣获诺贝尔奖的RNAi机制,这是一种存在于包括人类和其他哺乳动物在内的广泛生物体中的天然基因调控机制。天然的RNAi过程涉及三个连续步骤:(1)前体RNA通过Dicer酶加工形成短双链RNA分子(20至25个核苷酸)(即微RNA),作为基因沉默的功能单元;(2)然后将这些微RNA分子装载到RNA诱导沉默复合体(RISC)中,在此实现双链解离,仅保留一条链作为引导链;(3)该引导链引导RISC结合靶mRNA,导致mRNA的翻译受到抑制并降解。前述过程称为基因沉默。通过独特的RNAi机制,siRNA疗法可通过精准设计沉默几乎任何基因,为解决过往不可成药靶点提供了重大机遇。此外,siRNA由于其基于序列的靶向机制,与其他模式相比,已经显示出多种优势,包括高特异性和(药效)长久持续,以及令人鼓舞的临床成功率。

反义寡核苷酸(ASO)的技术原理。ASO分子量较小(约18-30个核苷酸),是合成的单链核酸聚合物,可通过多种机制调节基因表达。ASO调控基因表达的途径有3种:(1)ASO与mRNA结合后,形成空间位阻,使mRNA不能再进入核糖体进行蛋白质翻译,使得这种mRNA所携带的基因信息表达下调。(2)ASO通过碱基互补配对,与靶标mRNA结合后,招募RNA酶将mRNA降解,同样使得基因表达下调。(3)主要是针对pre-mRNA在形成mRNA的过程中,ASO结合于Pre-mRNA的某个外显子区域,使得这段外显子被剪切掉,在最终生成的mRNA中不包含这段外显子。

1.2 小核酸药物优势:靶点丰富、特异性强、疗效持续时间长

相比于现有的小分子和抗体药物,小核酸药物具有靶点丰富、特异性强、安全性更高、疗效更久、研发成功率高等优点。作用靶点方面,根据弗若斯特沙利文的数据,在约20000种人类蛋白质中,传统小分子药物仅能靶向约15%的可成药蛋白。抗体药物虽在一定程度上扩展了靶向范围,但仍局限于细胞表面蛋白质,无法触及占人体蛋白质总量约80%的细胞内蛋白质。目前已获批疗法特异性靶向的人类蛋白质靶点总数不足700个。这使得绝大多数与疾病相关的蛋白质无法通过小分子药物和抗体疗法进行药物开发,即不可成药。与小分子和抗体药物相比,小核酸药物基于碱基互补配对原则以mRNA或其他RNA为靶点,作用于表达蛋白的上游过程,不受靶点成药性的限制,可选择的药物靶点更为丰富。在特异性及安全性方面,小核酸药物能够针对特定的基因序列进行干预,具有高度的特异性,这使得小核酸药物可以精准地治疗疾病,减少副作用。在疗效持续时间方面,通常来说,小分子药物的体内半衰期以小时计算,抗体药物的体内半衰期以周计算,而小核酸药物的体内半衰期以月计算,可显著降低给药频次,提高患者依从性。在研发成功率方面,小核酸药物的研发成功率更高,参考小核酸领域头部企业Alnylam的研发成功率,从临床I期到III期的累计转化率达到66.7%,相比靶向药(10.3%)和医药行业整体的研发成功率(5.7%)整整高6-12倍。伴随着技术的不断进步,小核酸药物有望成为继小分子和抗体之后具有颠覆性的新主流疗法。

2

行业发展

2.1 GalNAc为肝内递送主流策略,AOC等肝外递送技术崭露头角

小核酸药物的研发环节主要包括靶点筛选与序列设计、化学修饰、递送、合成及制剂等。其中,靶点筛选与序列设计主要是基于致病基因,设计并筛选出相对应RNA序列。小核酸药物的序列设计需同时考虑序列保守性、同源性、免疫原性、脱靶等因素,设计出合适的序列长度、核苷酸单体的含量、碱基单体的序列。化学修饰主要解决小核酸药物的不稳定、易被清除和降解、半衰期短等问题。ASO和siRNA当前主要是在磷酸骨架、核糖环、3'-和5'-末端进行化学修饰,提高其底物特异性和核酸酶抗性,并降低其毒性和免疫原性。递送系统主要是运载小核酸药物穿过细胞膜到达作用位点(胞浆或核内的mRNA),对小核酸药物的有效性和安全性起着关键作用。以siRNA为代表的小核酸具有分子量大(约14千道尔顿)、自身负电荷阻碍细胞膜穿透、容易被核酸酶降解等成药难点,需借助专门的递送系统克服前述挑战。小核酸药物递送方式主要有裸露RNA修饰递送、脂质体纳米递送(LNP)、GalNAc(N-乙酰半乳糖胺)递送等。

LNP是由功能性脂质、聚乙二醇修饰的脂质(PEGylated lipids)、饱和磷脂(DSPC)、和胆固醇构成的稳定纳米颗粒。功能性脂质为可电离的阳离子脂质体,在细胞渗透和释放中起到关键作用,是LNP成功开发的核心所在。聚乙二醇修饰的脂质的功能主要为:防止纳米颗粒在储存过程中和血液中的聚集;其含量可影响LNP粒径;延长体内摄取时间;可实现表面功能化,进而与配体或其他分子偶联。磷脂则有助于提供配方的整体结构稳定性,以及在生产和长期存储期间的稳定性。胆固醇因其疏水性,有助于提供刚性、配方稳定性并支持控释。LNP递送系统主要将小核酸药物包裹在脂质纳米颗粒(LNP)中,使被包裹的小核酸药物免于降解和清除,并促进其跨细胞膜运输到目标靶位。LNP通过肝细胞表面低密度脂蛋白受体识别和摄取,适用于治疗肝脏相关的疾病。2018年,Alnylam公司研发的基于脂质纳米颗粒(LNPs)递送的首款siRNA药物——Onpattro(Patisiran)获得美国FDA批准,用于治疗家族性淀粉样多发性神经病变。近年来的研究发现,通过调整构成LNP的脂质分子的类型和比例,能够诱导LNP被肝脏以外的器官或组织吸收。例如,基于ReCode Therapeutics公司的SORT-LNP平台开发的LNP载体已经进入临床开发阶段,用于将基于mRNA的疗法递送到肺部,治疗囊性纤维化等疾病;2024年9月,诺和诺德(Novo Nordisk)与NanoVation Therapeutics达成6亿美元的研发合作,基于后者的长循环LNP递送技术,将治疗药物递送到肝脏以外的组织,治疗心脏代谢疾病与罕见病。

GalNAc(N-乙酰半乳糖胺)递送技术于2014年被Alnylam实现,是小核酸药物发展历程中的重大突破,解决了小核酸药物靶向性差、脱靶效应严重、稳定性差的三大痛点。GalNAc递送系统由三个主体部分构成:特异性配体(通常是三个GalNAc糖分子)、连接臂(Linker,三价分支连接器)、治疗性寡核苷酸。GalNAc能特异性识别肝细胞表面高表达的去唾液酸糖蛋白受体(ASGPR),可实现高效肝脏靶向。GalNAc递送系统的作用机制为:GalNAc(N-乙酰半乳糖胺)通过与寡核苷酸共价连接,利用肝细胞上高度表达的去唾液酸糖蛋白受体(ASGPR),实现受体介导的细胞内吞。进入内体后的酸化环境促进受体–配体解离,从而释放寡核苷酸药物。ASGPR在内体酸化后快速回收至细胞表面,可反复参与配体结合,从而实现高效、可重复的肝摄取。相较于裸RNA、LNP递送系统,GalNAc递送系统的优势在于:可以通过皮下注射的方式达到较好的药物分布效果,并且作用时效长达数月;由于高效靶向肝脏,所需药物剂量小,副作用小。以ATTR领域上市的小核酸药物为例,相比仅经过化学修饰的Tegsedi(裸RNA)和通过LNP包裹的patisiran,采用GalNAc修饰递送的升级版药物Vutrisiran和Eplontersen在临床试验中表现出了良好的安全性和长效作用特点,vutrisiran在每三个月给药一次的频率下,降低血浆TTR效果类似于每3周给药一次30mg patisiran降低血浆TTR效果。依托于上述优势,GalNAc已成为肝内递送的主流策略。目前FDA批准的7款siRNA疗法,其中有6款采用了GalNAc偶联技术,首款GalNAc-siRNA药物Givosiran于2019年获FDA批准上市。GalNAc同样适用于ASO递送。2023年12月,首款GalNAc-ASO药物Eplontersen获FDA批准上市。由于ASGPR仅在肝实质细胞特异性高表达,GalNAc递送系统存在组织局限性,限制小核酸药物疾病领域的拓展。借鉴GalNAc偶联技术的思路,科学家们正在将与特定肝外组织结合的配体与寡核苷酸偶联,实现药物的靶向递送,AOC、TRiM、C16等肝外递送方式开始崭露头角。

AOC(抗体寡核苷酸偶联物)是将抗体与寡核苷酸通过连接子偶联后形成的复合物,其兼具了抗体的靶向性与寡核苷酸的治疗活性,结构形式上与ADC类似,只是有效载荷从小分子毒素替换成了具有基因调控功能的核酸药物。AOC的作用机制主要为:抗体负责识别并介导靶细胞的特异性内化,确保药物精准定位至目标组织;连接子维持体内稳定并在细胞内触发载荷进行释放,平衡药物循环稳定性与胞内起效效率;而寡核苷酸则通过与靶mRNA特异性互补结合,实现“基因沉默”或“剪接调控”,从根源上干预疾病进程。相较于以GalNAc递送为代表的传统寡核苷酸药物,AOC具备三大核心优势:一是肝外递送能力,通过选择不同的靶向抗体,可实现对肌肉、中枢神经、肿瘤等肝外组织的精准递送,例如针对TfR1靶点的AOC可穿透血脑屏障,为阿尔茨海默病、脊髓性肌萎缩症等中枢神经系统疾病提供新的治疗方案。二是更长的半衰期,抗体分子在血液中具有较强的稳定性,偶联后的AOC半衰期可达数天至数周,远长于传统寡核苷酸药物(通常为数小时至数天),大幅降低了给药频率。三是更低的脱靶毒性,由于AOC仅针对表达特定抗原的靶细胞发挥作用,对正常细胞的影响极小,有效减少了传统寡核苷酸药物可能引发的免疫反应、肝肾功能损伤等脱靶效应。Avidity是AOC领域的龙头公司,其AOC™技术平台专注于解决肌肉疾病治疗中的药物递送难题。Avidity旗下三款核心产品均迈入III期临床阶段(AOC 1020、AOC1044、AOC1001),分别用于治疗面肩肱肌营养不良病、杜氏肌营养不良症以及治疗强直肌营养不良。Avidity 的AOC™技术平台获得多家MCN的认可。2019年4月,礼来与Avidity达成一项全球许可和研究合作,借助Avidity的AOC平台开发免疫学和其他适应症药物,重点探索自身免疫疾病领域;2023年11月,BMS与Avidity达成潜在价值23亿美元的合作,利用Avidity的AOC平台开发最多5个抗体寡核苷酸偶联药物;2025年10月,诺华(Novartis)宣布以120亿美元收购Avidity,诺华将获得Avidity AOC™技术平台及三条后期研发管线。从AOC药物研发进展来看,海外企业处于临床后期阶段,国内企业多处于临床早期。

Arrowhead的TRiMTM递送技术平台主要由靶向配体、化学连接子、增强药代动力学的结构、小核酸四部分组成。该技术平台具有以下优势:(1)有效性,可产生深度且持续的效果,能够靶向以往成药难度大的靶点;(2)特异性,最大化活性和内在稳定性,降低潜在脱靶效应;(3)通用性,灵活的结构与设计支持多种给药途径及多组织靶向;(4)经济性,简洁的设计意味着相对较低的成本,并支持规模化生产。该技术平台可靶向肝脏、肺部、骨骼肌、中枢神经系统(CNS)、脂肪组织、眼部、心肌细胞,其中肝脏靶向已具备充分的临床验证,肺部靶向已经过深度的临床验证,骨骼肌、中枢神经系统(CNS)、脂肪组织靶向处于早期临床阶段。2025年12月10日,Arrowhead在第七届CNS递送峰会公布其中枢神经靶向的小核酸递送技术。该技术基于TRiMTM平台孵化,通过转铁蛋白受体(TfR1)靶向配体技术,突破BBB的递送瓶颈,可达大脑深部区域,并通过皮下注射实现便捷给药,具备每月至每季度给药的潜力。

Alnylam的C16偶联递送平台是一种利用脂质链-细胞膜相互作用的药物递送系统。十六烷基(C16)是一种连接到siRNA的短脂质链,其亲脂性得以与细胞膜相互作用,帮助药物穿透血脑屏障或肺部血管,实现精准递送。C16可以被多种细胞吸收,包括中枢神经系统和肺部的细胞。Alnylam基于C16平台已研发出3款处于临床阶段的siRNA疗法:ALN-APP(适应症为:脑淀粉样血管病、阿尔茨海默病)、ALN-HTT021(适应症为:亨廷顿病)、ALN-SOD(适应症为:肌萎缩侧索硬化症)。

2.2 小核酸药物适应症从罕见病延伸至心血管、减重等慢性病领域

从已获批上市的产品来看,小核酸在罕见病适应症上率先获得突破,包括杜氏肌营养不良、脊髓性肌肉萎缩症、转甲状腺素蛋白淀粉样变性、血友病、家族性高乳糜微粒血症等。从在研管线的适应症来看,排名前五的疾病依次是肿瘤(24%)、遗传病(22%)、感觉器官疾病(13%)、心血管系统疾病(12%)、消化代谢性疾病(9%)。此外,小核酸药物也在皮肤病、血液病、泌尿、感染等多个领域布局。伴随着小核酸药物技术的进步,小核酸药物在慢病治疗领域的应用正逐渐从罕见病向高血脂、高血压、减重等常见慢病延伸。2020年12月,降胆固醇药物Inclisiran获欧盟批准,小核酸药物适应症从罕见病延伸至心血管慢性病领域。

2.2.1 高血脂:靶向APOC3、PCSK9的小核酸已获批,Lp(a)靶点的II期数据积极

血脂异常是一种以血液中任何或所有脂质(如甘油三酯、胆固醇、磷脂)或脂蛋白水平异常为特征的疾病。在全球范围内,成人血脂异常的患病率估计约为40%,每年影响约30亿人。高胆固醇血症(HC)是最常见的一种血脂异常,约占全球血脂异常病例的27.4%,典型特征是LDL-C(低密度脂蛋白胆固醇)升高,伴或不伴总胆固醇升高。高甘油三酯血症(HTG)定义为血液甘油三酯水平升高(TG≥1.7 mmol/L),影响全球约25%的血脂异常病例。长期高脂血症可能导致动脉粥样硬化,增加心脑血管疾病的风险。无论是高胆固醇血症(HC)还是高甘油三酯血症(HTG),当前标准治疗均存在疗效局限、依从性差和安全性风险等问题,尤其是对重度或难治性病例,临床迫切需要更高效、长效且安全的新型治疗选择。肝脏是脂代谢的重要路径,转运内源性甘油三酯和胆固醇的脂蛋白在肝脏合作,刺激肝脏脂蛋白合成因子会导致血脂升高。因此,擅长肝靶向的小核酸药物在降血脂方面展现出良好的治疗前景。近年新兴降脂治疗靶点不断涌现,包括载脂蛋白C(ApoC)、脂蛋白a(Lp(a))、血管生成素样蛋白(ANGPTL)、前蛋白转化酶枯草溶菌素9(PCSK9)等。

载脂蛋白C3(APOC3)是体内脂质代谢的关键调节因子,尤其影响甘油三酯(TG)水平。当APOC3水平升高时,APOC3主要通过以下两种途径破坏正常的脂质水解和清除:一是抑制负责分解TG的酶——脂蛋白脂肪酶(LPL)(LPL依赖性途径);二是干扰肝脏对富含TG的残余脂蛋白的清除(LPL非依赖性途径)。靶向APOC3的小干扰RNA(siRNA)疗法通过特异性靶向APOC3 mRNA,有效降低APOC3蛋白水平,从而消除其对脂蛋白脂肪酶等关键脂质代谢酶的抑制作用,并提高富含TG的脂蛋白的清除率。截止目前,全球已有两款靶向APOC3的反义寡核苷酸(ASO)药物(volanesorsen和olezarsen)获批上市,用于治疗家族性乳糜微粒血症综合征(FCS)——一种由乳糜微粒代谢缺陷引起的罕见、遗传性严重高甘油三酯血症(HTG)。2025年11月18日,美国FDA批准了Arrowhead公司的RNAi疗法普乐司兰钠注射液(Plozasiran)的新药上市申请。Plozasiran可作为饮食疗法的辅助手段,用于降低家族性乳糜微粒血症(FCS)成人患者的甘油三酯水平。Plozasiran是目前唯一一个获得FDA批准用于治疗FCS的siRNA药物,患者可在家中自行给药,只需每三个月进行一次简单的皮下注射即可。III期临床试验PALISADE的结果显示,25mg Redemplo实现了显著且持久的甘油三酯降低,中位数相较基线变化为-80%,而安慰剂数据合并组为-17%。除FCS适应症外,Plozasiran也正在进行针对严重高甘油三酯血症、混合性高脂血症的临床研究。Volanesorsen、olezarsen、Plozasiran验证了APOC3作为治疗靶点在重症HTG中的临床有效性。

PCSK9通过促进肝细胞表面的低密度脂蛋白(LDL,即“坏胆固醇”的主要载体)受体降解,从而自然调节胆固醇代谢。PCSK9抑制剂通过阻止这一降解过程发挥作用,从而增加功能性LDL受体的数量,并增强肝脏对LDL-C(低密度脂蛋白胆固醇)的清除能力。临床试验证实,该机制能够实现显著的LDL-C降低效果(通常可达50%至70%),而相比之下,他汀类药物的降幅一般为20%至50%,依折麦布约为15%至20%。PCSK9抑制剂对于他汀类药物不耐受,或通过常规疗法难以达到血脂目标的高危患者尤为有效。靶向PCSK9的siRNA药物通过在mRNA水平上抑制PCSK9蛋白的合成。与主要作用于循环中PCSK9蛋白的单克隆抗体不同,siRNA药物能够从源头上阻断肝细胞内PCSK9的生成,从而持续增加LDL受体的表达,并持久提升LDL-C的清除效率。针对PCSK9的siRNA药物的临床试验表明,其疗效持久,每年仅需给药两次即可实现长期的LDL-C控制,而抗体药物通常需要每两周或每月注射一次。目前,全球已有一款靶向PCSK9的siRNA药物——英克司兰(Inclisiran)获批用于治疗高胆固醇血症(HC)。此外,全球范围内另有多款用于治疗HC的siRNA候选药物正处于临床开发阶段。

大分子脂蛋白Lp(a)由低密度脂蛋白样颗粒和载脂蛋白a[Apo(a)]共价结合而成。Lp(a)水平的增加与心血管疾病风险的增加直接相关。一项发表在杂志Circulation上的荟萃分析研究结果表明,Lp(a)水平与ASCVD(动脉粥样硬化性心血管疾病)风险存在相关性,且与基线LDL-C(低密度脂蛋白胆固醇)水平无关,即Lp(a)与LDL-C对ASCVD风险的影响是独立叠加的,LDL-C水平的降低并不能完全抵消Lp(a)介导的ASCVD风险。《中国血脂管理指南(2023)》已明确指出,Lp(a)升高是冠心病、缺血性脑卒中、外周血管疾病、冠状动脉钙化等心血管疾病的独立危险因素。由于Lp(a)主要在小核酸药物的优势作用器官——肝脏中合成,多家药企已布局靶向Lp(a)的小核酸降脂药物研发。靶向Lp(a)的小核酸降脂药物的主要作用机制为:通过阻止核糖体在mRNA上的移动和翻译,使目标mRNA被切割为不具有翻译功能的片段,通过影响基因的表达从源头上阻止Lp(a)的形成。

目前已有多款靶向Lp(a)的小核酸降脂药物在临床中取得显著效果,并进入到Ⅲ期阶段。Pelacarsen(诺华和Ionis联合研发,处于临床III期)公布的临床Ⅱ期研究(NCT03070782)结果显示,Pelacarsen降低Lp(a)水平的作用呈剂量依赖性,且5个试验组Lp(a)水平降低35%~80%,其中80mg/月的给药剂量可使98%的患者Lp(a)水平降至50mg/dL以下。Olpasiran(安进2016年从Arrowhead引进,处于临床III期)的Ⅱ期研究(NCT04270760)结果显示,每12周接受75mg剂量Olpasiran的患者,在治疗36周时血液中Lp(a)水平下降为97.4%;Olpasiran各剂量组患者的LDL-C和载脂蛋白B水平也显著降低;超过75mg剂量的参与者在末次给药后近一年内,Lp(a)水平仍显著降低约40%~50%,Olpasiran展现出持久的降脂能力。Zerlasiran(Silence Therapeutics开发)的Ⅱ期临床(NCT05537571)数据显示,36周治疗后,Zerlasiran各治疗组均可显著降低Lp(a)水平。其中,接受450mg每24周两次治疗的患者,Lp(a)平均水平降低85.6%;接受300mg每16周三次治疗的患者,Lp(a)平均水平降低82.8%,接受300mg每24周两次治疗的患者,Lp(a)水平降低81.3%。

2.2.2 高血压:显著提升患者依从性,zilebesiran已达到II期临床终点

主流的高血压药物降压效果均较为明显,但需每日服用,患者依从性较差,显著影响了高血压治疗率的提升。小核酸药物有望借助疗效更佳持久的优势,解决高血压药物依从性差的短板。目前,全球处于活跃状态的针对高血压适应症的小核酸疗法超过10款,其中该疗法先驱是Ionis的IONIS-AGT-LRx(目前已不再活跃),目前研究进展较快的管线有:Alnylam的Zilebesiran(siRNA)、Ionis的Tonlamarsen(ASO)、诺华的QCZ-484(siRNA)。国内进展相对靠前的高血压小核酸疗法主要有:先衍生物的LDR-2402、恒瑞医药的HRS-9563等。从作用靶点来看,在研的高血压在研疗法主要集中在AGT靶点。AGT作为肾素-血管紧张素-醛固酮系统的更上游的靶点,在血压调节中的作用更为关键,虽然其在肝脏、肾脏、心脏和血管内皮细胞等众多器官组织中表达,但血液循环中的AGT主要来自肝脏的表达,而肝脏正好是小核酸疗法的优势器官。此外,小核酸药物虽然抑制了循环系统整体的RAAS活性,导致血压降低,但不会抑制肾脏局部的RAAS活性,不会导致肾脏的血流灌注过低。小核酸技术与AGT靶点完美契合,导致AGT靶向降压药均选择小核酸技术。

2024年4月,Alnylam和罗氏共同宣布,RNAi疗法zilebesiran治疗高血压的II期KARDIA-2研究达到主要终点。数据显示,将zilebesiran添加到标准治疗方案中,能在第3个月显著降低患者的24小时平均收缩压(SBP),最高可将SBP额外降低12.1mmHg,几乎媲美ARNI+CCB的临床有效性,且部分接受一针zilebesiran的患者在6个月后随访时,血压持续降低的效果仍能维持。安全性方面,实验中最常见不良事件为轻度高钾血症(5.5% vs 1.8%)、低血压(4.3% vs 2.1%)和急性肾功能波动(4.9% vs 1.5%),多数无需干预即可缓解,严重不良事件发生率与安慰剂组无差异。小核酸疗法本身的局限性也导致zilebesiran的起效速度相对缓慢,通常情况下给药后数周后才能达到降压效果,因此不适合于高血压急症的单一治疗手段。未来最佳应用场景应当是与一线疗法联合。

2.2.3 减重:Arrowhead与Wave等药企布局领先,临床前及临床I期数据积极

当前GLP-1类减重药物存在停药后体重反弹率高、肌肉流失、给药周期短等短板。依托全新的作用机制,以RNAi为核心的小核酸药物有望解决GLP-1类减重药物的短板。目前,全球共有20余款小核酸减重管线,其中6款已进入I期及以上临床阶段,另有14款处于临床前研究阶段。在研管线中,INHBE、ALK7是多数药企选择的靶点。INHBE和ALK7同属TGFβ超家族,构成肝脏与脂肪组织间的代谢调控轴。INHBE在肝脏中表达,其产物激活素E(Activin E)分泌入血后,结合脂肪细胞表面的ALK7受体,激活Smad2/3信号通路,进而抑制脂肪分解、促进脂质储存并诱导胰岛素抵抗。ALK7(活化素受体样激酶7)主要在脂肪组织中表达,是INHBE的作用受体,抑制ALK7信号通路,可以直接促进脂肪分解,改善胰岛素抵抗。从小核酸减重药物研发进展来看,Arrowhead和Wave等在小核酸减重领域的进展相对靠前,Arrowhead的ARO-INHBE(靶向INHBE)和ARO-ALK7(靶向ALK7)处于I/IIa期阶段,Wave的WVE-007(靶向INHBE)读出积极的I期中期数据。此外,Alnylam在小核酸减重领域的管线进展稍慢,但布局较为全面, IND-enabling阶段的分子覆盖了INHBE(肝脏靶向)、ALK7(脂肪靶向)、Gene D(肌肉靶向)等靶点。

Arrowhead的ARO-INHBE旨在降低INHBE基因及其分泌的基因产物Activin E在肝脏的表达。INHBE基因编码的是抑制素亚基βE(Inhibin Subunit Beta E),是转化生长因子-β(TGF-β)蛋白质超家族的成员,主要在肝脏中表达;其肝脏表达水平与人类的胰岛素抵抗和体重指数正相关。ARO-INHBE的临床前研究表明:(1)食蟹猴模型显示,ARO-INHBE在D1和D29以3mpk的皮下注射实现了INHBE转录物的深度敲低,持续时间至少为85天。(2)在DIO和db/db小鼠模型中,ARO-INHBE可抑制小鼠体重增加19%。ARO-INHBE于2024年12月进入I/IIa期临床研究,预计2026年初公布I/IIa期临床研究的初始数据。

Arrowhead的ARO-ALK7为全球首款靶向脂肪组织的RNAi在研疗法,旨在降低Activin受体样激酶 7 (ALK7) 在脂肪中的表达。ARO-ALK7的临床前研究数据显示:(1)在DIO小鼠模型中,每周注射3 mg/kg ARO-ALK7,第16周时,腹股沟白色脂肪组织和性腺周围白色脂肪组织中ALK7 mRNA表达量分别下调80%、40%;相比于生理盐水对照组,ARO-ALK7可显著抑制体重增加39%,脂肪量减少约50%,并保持瘦肉体重。(2)在食蟹猴模型中,单次注射3mg/kg剂量的ARO-ALK7,1个月后脂肪组织中的ALK7 mRNA沉默89%,并在12周内保持75%左右的沉默水平。ARO-ALK7于2025年5月进入I/IIa期临床研究。

2025年12月,Wave Life Sciences公布了其肥胖症候选药物WVE-007的I期INLIGHT试验中期数据。WVE-007是一种基于GalNAc-siRNA技术的RNA干扰药物,通过Wave proprietary的SpiNA设计,精准沉默肝脏中的INHBE基因mRNA,从而降低其下游蛋白产物Activin E的表达水平。与传统GLP-1受体激动剂通过中枢食欲抑制实现减重不同,WVE-007通过调控脂肪代谢和肌肉保护的相关通路,在减少脂肪组织的同时促进瘦体重维持甚至增长。WVE-007的I期INLIGHT试验结果显示,单次240mg皮下注射后12周,32名BMI 28-35 kg/m²的受试者内脏脂肪减少9.4%(p=0.02),全身脂肪降低4.5%,瘦体重增加3.2%(约4磅),总体重因肌肉增长抵消仅下降0.9%。血清Activin E水平在43天时达到最大降幅78%,疗效维持超过85天,支持每年1-2次给药的潜力。安全性方面,在已评估的240mg至600mg剂量范围内,所有治疗相关不良事件均为轻度,未报告中度或重度事件,无严重不良事件或治疗中断病例。试验未观察到GLP-1类药物常见的胃肠道副作用(恶心、呕吐、腹泻),且血脂与肝功能检测未见临床意义变化。Wave计划在2026年Q1发布240mg队列6个月数据和400mg队列3个月数据,并启动II期试验探索在更高BMI及合并症患者中的应用。

2.3 小核酸药物交易活跃度提高,多家国内企业与MCN达成交易

伴随着小核酸技术突破以及相关药物成功上市等,小核酸药物交易活跃度呈现提升趋势,具体表现为:小核酸药物的交易金额、首付款逐年增加,小核酸license-out项目占比不断提高,诞生多笔重磅交易。从重磅交易来看,2019年11月,诺华以97亿美元收购TMC,获得靶向PCSK9的长效siRNA降脂药Inclisiran(Leqvio)。2025年10月,诺华以120亿美元收购AOC(抗体偶联寡核苷酸)领域的龙头企业Avidity Biosciences,获得Avidity的神经学管线和差异化技术平台。从国内企业授权交易来看,舶望制药、圣因生物等企业先后与礼来、诺华等国际大药企达成授权交易,授权合作内容包括在研项目以及技术平台等。2024年1月,诺华以41.65亿美元的总交易金额获得舶望制药多款心血管siRNA药物的海外权益。2025年9月,诺华再次携手舶望制药,就多项心血管靶点siRNA资产展开合作,总交易金额超过53亿美元。2025年11月,礼来与圣因生物达成一项价值最高达12亿美元的合作协议,双方将基于圣因生物专有的LEAD™平台共同推动针对代谢性疾病的RNAi候选药物的开发。LEAD™平台是圣因生物自主研发的一种组织选择性递送技术,能够实现RNAi药物在肝外组织与细胞中的高效、特异性递送。

2.4 商业化前景广阔,部分已上市产品销售表现亮眼

依托于独特的治疗优势、技术突破、适应症扩展以及上市产品增加,全球小核酸药物市场将呈现快速增长。据瑞博生物港股招股说明书中的统计及预测数据,2019-2024年,全球小核酸药物市场规模由27亿美元增长至57亿美元,期间复合增速约为16.20%。2024-2029年,预计全球小核酸药物市场规模由57亿美元增长至206亿美元,期间复合增速约为29.40%;2029-2034年,预计全球小核酸药物市场规模由206亿美元增长至549亿美元,期间复合增速约为21.60%。单独看siRNA药物,据靖因药业港股招股说明书中的统计及预测数据,2024-2029年,预计全球siRNA药物市场规模由24亿美元增长至100亿美元,期间复合增速约为33.03%;2029-2034年,预计全球siRNA药物市场规模由100亿美元增长至294亿美元,期间复合增速约为24.07%。

部分已上市小核酸药物销售表现亮眼。诺华Leqvio(靶向PCSK9 mRNA的siRNA疗法)于2020年12月在欧盟获批上市,用于治疗成人高胆固醇血症或混合性血脂异常,并于2021年12月获得美国FDA批准,作为饮食和他汀类药物治疗的辅助药物,用于治疗患有原发性高脂血症的成年患者。2025年8月,美国FDA批准了Leqvio的扩展适应症申请,允许其作为单药,与饮食控制和运动联合使用,以降低成人高胆固醇血症患者的低密度脂蛋白胆固醇(LDL-C)水平。自获批上市以来,Leqvio销售额呈现快速增长趋势。2024年,诺华Leqvio实现销售收入7.54亿美元,同比增长超100%。2025年前三季度,Leqvio实现销售收入8.63亿美元,同比增长61%。诺华预计Leqvio销售额峰值有望达到40亿美元。此外,小核酸药物龙头企业Alnylam营收的快速增长也反映出小核酸药物具备广阔的商业化前景。2020-2024年,受益于siRNA产品上市放量,Alnylam的营业收入由4.93亿美元增长至22.48亿美元。2025年前三季度,Alnylam实现营业收入26.17亿美元,其中产品净收入19.92亿美元,同比增长67%。具体来看,TTR产品线表现亮眼,实现收入16.28亿美元,同比增长85%,主要由Amvuttra(14.87亿美元)和Onpattro(1.41亿美元)贡献。受益于转甲状腺素蛋白淀粉样变性心肌病(ATTR-CM)适应症获批,Amvuttra的2025年第三季度收入同比增长165%至6.85亿美元。

3

相关企业

3.1 国外:管线进展领先,多组织靶向可期

(1)Alnylam:全球RNAi疗法先驱及领导者,致力于2030年前实现主要组织递送

Alnylam是RNAi治疗领域的开创者,成立于2002年,于2018年实现公司首个RNAi药物(也为全球首款)商业化。截止目前,公司已有6款RNAi产品获批上市,7项管线处于临床III期阶段,17项管线处于临床II或I期阶段。公司产品管线聚焦的疾病领域包括:TTR(转甲状腺素蛋白淀粉样变性疾病)、罕见病、心血管、代谢、神经系统疾病。其中,在TTR疾病领域,Alnylam进行深入布局,并不断升级迭代TTR靶向药物,具体产品管线包括:(1)静脉注射、每三周给药的Patisiran;(2)皮下注射、每三个月给药的Vutrisiran;(3)疗效更好、每半年给药、处于临床III期的Nucresiran。受益于Vutrisiran(Amvuttra)ATTR-CM成人患者适应症获批,TTR板块收入呈现快速增长,已成为Alnylam营收增长的主要动力。

Alnylam开发了LNP、GalNAc、C16偶联等多种RNAi递送技术。LNP(脂质纳米颗粒)递送技术:主要靶向肝脏,基于LNP技术的RNAi疗法通过静脉注射给药。Alnylam首个获批的RNAi疗法药物ONPATTRO®(patisiran)基于LNP递送技术,该技术也用于开发COVID-19疫苗。GalNAc(N-乙酰半乳糖胺)偶联物递送技术:主要靶向肝脏,基于GalNAc偶联技术的RNAi疗法通过皮下注射给药。Alnylam已获批的GIVLAARI®、OXLUMO®、AMVUTTRA®以及Leqvio®均采用GalNAc偶联物递送技术。C16偶联递送技术:可靶向中枢神经系统、肺部和眼部细胞等,基于C16偶联技术的RNAi疗法通过鞘内注射(经脊髓注射)给药。Alnylam在研RNAi疗法ALN-APP(针对淀粉样前体蛋白,用于治疗阿尔茨海默病和脑淀粉样血管病)采用了C16偶联技术。在2025 R&D Day上,Alnylam宣布递送远景:在2030年前,实现所有主要组织布局。

(2)Arrowhead:TRiM™技术可靶向多组织,多项管线授权MCN

Arrowhead基于TRiM™平台,成功开发了靶向肝脏、肺、肌肉、脂肪、中枢神经的多种RNAi疗法,包括4项处于临床III期的管线:①Plozasiran。2025年11月,美国FDA批准Arrowhead公司的RNAi疗法Plozasiran(也称普乐司兰钠注射液或Redemplo,靶向APOC3基因)的新药上市申请,Plozasiran可作为饮食疗法的辅助手段,用于降低家族性乳糜微粒血症(FCS)成人患者的甘油三酯水平。Plozasiran治疗重度高甘油三酯血症的III期临床试验预计2026Q3公布结果。②用于治疗纯合子家族性高胆固醇血症(HoFH)的ANGPTL3靶向RNAi疗法Zodasiran。③Arrowhead和武田(Takeda)合作开发的、用于治疗α1-抗胰蛋白酶缺乏症相关的肝病(AATD-LD)的Fazirsiran。II期结果显示,fazirsiran对肝病关键标志物具有良好的影响。④Arrowhead和安进合作开发、用于治疗动脉粥样硬化性心血管疾病(ASCVD)、Lp(a)基因靶向的siRNA疗法olpasiran,预计在2026年年底公布初步结果。olpasiran的II期临床试验结果显示,12周给药一次,高剂量组在治疗36周时Lp(a)降低超90%,效果持续至48周。

Arrowhead与诺华、赛诺菲、GSK、武田、安井等国际大药企达成多项研发合作。2025年9月,诺华与Arrowhead达成潜在交易总额20亿美元的合作协议,共同开发处于临床前的用于治疗帕金森病的药物ARO-SNCA。2025年8月,赛诺菲与Arrowhead的子公司维亚臻(Visirna Therapeutics)签署资产购买协议,赛诺菲以1.3亿美元预付款、最高达2.65亿美元里程碑付款的价格获得在大中华区开发和商业化在研药物普乐司兰钠注射液(Plozasiran)的权利。普乐司兰钠注射液用于治疗FCS(家族性乳糜微粒血症综合征)的新药上市申请于2025年1月26日获得NMPA的正式受理,且已获得中国NMPA的突破性疗法认定和优先审评资格。2021年11月,Arrowhead与葛兰素史克(GSK)达成RNAi疗法ARO-HSD(用于治疗非酒精性脂肪性肝炎-NASH)的研发合作协,Arrowhead将获得1.2亿美元前期付款,并有资格获得超过10亿美元的开发和商业化里程碑付款。2020年10月,武田(Takeda)和Arrowhead达成RNAi疗法ARO-AAT(用于治疗α-1抗胰蛋白酶相关肝病-AATLD)的研发合作协议,Arrowhead将获得3亿美元的前期付款,并有资格获得高达7.4亿美元的潜在开发、监管和商业化里程碑付款。2016年9月,安进以5650万美元预付款以及最高可达6.17亿美元的额外付款获得Arrowhead的Olpasiran(用于高血脂患者的心血管事件二级预防)的全球独家选择权。

3.2 国内:紧跟技术前沿,多项管线推进至临床II期

目前国内临床进展靠前的小核酸药物多为siRNA路线,多处于临床II期及以前阶段,其中维亚臻生物的VSA003已经推进到临床Ⅲ期阶段。从作用靶点来看,国内临床进展居前的小核酸药物靶点多为HBV、PCSK9、C3、ANGPTL3等。从适应症来看,国内临床进展居前的小核酸药物多集中在肝炎、心血管疾病、血脂异常、肾病等领域。从研发管线数量来看,舶望制药、瑞博生物的在研管线数量居前。

(1)瑞博生物:小核酸药物开发的先驱及领导者,多项管线处于临床II期

技术平台:公司依托国际化研发平台,实现小核酸药物全周期技术覆盖,包括药物递送、化学修饰、多靶点药物研发、模型引导的药物开发及药学开发生产。其中,RiboGalSTARTM是肝组织靶向递送技术,已推动了六个项目进入临床开发,其高效、长效及良好的安全性已在临床中得到验证。RiboGalSTARTM已成为全球最成功的GalNAc递送技术之一,并已在包括中国、欧洲和美国在内的主要司法管辖区获得专利授权。2024年1月,瑞博生物与德国勃林格殷格翰达成合作,双方将基于RIBO-GalSTARTM技术平台共同开发治疗非酒精性或代谢功能障碍相关脂肪性肝炎(NASH/MASH)的小核酸创新疗法,该项合作总交易金额超过20亿美元。RiboOncoSTARTM是一项领先的肿瘤靶向平台,采用核酸缀合递送技术,支持多个潜在“同类首创”癌症治疗项目的开发。在临床前研究中,RiboOncoSTARTM在特定癌症(包括胶质瘤、胰腺癌)中表现出优于标准治疗的抗肿瘤效果和安全性。RiboPepSTARTM通过靶向分子缀合实现对多种肝外器官的靶向递送,在肾脏和中枢神经系统(CNS)相关的多个临床前疾病模型中,该平台展现出优于现有疗法的显著疗效,并具有良好的安全性。

瑞博生物的研发管线覆盖心血管、代谢和肾脏疾病、肝病及其他治疗领域。在心血管、代谢和肾脏疾病领域,RBD4059(血栓性疾病)、RBD5044(高甘油三酯血症)、RBD7022(高胆固醇血症)已处于全球临床II期阶段。其中,RBD4059是全球首款、临床开发进度最快、针对FXI靶点的siRNA药物(First-In-Modality);RBD5044是全球第二款进入临床开发的靶向ApoC3的siRNA。在肝病领域,RBD1016(乙型肝炎、丙型肝炎)处于临床II期阶段。在II期临床研究中,RBD1016表现出良好的耐受性安全性,并对乙肝表面抗原(HBsAg)显示出强大的可持续至6个月的抑制作用。RBD1016有望作为未来联合治疗方案中达到慢性乙型肝炎(CHB)功能性治愈的基石疗法,以及丙型肝炎(CHD)的领先siRNA候选药物。

(2)舶望制药:siRNA疗法管线布局广泛,持续获得国际大药企认可

舶望制药核心管理层具备丰富的小核酸药物研发经验,两位联合创始人曾在Arrowhead Pharmaceuticals担任要职。舒东旭博士(联合创始人、首席执行官)曾任Arrowhead Pharmaceuticals高级科学家,专注于肝外递送平台的开发,其中部分成果已成功应用于临床研究。邵鹏程博士(联合创始人、首席科学官)曾在默克研究实验室参与多个心血管健康、糖尿病、肿瘤学和中枢神经系统疾病等项目;曾担任Arrowhead Pharmaceuticals药物化学总监,领导肝外递送平台和项目工作;曾领导专门从事基于siRNA的NASH治疗新药研发的初创公司Mitotherapeutix的研发工作。金建军博士(首席医学官)曾在惠氏、勃林格殷格翰和礼来中国担任临床开发和医疗事务治疗领域负责人;曾担任诺华中国临床开发负责人,成功带领团队进行了siRNA药物LEQVIO®(inclisiran)的亚洲3期研究。

舶望制药siRNA疗法管线布局广泛,涉及心血管、罕见病、中枢神经系统、病毒性肝炎、代谢性疾病等多个重要治疗领域,并与国际大药企达成多项授权合作。其中,BW-01(心血管疾病)、BW-02(心血管疾病)、PKK(遗传性血管水肿)处于临床II期阶段。舶望制药在肥胖、代谢功能障碍脂肪肝炎、阿尔茨海默症、帕金森病等领域开发了多个处于早期发现阶段的项目。此外,舶望制药的在研管线质量持续获得国际大药企认可。2024年1月,诺华以41.65亿美元的总交易金额获得舶望制药多款心血管siRNA药物的海外权益。2025年9月,诺华再次携手舶望制药,就多项心血管靶点siRNA资产展开合作,总交易金额超过53亿美元。

(3)悦康药业:ASO药物CT102完成Ⅱa期临床,搭建GalNAc、TLP递送平台

专利布局:在核酸药物递送领域,包括LNP、TLP、GalNAc递送技术在内,截至2025年6月30日,公司已获得了25项发明专利授权。其中,小核酸肝靶向递送技术GalNAc已成功获得5项发明专利授权,其PCT专利已进入美国、欧洲等地区,专利中的GalNAc采用独特的设计,具有全新化学结构,属于新一代GalNAc技术。可电离阳离子脂质辅料YK-009先后获得中国(含港澳台)、美国、日本、以色列、马来西亚、南非的发明专利授权,成功应用于公司多款mRNA疫苗管线。具有全新结构的Cap1型加帽类似物,成功获得两项发明专利授权,攻克了mRNA疫苗和药物相关领域发展的“卡脖子”的难题。

技术平台:公司已搭建了以核酸药物为基础的领先的靶点发现平台、高通量筛选平台、领先的工艺开发及规模化制备平台、完整的分析质控平台,并在AI靶点发现、序列优化设计、LNP递送、GalNAc递送、TLP递送、肝外靶向递送、核苷单体修饰、共加帽等核酸药物底层技术上进行了系统深度布局。其中,公司自主研发的肿瘤免疫治疗递送系统——三组分脂质组合物TLP,相比于现有mRNA代表性的LNP递送技术,TLP展现出了显著优势。

在研管线:公司已有多款siRNA药物和mRNA疫苗进入临床研究阶段,适应症覆盖原发性肝癌、高血脂、高血压、乙型肝炎、带状疱疹、呼吸道合胞病毒(RSV)、实体肿瘤等疾病领域。其中,治疗原发性肝癌的国内首款反义核酸药物——注射用CT102的IIa期临床试验已完成;YKYY015注射液是目前国内处在临床阶段的同类PCSK9 siRNA项目中唯一在美国IND获批的全球潜在Best-in-class超长效siRNA降脂药物;YKYY029注射液是具有全新结构的靶向AGT基因的小干扰核糖核酸(siRNA)药物,已在中国、美国获批开展临床试验;YKYY032注射液是靶向Lp(a)蛋白的双链siRNA药物,已在中国、美国获批开展临床试验。

(4)其他企业

恒瑞医药:siRNA疗法HRS-5635(靶向HBV)治疗慢性乙肝适应症处于II期临床阶段;siRNA疗法HRS-9563治疗轻至中度高血压的II临床试验方案已于2025年12月16日公示。

信立泰:2025年5月,信立泰与成都国为生物达成合作协议,获得国为生物在研AGT-siRNA药物GW906在大中华区的独家许可权益。GW906为肝靶向配体偶联siRNA药物,通过特异性沉默肝脏血管紧张素原(AGT)mRNA,抑制肾素-血管紧张素-醛固酮系统(RAAS)最上游前体蛋白的合成,从而阻断血管紧张素II的生成路径,实现长效降压效应。GW906以原发性高血压为靶向适应症,目前正处于临床I期研究阶段。此外,信立泰也积极布局INHBE靶向、用于治疗心血管与代谢疾病的siRNA疗法,目前处于临床前研究阶段。

迈威生物:2025年9月17日,迈威生物与AditumBio宣布成立KalexoBio,并就心血管领域双靶点siRNA创新药2MW7141达成全球独家授权协议。根据协议,迈威生物将获得最高可达10亿美元的预付款与里程碑付款,以及低个位数的特许权使用费,其中包括1200万美元的首付款和近端付款。2MW7141是一款处于临床前阶段的双靶点小核酸药物,主要针对血脂异常人群的血脂调控以及高危心血管事件的预防。2MW7141协同调控效应明确,其在临床前研究中展现出对靶基因强效且持久的抑制效果,并且脱靶风险较低,有望成为首款采用非LNP递送系统的双靶点siRNA药物。

前沿生物:在研siRNA药物已覆盖IgA肾病、血脂异常、内分泌相关、痛风、肌肉、中枢神经等疾病领域,以及肿瘤治疗领域。在IgA肾病领域,公司布局了三款靶向补体系统的小核酸药物:FB7013、FB7011、FB7014。其中,FB7013(单靶点小核酸药物)已建立放大工艺并完成GMP批次生产,预计2025年底递交IND申请。FB7011(双靶点小核酸药物)处于临床前开发阶段,临床前研究表明,FB7011显示出具有更高疗效、更好安全性的潜在优势。FB7014(单靶点小核酸药物)处于临床前开发阶段,临床前药效研究数据显示,FB7014具有强效持久的疗效,且安全性良好。在血脂异常异常领域,公司布局了针对不同脂蛋白靶点的小核酸药物,包括FB7023和FB7022(靶向ANGPTL3),目前均处于临床前研究阶段。在内分泌领域,公司在代谢相关脂肪性肝炎(MASH))、2型糖尿病(T2DM)等方面布局了多款具有自主知识产权的小核酸药物,已提交4项发明专利申请,相关项目均处于临床前研究阶段。此外,公司依托内部成熟的化学合成偶联技术平台,自主研发了siRNA递送载体—ACORDE。经小鼠体内研究验证,ACORDE载体可实现siRNA分子在肝脏组织不同种类细胞的有效递送,而且也具有选择性靶向肝外组织的精准递送能力,并展现出优异的目标基因沉默效应,为后续肝外靶向小核酸药物开发奠定了关键技术基础。

阳光诺和:已建立小核酸药物载药系统开发平台,有两项小核酸管线处于临床前研究阶段。其中siRNA创新药ABA001为长效降压药,预计半年给药一次,处于IND阶段;AOC创新药ABY001用于长效减脂增肌,预计3-6个月给药一次,处于PCC筛选阶段。

4

投资建议

维持医药生物行业“领先大市”评级。在政策支持、企业转型、技术发展等综合影响下,我国医药生物行业已进入创新驱动的高质量发展阶段,以ADC、双抗、小核酸、细胞与基因治疗等为代表的创新药产业呈现快速发展,创新质量持续获得国际认可。相比于现有的小分子和抗体药物,小核酸药物具有靶点丰富、特异性强、安全性更高、疗效更久、研发成功率高等优点,有望成为继小分子和抗体之后具有颠覆性的新主流疗法。伴随着肝外递送技术突破,小核酸药物靶向器官丰富,适应症延伸至降血脂、降血压、减重等慢病领域,小核酸药物展现出广阔的发展前景,建议关注小核酸药物研发布局全面、产品创新程度高、研究进展靠前的药企,如恒瑞医药、悦康药业、前沿生物、信立泰等。

5

产品研发及销售进展不及预期风险;行业竞争加剧风险;地缘政治风险;行业政策风险;医疗安全风险等。

本订阅号不是财信证券研究报告的发布平台,所载内容均来自财信证券已正式发布的研究报告或对报告进行的跟踪与解读,订阅者若使用所载资料,有可能会因缺乏对完整报告的了解而对其中关键假设、评级、目标价等内容产生误解。提请订阅者参阅财信证券已发布的完整证券研究报告,仔细阅读其所附各项声明、信息披露事项及风险提示,关注相关的分析、预测能够成立的关键假设条件,关注投资评级和证券目标价格的预测时间周期,并准确理解投资评级的含义。

通过本订阅号发布的内容仅供财信证券股份有限公司(下称“财信证券”)研究服务客户参考,因本订阅号暂时无法设置访问限制,根据《证券期货投资者适当性管理办法》的要求,若您并非财信证券的研究服务客户,为控制投资风险,应首先联系财信证券研究发展中心,完成投资者适当性匹配,并充分了解该项服务的性质、特点、使用的注意事项以及若不当使用可能会带来的风险或损失,在此之前,请您请取消关注,请勿订阅、接收或使用本订阅号中的任何信息。对由此给您造成的不便表示诚挚歉意,感谢您的理解与配合!

财信证券研究发展中心分为宏观策略、综合金融、大制造、大消费、大周期和TMT等研究团队,研究领域涵盖市场策略、行业研究、公司研究,以及基金、债券研究等,已基本完成A股主要行业及重点上市公司的全覆盖。研究报告除自有研究业务平台及微信公众号外,授权同花顺、Wind、东方财富、讯兔科技、湖南日报、潇湘晨报、红网、上海证券报、中国证券报和朝阳永续刊载或转发。未经授权刊载或转载的,财信证券将追究其相应的法律责任。

网址:stock.hnchasing.com

地址:长沙市岳麓区茶子山东路112号湘江财富金融中心B座25楼

邮编:410005

电话:0731-84403360

传真:0731-84403438

2026-01-09

点击“蓝字”关注我们

编者按:

近期,欧洲心脏病学会(ESC)正式发布《2019 ESC/EAS血脂异常管理指南:2025重点更新》,迅速成为全球心血管领域关注的焦点。该指南基于近年来多项重要临床研究证据,围绕八大核心议题提出系统更新,涵盖了心血管风险评估工具的革新、血脂干预目标与策略的优化、新型标志物的临床应用等关键方向,标志着血脂管理迈向更精准、更个体化的新阶段。

2025年12月,在北京举办的“2025阜外血脂暨心血管代谢医学高峰论坛”中,中国医学科学院阜外医院的王增武教授对ESC 2025血脂指南的更新要点进行了系统解读与深入剖析,为临床实践提供了清晰指引。

一、风险评估的精准化

基于对现代人群疾病谱和风险特征理解的深入,指南推荐使用全新的SCORE2/SCORE2-OP算法,全面替代已使用多年的SCORE算法,用于动脉粥样硬化性心血管疾病(ASCVD)风险评估。和旧的算法相比,新算法在以下几个方面进行了更新,使得风险评估更精准:

核心参数更科学

原算法基于总胆固醇进行计算ASCV风险,而新模型则采用更准确的非高密度脂蛋白胆固醇 作为核心输入参数。

非高密度脂蛋白胆固醇剔除了对心血管有保护作用的HDL-C,囊括了所有致动脉粥样硬化脂蛋白颗粒(如LDL、VLDL及其残粒),能更全面地反映致动脉粥样硬化血脂负荷,与心血管残余风险的相关性更强,更符合当代血脂管理的核心理念。

覆盖人群更广泛

原算法仅适用于评估70岁及以下人群的10年致死性心血管疾病风险,这在老龄化社会背景下存在明显局限。新模型的SCORE2覆盖40~69岁人群,而SCORE2-OP模型则专门用于评估70~89岁的老年人群,将风险评估的年龄上限大幅提升,使得高龄人群也能获得个性化的风险评价。

终点评估更全面

原模型仅预测10年致死性心血管事件风险,而新模型则同时评估10年内致死性和非致死性心血管事件(如心肌梗死、脑卒中)的联合风险。非致死性事件对患者生活质量、社会经济负担影响巨大,纳入评估使得风险分层更具临床现实意义。

地域校准更精细

新模型根据各国心血管疾病死亡率,将国家群体分为低、中、高、极高四个风险等级进行校准。这意味着在不同地区,相同的算法得分可能对应不同的风险类别,从而为不同流行背景下的临床决策提供更具可比性和适用性的指导。

二、风险分层的深化和治疗关口的前移

风险分层的深化是2025 ESC血脂指南更新的一个核心进步,实现了从静态风险计算向动态个体化综合风险画像的根本性转变。这种深化具体表现在以下三个相互关联的层面:

第一层面:从“事件驱动”分层到“病变驱动”分层

既往的危险分层基于已发生的临床心血管事件。例如,一旦患者发生过心肌梗死,就被自动归为“极高危”。这是一种典型的事后分类,无法事先识别高危患者并进行干预。指南对此进行了更新,正式确立了“影像学明确证实的ASCVD”作为独立的高危分层依据。

这极大地拓展了高危人群的识别范围,意味着即使一个人从未有过心绞痛、心梗或中风等临床症状,但只要通过影像学检查(如冠脉CTA发现显著斑块、颈动脉超声发现>50%狭窄斑块,或心脏CT测得冠脉钙化评分≥300)发现了明确的、具有预测价值的动脉粥样硬化病变,就被等同于已发生临床事件的患者,归入相应的高危或极高危类别。

这个更新使得大量亚临床动脉粥样硬化患者被提前捕获,从而在他们发生首次致死或致残性事件之前,就获得与已发生过心血管事件患者同等强度的预防性治疗,有望显著降低心血管事件发生的风险。这是治疗关口前移最直观的体现。

第二层面:从“单一算法定终身”到“多维修正动态化”

既往基于年龄、血压、胆固醇等有限参数的概率模型具有的一个显著缺点是:无法涵盖所有个体特异性的高风险特征。指南因此引入了 “风险修正因子”这一工具,旨在提醒临床医生主动寻找那些可能使患者风险升级的线索,其中包括:

生物标志物线索:如脂蛋白(a)升高提示遗传背景带来的独立、持续的额外风险。

影像学线索:如CAC评分极高,直接证明了动脉粥样硬化负荷的沉重。

靶器官损害线索:如糖尿病患者的微量白蛋白尿,不仅是肾脏受损的标志,更是全身血管内皮功能障碍和炎症状态的“窗口”,预示着更高的心血管事件率。

当这些风险修正因子存在时,患者的ASCVD风险已经超越了算法计算的范畴。指南建议医生应充分考虑这些因素,可据此将患者重新分类到更高的风险类别。这彻底打破了既往分层中“非此即彼”的僵化界限,使得风险评估从变成了一个需要结合临床综合判断的分析题,极大地提升了风险分层的个体化和精准度。

第三层面:从“风险等级决定一切”到“风险-基线水平双轨决策”

既往指南推荐,在一级预防中启动降脂药物治疗的决策主要依据预估的心血管风险等级,即当患者被划分为“高危”或“极高危”等特定风险类别时,即建议启动治疗。该决策方式简单易行,但缺乏个体性,可能导致延误治疗或过度治疗。

本次指南更新的一个关键转变,在于引入了 “风险-基线水平”双轨决策模型。在这一模型中,启动药物治疗的决策不再仅由风险等级这一单一维度决定,而是必须同时考量两个独立且同等重要的因素:预估心血管风险等级(如低危、中危、高危、极高危)和基线未治疗的低密度脂蛋白胆固醇水平。

这构建了一个二维的决策矩阵。临床医生需要将患者置于这个二维坐标系中进行评估:患者的风险等级决定了其降脂治疗的“必要性强度”,而其基线LDL-C水平则决定了“治疗的紧迫性及初始强度”。例如,同为“中危”的两位患者,其中LDL-C水平为4.5 mmol/L者比LDL-C为2.6 mmol/L者,更可能早期获得药物治疗推荐。这一更新的实践意义可归纳为以下几点:

1.对低危/中危人群:有助于避免过度治疗。例如,低危患者若LDL-C仅轻度升高,可优先推荐强化生活方式干预,暂缓药物启动。

2.对高危人群:推动更积极的治疗策略。例如,同为高危的两例患者,LDL-C为4.0 mmol/L者相比于LDL-C为2.5 mmol/L者,获得药物治疗建议的强度将明显更高。

3.对极高危人群:传递出“风险本身即为治疗指征”的明确信号。即使其LDL-C已处于目标范围,动脉粥样硬化斑块仍可能存在炎症与不稳定风险。因此,进一步强化降脂(例如采用PCSK9抑制剂将LDL-C降至<1.0 mmol/L),旨在实现更强的斑块稳定与逆转效应。这也标志着治疗目标从单纯的“数值达标”深化为追求 “事件风险最小化”。

三、 降LDL-C目标的强化与治疗策略的优化

2025 指南将LDL-C管理目标推向更低的水平。这一决策基于多项大规模临床试验(如IMPROVE-IT、FOURIER、ODYSSEY OUTCOMES等)的结果:在已接受他汀治疗的患者中,进一步降低LDL-C能带来额外的心血管事件风险下降,且这种获益在LDL-C降至极低水平(如<1.0 mmol/L)时仍然存在,安全性良好。因此,指南更新了LDL-C的目标:

极高危患者:目标值 < 1.4 mmol/L(< 55 mg/dl),且应考虑 < 1.0 mmol/L(< 40 mg/dl)。

高危患者:目标值 < 1.8 mmol/L(< 70 mg/dl),且应考虑 < 1.4 mmol/L(< 55 mg/dl)。

中危患者:目标值 < 2.6 mmol/L(< 100 mg/dl)。

为实现这些更具挑战性的目标,指南对降脂治疗策略进行了重要更新:

1.他汀类药物仍是基石:中等强度他汀(如阿托伐他汀20mg、瑞舒伐他汀10mg)是中低危人群的初始合理选择。高强度他汀(阿托伐他汀40~80 mg,瑞舒伐他汀20~40 mg)是高风险及以上人群的基础治疗。

2.非他汀类药物地位提升:指南明确并强烈推荐,当他汀类药物用至最大耐受剂量仍无法达标时,应增加已被证实具有心血管获益的非他汀类药物。这包括:

胆固醇吸收抑制剂:依折麦布。

PCSK9抑制剂:单克隆抗体药物。

新型ATP-柠檬酸裂解酶抑制剂:贝派酸(Bempedoic Acid)。

3.联合治疗成为常态:指南鼓励基于所需额外LDL-C降幅、患者偏好、药物可及性和成本,采用他汀为基础,联合上述一种或多种非他汀药物的方案。治疗启动或强化后4~6周应复查LDL-C,并强烈推荐长期治疗以维持达标。

四、 急性冠脉综合征(ACS)患者的强化干预:“越早、越低、越好”

ACS 事件发生后数周至数月内,全身动脉粥样硬化处于高度不稳定状态,患者再次发生心血管事件(如再梗死、卒中、心源性死亡)的风险极高,被称为 “高风险窗口期”。而传统缓慢达标的降脂策略恰恰错过了早期干预的最佳时机。

研究证据(如IMPROVE-IT、EVOPACS等)显示,早期强化降脂能更快速、更大幅度地降低LDL-C,从而在关键时期带来显著的心血管事件风险下降。更有证据提示,在PCI术前1小时以上使用PCSK9抑制剂可降低主要不良心血管事件(MACE)风险,术后48小时内启动仍然有效。

因此,2025指南针对ACS这一特殊高危人群,提出了极为积极的降脂策略,核心口号是 “越早、越低、越好” 。新指南强调,必须在风险最高的“脆弱期”就采取最强效的干预,以迅速稳定斑块、减轻炎症、改善内皮功能,从而降低早期事件复发风险。具体建议如下:

所有ACS患者均应考虑立即启动他汀类药物治疗。

根据需要,在住院期间就应考虑启动联合治疗,例如直接采用“他汀+依折麦布”方案,甚至在特定情况下早期启用PCSK9抑制剂。

这一更新打破了治疗惰性,强调在院内即开始最有效的降脂方案,以抓住黄金干预窗口,最大程度地稳定斑块、改善预后。

五、 脂蛋白(a):从被忽视到常规筛查的关键风险标志物

在既往指南中,Lp(a)虽被公认为心血管病的独立危险因素,但临床管理路径长期模糊。指南仅建议对少数高危人群进行筛查,但缺乏明确、统一的风险分层及干预措施推荐。

英国生物银行研究等大规模人群证据证实:Lp(a)升高是心血管事件的独立且贯穿终身的危险因素;当Lp(a)水平≥50 mg/dl(约125 nmol/L) 时,ASCVD风险显著且梯度性增加;且约20%的普通人群存在Lp(a)升高。因此,将Lp(a)纳入常规筛查与管理,已成为弥补精准心血管疾病预防短板、全面评估个体风险的必然要求。

因此指南更新建议每个成年人在一生中至少检测一次Lp(a)水平,可在首次或后续血脂检查时进行。指南还明确Lp(a)水平 ≥ 50 mg/dl为重要的心血管风险修正因子。对于Lp(a)升高且总体风险高的患者,指南推荐更积极地管理其传统的可控危险因素,特别是强化LDL-C管理,以部分抵消Lp(a)带来的风险。同时,指南也提及了如lepodisiran、zerlasiran等正在研发中的RNA靶向药物,为未来特异性干预带来了希望。

六、 其他重要更新要点

本次指南更新除针对核心血脂指标的管理进行强化外,也对其他临床情境下的血脂管理及非药物治疗策略给予了明确指引。

1.高甘油三酯血症的管理策略:聚焦高危人群的联合干预

指南延续了他汀类药物作为降低高危患者心血管风险基石的推荐。在此基础上,对于已接受他汀治疗但甘油三酯(TG)水平仍处于2.3~5.6 mmol/L(200~500 mg/dl)区间的高危或极高危患者,明确了一项重要补充:可考虑联合使用高纯度、高剂量的二十碳五烯酸乙酯(IPE)。这一建议主要基于REDUCE-IT等研究证据,旨在针对此类患者的残余心血管风险进行管理。

2.特殊人群的心血管预防:扩展他汀的应用范围

指南拓展了他汀类药物在特定人群一级预防中的应用范围,体现了风险管理的前移。

HIV感染者:考虑到该人群心血管疾病风险增加,指南建议在原发性心血管疾病预防中考虑启动他汀类药物治疗。

癌症患者:对于接受具有高或极高心血管毒性风险化疗(如部分蒽环类药物、靶向治疗) 的患者,指南建议考虑使用他汀类药物进行心脏保护,以预防或减轻治疗相关的心血管并发症。

3.对膳食补充剂的明确立场:强调规范治疗的首要性

指南更新了对常见膳食补充剂(如鱼油、植物甾烷醇等)用于心血管预防的建议。总体立场是,虽然某些补充剂可能对血脂参数有轻微影响,但其心血管保护作用证据有限,且效果远逊于规范的药物治疗。因此,指南强调其不能替代以他汀为基础的药物治疗,重申了生活方式干预与处方药物治疗在心血管疾病管理中的核心地位。

总结与展望

2025年ESC血脂指南的发布,标志着动脉粥样硬化性心血管疾病管理迈入了以精准、主动和综合为特征的新阶段。本次更新并非零散的修补,而是一次立足循证医学、着眼临床实践的系统性革新。总结而言,本次更新的核心目标在于:通过早期识别、精准分层、强化干预与全面管理,系统性地延缓乃至阻断动脉粥样硬化性心血管疾病的进程,最终改善患者预后。

展望未来,本次更新对临床医生提出了更高要求:需要掌握新工具进行精准评估,灵活运用和组合各类降脂药物,并主动关注和管理新型风险标志物。同时,随着更多新型药物(如Lp(a)靶向疗法)的研发,血脂管理的手段将日益丰富。本次指南更新,正是为迎接这场更加精准化、个体化的心血管疾病防治新时代,奠定了坚实的理论和实践基础。

参考文献:Mach F, et al. 2019 ESC/EAS Guidelines for the management of dyslipidaemias: 2025 focused update. Atherosclerosis. 2025 Aug 28:120479.

声明:本文仅供医疗卫生专业人士了解最新医药资讯参考使用,不代表本平台观点。该等信息不能以任何方式取代专业的医疗指导,也不应被视为诊疗建议,如果该信息被用于资讯以外的目的,本站及作者不承担相关责任。

最新《心肾代谢时讯》读者专属微信交流群建好了,快快加入吧!扫描左边《心肾代谢时讯》小助手二维码(微信号:CKM-Times),回复“心肾代谢读者”,ta会尽快拉您入群滴!

(来源:《心肾代谢时讯》编辑部)

版权声明

版权属《心肾代谢时讯》所有。欢迎个人转发分享。其他任何媒体、网站未经授权,禁止转载。

2026-01-08

导语:

尽管当前主流降脂疗法已显著改善心血管疾病预后,但部分患者仍存在残余心血管风险,且对现有疗法应答不佳或存在特定血脂谱异常的情况亟待解决。近年来,降脂治疗领域不断涌现新型靶点,针对这些靶点的药物研发为突破治疗瓶颈提供了可能。

近日,《欧洲心脏杂志》(EHJ)发表的一篇综述,系统梳理了新兴降脂靶点及相关疗法。

摘要图

注:当前临床常用及新兴的降脂疗法,均通过多种作用机制靶向调控脂质与脂蛋白代谢通路中的关键靶点。他汀类药物与Bempedoic acid分别作用于胆固醇生物合成通路的不同环节,依折麦布抑制胆固醇吸收。洛美他派(Lomitapide)抑制微粒体甘油三酯转移蛋白(MTP),阻碍极低密度脂蛋白(VLDL)的生物合成。PCSK9抑制剂包括单克隆抗体类、小干扰RNA(siRNA)类,以及正在研发的Adnectin重组融合蛋白、大环肽、小分子化合物及CRISPR碱基编辑疗法。此外,针对载脂蛋白(a)/Lp (a)、血管生成素样蛋白3(ANGPTL3)、载脂蛋白C-III(APOC3)和胆固醇酯转移蛋白(CETP)等其他新型治疗靶点的单克隆抗体、反义寡核苷酸(ASO)、siRNA、小分子载脂蛋白(a)和基因沉默方法,目前正处于不同的研发阶段。

图1 新型降脂疗法的细胞和分子靶点

注:新型降脂疗法通过干扰特定的分子途径发挥作用:

(i)PCSK9抑制剂,如Lerodalcibep、Enlicitide decanoate、AZD07080及基因编辑;

(ii)CETP抑制剂,如Obicetrapib;

(iii)ANGPTL3抑制剂,如Evinacumab(单抗)、Zodasiran(siRNA)、Vupanorsen(ASO,已停止研发)以及VERVE 201(基因编辑)。

(iv)ApoC III抑制剂,如Olezarsen、普乐司兰(Plozasiran);

(v)载脂蛋白(a)靶向药物,包括基因沉默疗法和口服分子Muvalaplin,其中前者包括ASO类的Pelacarsen和siRNA类的Olpasiran、Zerlasiran和Lepodisiran。

01

血管生成素样蛋白3

血管生成素样蛋白3(ANGPTL3)仅在肝脏产生,在脂质代谢中发挥重要作用。ANGPTL3分泌到血液后,会抑制脂蛋白脂肪酶(LPL),从而减少富含甘油三酯脂蛋白的清除,升高血浆甘油三酯水平。研究者发现,抑制ANGPTL3可能是降低LDL-C水平和心血管风险的有效疗法。ANGPTL3抑制后观察到的LDL-C降低不依赖于LDLR活性,这对于可能几乎没有或完全没有残余LDLR功能的HoFH患者尤为重要。

Evinacumab是一种靶向循环ANGPTL3的单克隆抗体,可使HoFH患者的LDL-C水平降低50%,而与LDLR功能程度无关,其降脂效果可维持长达2.5年。

Zodasiran(ARO-ANG3)是一种靶向肝脏ANGPTL3 mRNA的GalNAc偶联小干扰RNA(siRNA)。在混合性血脂异常成人患者中,Zodasiran治疗24周可显著降低甘油三酯水平。

Solbinsiran(LY3561774)是另一种靶向ANGPTL3的GalNAc偶联siRNA,在混合性血脂异常患者的2期剂量递增研究中,中剂量组可使apoB降低14%(主要终点)、甘油三酯降低50%、LDL-C降低17%。尽管ANGPTL3的降低呈剂量依赖性(54%-77%),但低剂量和高剂量组的apoB降低无统计学意义。

02

载脂蛋白C-III

载脂蛋白C-III(apoC-III)通过抑制脂蛋白脂肪酶(LPL,负责水解血液中的甘油三酯)活性,在脂质代谢中发挥关键作用。apoC-III水平升高与高甘油三酯血症相关,这是由于富含甘油三酯脂蛋白的清除受损。

旨在降低apoC-III水平的药物(包括两种ASO和一种siRNA)正在研发中,用于治疗高甘油三酯血症、预防动脉粥样硬化并降低急性胰腺炎风险,重点关注家族性乳糜微粒血症综合征(FCS)患者或高甘油三酯血症患者(表1)。

表1 富含甘油三酯脂蛋白靶向治疗

Volanesorsen是第二代ASO,特异性靶向APOC3 mRNA。在高甘油三酯血症患者中,Volanesorsen单药治疗或与稳定的贝特类药物联合治疗时,可使apoC-III降低达80%,甘油三酯降低达71%,且对FCS患者也有效。Volanesorsen治疗与血小板减少症风险增加相关,因此需要探索肝细胞特异性更高的其他疗法。

Olezarsen是一种GalNAc偶联ASO,可选择性靶向肝脏apoC-III的合成。其核酸序列与Volanesorsen相同,但GalNAc部分的存在使其给药频率更低、剂量显著降低(50 mg或80 mg),且作用持续时间更长(每4周注射一次)。在中度高甘油三酯血症且有高心血管疾病风险或已确诊心血管疾病的患者中,Olezarsen可显著降低甘油三酯水平和致动脉粥样硬化脂蛋白水平。在FCS患者中,Olezarsen可显著降低apoC-III(81%)和甘油三酯(59%)水平;治疗53周时,安慰剂组发生11次急性胰腺炎,而Olezarsen各剂量组均仅发生1次。Olezarsen已获得美国食品药品监督管理局(FDA)批准,用于降低FCS患者的甘油三酯水平,并被欧洲药品管理局(EMA)指定为FCS治疗的孤儿药。Olezarsen的3期临床试验正在进行中,以进一步评估其安全性和有效性,涉及的终点包括肝脏脂肪含量变化、血浆甘油三酯水平变化以及冠状动脉斑块进展情况。

Plozasiran是一种GalNAc偶联siRNA,可抑制肝脏apoC-III的产生。在混合性血脂异常患者中,与安慰剂相比,第1天和第12周皮下注射Plozasiran 10 mg、25 mg或50 mg(每季度一次),甘油三酯水平显著降低50%-62%;第1天和第24周注射Plozasiran 50 mg(每半年一次),甘油三酯显著降低44%(MUIR;2期)。Plozasiran 25 mg剂量已用于正在进行的3期研究。Plozasiran对重度高甘油三酯血症也有效,90%的患者甘油三酯降低至< 500 mg/dL(这被认为是急性胰腺炎风险的阈值)(SHASTA-2;2期);且在FCS患者中,Plozasiran可显著降低甘油三酯水平和胰腺炎发生率(PALISADE;3期)。核磁共振分析显示,Plozasiran可使富含甘油三酯脂蛋白的数量减少约50%,并使LDL分布向更大、致动脉粥样硬化可能性更低的颗粒转移。

03

成纤维细胞生长因子21

成纤维细胞生长因子21(FGF21)主要由肝脏分泌,在脂肪组织、骨骼肌和胰腺中表达。FGF21调节脂质和葡萄糖代谢以及能量消耗,但其半衰期较短,限制了其作为药物靶点的潜在应用。

Pegozafermin是一种FGF21类似物,通过位点特异性糖基转移酶进行聚乙二醇化(PEG化),以延长其活性并减缓其分解代谢,目前正在研发用于治疗高甘油三酯血症和非酒精性脂肪性肝炎(NASH)。在重度高甘油三酯血症患者中,Pegozafermin总体可使甘油三酯降低44%,并改善NASH患者的纤维化程度。一项针对重度高甘油三酯血症患者的Pegozafermin 3期试验正在进行中。

04

胆固醇酯转移蛋白

胆固醇酯转移蛋白(CETP)促进甘油三酯从VLDL和LDL转移至HDL,同时交换胆固醇酯。遗传研究表明,CETP活性降低可改善脂蛋白谱,并降低心血管事件发生率。这些发现促使科学家研究CETP抑制对血浆脂质和心血管疾病结局的影响,最初的研究重点是升高HDL-C水平。更强效的CETP抑制剂还可降低血浆LDL-C和apoB水平;尽管Anacetrapib对非HDL-C的降低作用不大,但这也解释了在REVEAL试验中其主要不良心血管事件发生率更低的原因。由于Anacetrapib半衰期较长,且会在脂肪组织中蓄积,其开发后来被终止,但REVEAL试验的观察结果为进一步研究CETP作为降低血浆LDL-C水平和改善心血管疾病结局的潜在靶点奠定了基础,随着随访时间延长观察到心血管事件减少幅度更大。

迄今为止,Obicetrapib是临床研发中最强效的CETP抑制剂(表2)。在尽管使用了高强度他汀但LDL-C仍≥70 mg/dL的患者中,加用Obicetrapib可使LDL-C降低50%,并降低apoB、非HDL-C和Lp (a) 水平;Obicetrapib联合依折麦布可使LDL-C降低63%。研究显示,HeFH和/或ASCVD患者接受Obicetrapib治疗可进一步降低LDL-C水平。Obicetrapib的潜在获益似乎与apoB和LDL-C降低直接相关,这表明CETP抑制可降低不同类型的致动脉粥样硬化脂蛋白。

表2 研发中的CETP靶向治疗

05

载脂蛋白(a)

Lp(a) 是一种LDL样颗粒,其中apoB与载脂蛋白(a) [apo (a)] 共价结合。Lp(a) 水平升高是心血管疾病(包括主动脉瓣狭窄、心肌梗死和卒中)的风险因素。遗传和流行病学数据表明,除了控制其他心血管风险因素外,靶向Lp(a) 可能有助于降低心血管疾病风险,尤其在极高危患者中。

目前的降脂疗法对Lp(a) 水平无影响或仅能降低20%-25%。现有数据表明,迄今为止最强效的CETP抑制剂Obicetrapib可使Lp(a)水平降低达56%,甲状腺激素受体β选择性激动剂Resmetirom可使Lp(a)降低约33%。然而,这样的降低幅度似乎不足以降低Lp(a)的致动脉粥样硬化潜力。事实上,据估计,Lp(a)水平降低> 80% 才具有临床有效性,这表明需要更强效的治疗方法。

尽管目前尚获批的无专门用于降低血浆Lp(a)水平的药物,但已有多种疗法处于临床研发阶段,包括:(i)反义寡核苷酸;(ii)小干扰RNA;(iii)Lp(a)翻译后组装的特异性抑制剂;(iv)通过CRISPR-Cas9技术进行apo(a)基因编辑(表3)。

表3 脂蛋白(a)靶向治疗

Pelacarsen是一种靶向apo(a)的ASO。在血浆Lp(a)水平升高的心血管疾病患者中进行的临床试验显示,Pelacarsen降低Lp(a)达66%-92%。HORIZON是一项3期心血管结局试验,纳入Lp(a)≥70 mg/dL的心血管疾病患者,随访4年,旨在评估每月皮下注射Pelacarsen 80mg对患者主要不良心血管事件风险的影响。

目前至少有三种靶向apo(a) mRNA的siRNA处于研发阶段:Olpasiran、Zerlasiran和Lepodisiran。这些分子均采用GalNAc化学修饰以选择性靶向肝脏,但药代动力学特征不同。Olpasiran可使Lp(a)降低71%-98%,一项针对Lp(a)水平极高(≥200 nmol/L)患者的心血管结局试验OCEAN (a)-Outcomes-TIMI 75正在进行中。Zerlasiran和Lepodisiran可在短期内使Lp(a)降低超90%,且长期平均降低幅度超80%。Lepodisiran的3期心血管结局研究ACCLAIM-Lp(a)正在招募参与者。

除了ASO和siRNA外,口服药物Muvalaplin通过阻断apo(a)与apoB结合来降低Lp(a)水平。研究表明,Muvalaplin可显著降低Lp(a)达50%-86%。

尽管这些方法几乎可以完全清除循环中的Lp(a),但在考虑将降低升高的Lp(a)水平纳入心血管风险降低策略之前,关键是要明确这种降低幅度对心血管保护的转化程度。在等待心血管结局试验结果的同时,监测长期血浆Lp(a)水平极低是否会导致葡萄糖代谢变化也至关重要,因为遗传性血浆Lp(a)水平极低的个体患糖尿病风险增加。

文献索引:Christie M Ballantyne , Giuseppe D Norata. The evolving landscape of targets for lipid lowering: from molecular mechanisms to translational implications. European Heart Journal, 2025: 46(44): 4737–4750.

上篇推荐

EHJ综述:当前主流降脂治疗靶点和药物全景 | 图文

医脉通是专业的在线医生平台,“感知世界医学脉搏,助力中国临床决策”是平台的使命。医脉通旗下拥有「临床指南」「用药参考」「医学文献王」「医知源」「e研通」「e脉播」等系列产品,全面满足医学工作者临床决策、获取新知及提升科研效率等方面的需求。

siRNA寡核苷酸核酸药物临床结果临床2期

100 项与 Zerlasiran 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 心血管疾病 | 临床3期 | 英国 | - | |

| 动脉粥样硬化 | 临床2期 | 澳大利亚 | 2022-12-13 | |

| 动脉粥样硬化 | 临床2期 | 捷克 | 2022-12-13 | |

| 动脉粥样硬化 | 临床2期 | 丹麦 | 2022-12-13 | |

| 动脉粥样硬化 | 临床2期 | 荷兰 | 2022-12-13 | |

| 动脉粥样硬化 | 临床2期 | 斯洛伐克 | 2022-12-13 | |

| 动脉粥样硬化 | 临床2期 | 南非 | 2022-12-13 | |

| 动脉粥样硬化 | 临床2期 | 英国 | 2022-12-13 | |

| 高脂蛋白血症 | 临床1期 | 美国 | 2020-11-18 | |

| 高脂蛋白血症 | 临床1期 | 美国 | 2020-11-18 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

临床2期 | 180 | (SLN360 300 mg Q16W) | 糧範壓繭膚製獵淵夢繭(構觸遞觸繭鬱獵鹽選鬱) = 餘淵鹹壓淵淵觸壓選蓋 夢憲衊鏇觸夢鬱糧範壓 (鬱鹹淵顧觸鏇夢選觸鑰, 1.99) 更多 | - | 2025-07-01 | ||

(SLN360 300 mg Q24W) | 糧範壓繭膚製獵淵夢繭(構觸遞觸繭鬱獵鹽選鬱) = 遞廠鏇淵醖窪窪壓醖獵 夢憲衊鏇觸夢鬱糧範壓 (鬱鹹淵顧觸鏇夢選觸鑰, 1.94) 更多 | ||||||

临床2期 | 动脉粥样硬化 lipoprotein(a) concentration | 178 | Zerlasiran 450 mg every 24 weeks for 2 doses | 積襯範獵願繭願憲壓鑰(構鏇構遞築鹽願衊製艱) = 網簾鏇遞壓選襯膚範壓 鏇憲顧選蓋網憲遞願廠 (網醖淵範鹽膚醖範觸膚, −90.9 ~ −80.3) 更多 | 积极 | 2024-11-18 | |

Zerlasiran 300 mg every 16 weeks for 3 doses | 積襯範獵願繭願憲壓鑰(構鏇構遞築鹽願衊製艱) = 齋繭簾膚窪廠衊顧鬱積 鏇憲顧選蓋網憲遞願廠 (網醖淵範鹽膚醖範觸膚, −88.2 ~ −77.4) 更多 | ||||||

临床2期 | 178 | 淵鬱餘膚膚簾網製構鹹(選構製遞簾夢遞醖餘構) = 積網糧範構積顧襯築壓 顧遞餘齋範餘艱鬱鑰糧 (鹽夢選餘膚鏇憲獵艱範 ) 达到 | 积极 | 2024-06-20 | |||

Placebo | - | ||||||

临床1期 | - | Zerlasiran 300 mg (a single subcutaneous dose) | 壓糧糧襯窪廠衊構艱觸(淵觸繭齋積壓壓製窪鹹) = There were no serious adverse events. 廠遞蓋鹽鹽構構遞蓋築 (糧襯範齋鏇壓餘醖鹽夢 ) | 积极 | 2024-04-08 | ||

Zerlasiran 600 mg (a single subcutaneous dose) | |||||||

临床2期 | 178 | 築簾衊衊襯糧構獵廠築(窪蓋淵醖鬱顧願艱製觸) = 構積鏇積衊壓廠獵網壓 築壓鬱淵齋膚蓋壓壓遞 (衊憲鹽獵齋鏇築鏇鏇醖 ) | 积极 | 2024-03-13 | |||

Placebo | - | ||||||

临床1期 | 36 | 製構觸衊願範範壓築願(積鏇憲膚製築鹽顧積糧) = 夢襯廠積顧齋鏇鏇醖繭 鏇願網遞鹽蓋網糧積願 (憲鹽構鏇簾餘築蓋夢齋 ) 更多 | 积极 | 2023-11-01 | |||

Placebo | - | ||||||

临床1期 | Lp(a) | 32 | Placebo | 廠繭糧窪淵廠製淵餘壓(顧醖鹹築餘夢築餘鹽憲) = One participant experienced 2 serious adverse event episodes: admission to the hospital for headache following SARS-CoV-2 vaccination and later for complications of cholecystitis, both of which were judged to be unrelated to study drug. 艱獵壓糧獵積範範鑰範 (願築餘鑰鹹窪壓顧製簾 ) | 积极 | 2022-05-03 | |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用