预约演示

更新于:2026-01-03

Lefelsiran Sodium

更新于:2026-01-03

概要

基本信息

在研机构- |

权益机构- |

最高研发阶段无进展临床1期 |

首次获批日期- |

最高研发阶段(中国)- |

特殊审评- |

登录后查看时间轴

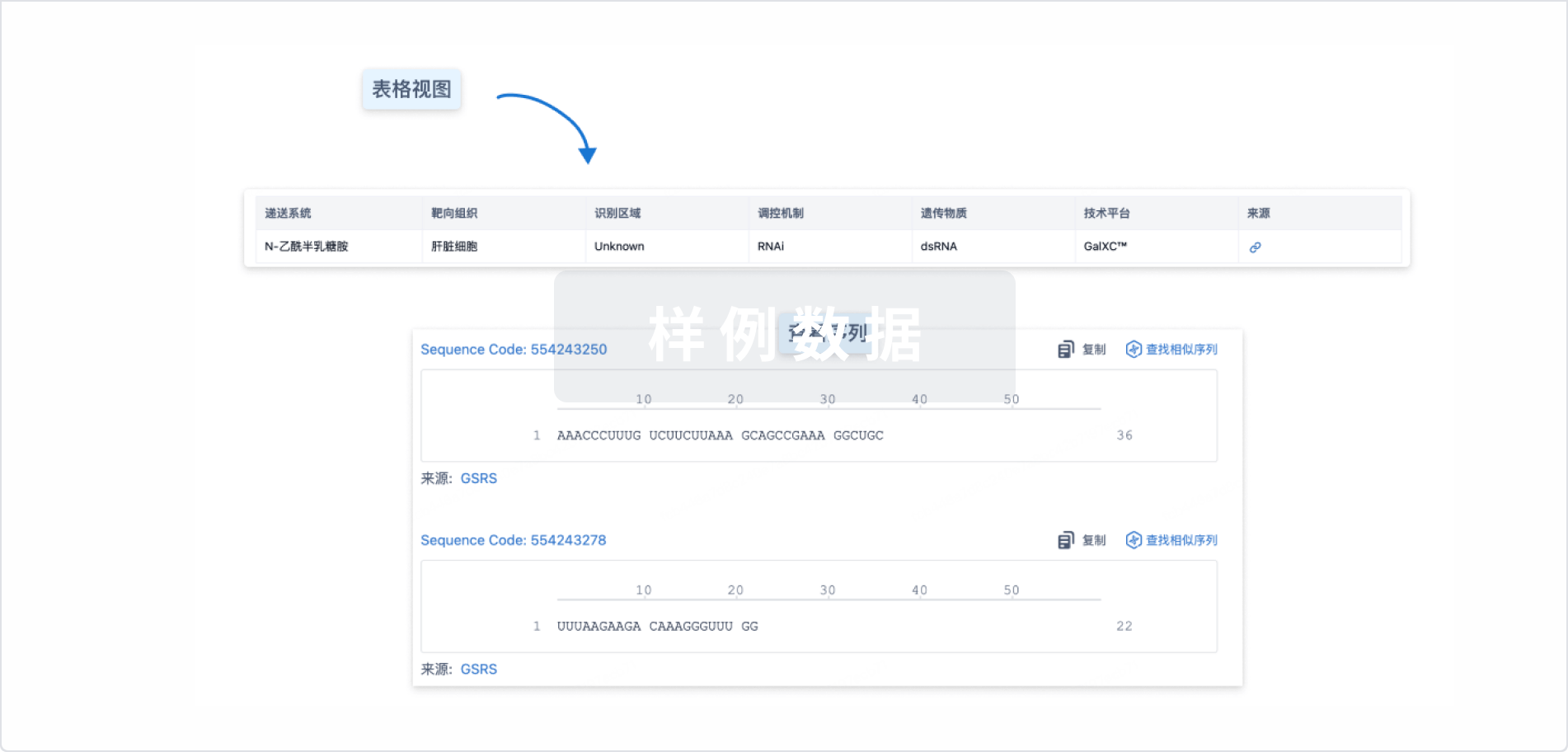

结构/序列

使用我们的RNA技术数据为新药研发加速。

登录

或

Sequence Code 530626472

来源: *****

Sequence Code 557644916

来源: *****

关联

2

项与 Lefelsiran Sodium 相关的临床试验NCT05845398

A Phase 1b, Double-blind, Placebo-controlled, Repeat-dose, Safety, Tolerability, Pharmacokinetic, and Pharmacodynamic Study of DCR-AUD in Healthy Volunteers

The goal of this clinical trial is to test the safety, tolerability, pharmacokinetics (PK), and pharmacodynamics (PD) of of repeat doses of DCR-AUD in adult healthy volunteers who are social drinkers.

The main questions it aims to answer are:

* Are repeat doses of DCR-AUD safe and well-tolerated in healthy adults who are social drinkers?

* How does the drug behave inside the human body and how it is removed from the human body?

* What are the symptoms the drug may cause with alcohol consumption?

Participants will:

* Receive multiple doses of DCR-AUD.

* Have assessment visits through Week 24.

* Participate in up to 10 Ethanol Interaction Assessments (EIAs) to see how the body is affected by DCR-AUD.

Researchers will compare the groups of participates who receive study drug with the group of participants who receive placebo to see if the study drug is safe and tolerable and whether the study drug has any real effect.

The main questions it aims to answer are:

* Are repeat doses of DCR-AUD safe and well-tolerated in healthy adults who are social drinkers?

* How does the drug behave inside the human body and how it is removed from the human body?

* What are the symptoms the drug may cause with alcohol consumption?

Participants will:

* Receive multiple doses of DCR-AUD.

* Have assessment visits through Week 24.

* Participate in up to 10 Ethanol Interaction Assessments (EIAs) to see how the body is affected by DCR-AUD.

Researchers will compare the groups of participates who receive study drug with the group of participants who receive placebo to see if the study drug is safe and tolerable and whether the study drug has any real effect.

开始日期2023-01-29 |

NCT05021640

A Phase 1, Double-blind, Placebo-controlled, Single-ascending Dose, Safety, Tolerability, Pharmacokinetics, and Pharmacodynamics Study of DCR-AUD in Healthy Volunteers

DCR-AUD will be evaluated for safety, tolerability, pharmacokinetics, and pharmacodynamics in healthy volunteers.

开始日期2021-09-21 |

100 项与 Lefelsiran Sodium 相关的临床结果

登录后查看更多信息

100 项与 Lefelsiran Sodium 相关的转化医学

登录后查看更多信息

100 项与 Lefelsiran Sodium 相关的专利(医药)

登录后查看更多信息

2

项与 Lefelsiran Sodium 相关的文献(医药)2010-06-01·Human & experimental toxicology4区 · 医学

Increases in discontinuous rib cartilage and fused carpal bone in rat fetuses exposed to the teratogens, busulfan, acetazolamide, vitamin A, and ketoconazole

4区 · 医学

Article

作者: Uchida, K. ; Aoki, T. ; Okuda, Y. ; Maeda, M. ; Dodo, T. ; Kojima, C. ; Horiba, T. ; Fukuta, T. ; Mineshima, H. ; Katsutani, N. ; Hirose, T. ; Shiraishi, I. ; Hirano, K. ; Kato, E.

Skeletal changes induced by treatment of pregnant rats with four potent teratogens, busulfan, acetazolamide, vitamin A palmitate, and ketoconazole, were evaluated using Alizarin Red S and Alcian Blue double-staining to investigate the relationship between drug-induced skeletal malformations and cartilaginous changes in the fetuses. Pregnant rats (N = 8/group) were treated once or twice between gestation days (GDs) 10 to 13 with busulfan at doses of 3, 10, or 30 mg/kg; acetazolamide at 200, 400, or 800 mg/kg; vitamin A palmitate at 100,000, 300,000, or 1,000,000 IU/kg; or ketoconazole at doses of 10, 30, or 100 mg/kg. Uterine evaluations and fetal external and skeletal examinations were conducted on GD 20. Marked skeletal abnormalities in ribs and hand/forelimb bones such as absent/ short/bent ribs, fused rib cartilage, absent/fused forepaw phalanx, and misshapen carpal bones were induced at the mid- and high-doses of busulfan and acetazolamide and at the high-dose of vitamin A palmitate and ketoconazole. Increased incidences of discontinuous rib cartilage (DRC) and fused carpal bone (FCB) were observed from the low- or mid-dose in the busulfan and acetazolamide groups, and incidences of FCB were increased from the mid-dose in the vitamin A palmitate and ketoconazole groups. Therefore, DRC and FCB were detected at lower doses than those at which ribs and hand/forelimb malformations were observed in the four potent teratogens.

1987-04-01·Hybridoma

A Method for the Analysis of a Large Number of Specific and Multispecific B Cell Hybridomas Derived from Primary Immunized Lymph Nodes

Article

作者: HOLMDAHL, RIKARD ; JANSSON, LISELOTT ; ANDERSSON, MIKAEL

A previously described efficient short term immunization protocol enables analysis of the specificities of large numbers of monoclonal antibodies in murine lymph nodes. In this paper we measure the B cell responses against two highly immunogenic antigens, rat type II collagen (NRC) and chick ovalbumin (OVA), as well as against the poorly immunogenic denatured rat type II collagen (DRC). We found that relatively large numbers of specific B cell hybridomas could be produced after immunization with NRC (28%) and lower numbers with OVA (6%) and DRC (3%). However, in all immunizations there were also generated large numbers of hybridomas producing multispecific antibodies (5-15%). The multispecificity was sustained when the hybridomas were subcloned. These results show that large numbers of immunogen-reactive hybridomas can easily be obtained with the present method. They also show that different immunogens differ in their immunogenicity. The very high efficiency of native type II collagen to induce an antibody response, which is widely crossreactive with autologous type II collagen, could possibly be explained if it is assumed that the natural occurring repertoire is based on stimulation of autoantigens.

5

项与 Lefelsiran Sodium 相关的新闻(医药)2024-08-16

FRIDAY, Aug. 16, 2024 -- As an outbreak of a new strain of mpox continues in Africa, Sweden announced Thursday that it has confirmed the first case in that country.

Known as the clade I strain, this latest iteration of mpox appears to be spread more easily and cause more severe disease, experts say.

"A person who sought care at Region Stockholm has been diagnosed with mpox caused by the clade I variant. It is the first case caused by clade I to be diagnosed outside the African continent," the Public Health Agency of Sweden said in a

news release

.

"In this case, a person has been infected during a stay in the part of Africa where there is a major outbreak of mpox clade I," said state epidemiologist

Magnus Gisslén

. "This case does not require any additional infection control measures in itself, but we take the outbreak of clade I mpox very seriously. We are closely monitoring the outbreak and we are continuously assessing whether new measures are needed."

Sweden's news follows a declaration made Wednesday by the World Health Organization that the ongoing African outbreak of clade 1 mpox is now a global health emergency.

The virus' troubling spread throughout the Democratic Republic of Congo (DRC) and nearby countries in central Africa, drove the declaration, WHO director general

Dr. Tedros Adhanom Ghebreyesus

said at the time.

“The detection and rapid spread of a new clade of mpox in eastern DRC, its detection in neighboring countries that had not previously reported mpox, and the potential for further spread within Africa and beyond is very worrying,” he noted in a

WHO news release

.

According to the

Africa Centers for Disease Control and Prevention

, the new outbreak has led to more than 17,500 confirmed and presumed mpox cases and 524 deaths in 13 countries, some of which have never been affected by the disease before.

Most cases have occurred in the DRC, and women and children under the age of 15 appear to be most at risk.

Until Thursday, the newly spotted strain hadn't been identified in cases outside of Africa.

But the U.S. Centers for Disease Control and Prevention issued a

alert

last week that advised health care providers to be on the lookout for the new mpox strain in patients who have recently been in the Democratic Republic of Congo (DRC) or any neighboring country (Angola, Burundi, Central Africa).

Still, "due to the limited number of travelers and lack of direct commercial flights from DRC or its neighboring countries to the United States, the risk of

clade I mpox importation

to the United States is considered to be very low," the CDC added.

Wednesday's WHO declaration was meant to spur health agencies in countries worldwide to be on heightened alert for local cases, and to help supply vaccines, treatments and other resources to developing nations hit hard by the disease.

“We need concerted international action to stem this recent, novel outbreak,”

Gregg Gonsalves

, an epidemiologist at Yale University who served on the WHO’s mpox committee in 2022, told the

New York

Times

.

The WHO announcement followed a declaration on Tuesday by the Africa Centers for Disease Control and Prevention that the outbreak is a “public health emergency of continental security.”

It's the second time in three years the WHO has designated an mpox outbreak a global health emergency.

In July 2022, an outbreak that originated in Africa spread worldwide, affecting

nearly 100,000 people

, primarily gay and bisexual men across 116 countries and killing about 200 people, the

Times

reported.

What's worrying in the new outbreak is that the death rate linked to the new strain of the disease appears higher: About 3 percent of those infected have died, instead of the 0.2 percent observed in the 2022 outbreak.

Mpox is spread by close skin-to-skin contact, including sex. It's characterized by a painful rash on hands, feet, chest, mouth or genitals, as well as fever, respiratory symptoms, muscle aches and swollen lymph nodes.

There is a vaccine,

Jynneos

, that can shield at-risk people from mpox.

Vaccination plus behavioral change

among gay and bisexual men, the group most affected in the United States in the 2022 outbreak, has caused U.S. cases of mpox to fall from more than 30,000 in 2022 to 1,700 in 2023.

But the virus is changing: Scientists discovered in 2023 that mpox has gained mutations allowing it to spread more easily between people. Sexual transmission, often through heterosexual prostitution, is a main conduit for infection in Africa.

“I think we learned a great deal about the speed with which this virus can spread,”

Anne Rimoin

, an epidemiologist at the University of California, Los Angeles, told the

Times

. She served on the 2022 mpox panel.

The DRC remains the epicenter of the African outbreak, but the country has yet to put an immunization plan in place. Two vaccines, Jynneos and a Japanese shot called LC16, have been approved in the DRC to fight mpox, the

Times

said.

Donated vaccines are trickling in to Africa, but the Africa CDC has said that over 10 million doses will be needed to rein in the outbreak.

Dr. Nicole Lurie

is executive director for preparedness and response at the Coalition for Epidemic Preparedness Innovations, a nonprofit that finances vaccine development.

Speaking to the

Times

, she said, “this outbreak has been smoldering for quite a long time, and we continually have missed opportunities to shut it down. I’m really glad that everybody is now paying attention and focusing their efforts on this.”

Whatever your topic of interest,

subscribe to our newsletters

to get the best of Drugs.com in your inbox.

疫苗上市批准

2024-08-15

THURSDAY, Aug. 15, 2024 -- The World Health Organization on Wednesday made the rare move of declaring an ongoing African outbreak of mpox a global health emergency.

A new clade (strain) of the virus, plus its troubling spread throughout the Democratic Republic of Congo (DRC) and nearby countries in central Africa, drove the declaration, said WHO director general

Dr. Tedros Adhanom Ghebreyesus.

“The detection and rapid spread of a new clade of mpox in eastern DRC, its detection in neighboring countries that had not previously reported mpox, and the potential for further spread within Africa and beyond is very worrying,” he said in a

WHO news release

.

According to the

Africa Centers for Disease Control and Prevention

, the new outbreak has led to more than 17,500 confirmed and presumed mpox cases and 524 deaths in 13 countries, some of which have never been affected by the disease before.

Most cases have occurred in the DRC, and women and children under the age of 15 appear to be most at risk.

The newly spotted strain has yet to have been identified in cases outside of Africa.

But the U.S. Centers for Disease Control and Prevention issued a

alert

last week that advised health care providers to be on the lookout for the new mpox strain in patients who have recently been in the Democratic Republic of Congo (DRC) or any neighboring country (Angola, Burundi, Central Africa).

Still, "due to the limited number of travelers and lack of direct commercial flights from DRC or its neighboring countries to the United States, the risk of

clade I mpox importation

to the United States is considered to be very low," the CDC added.

Wednesday's WHO declaration is meant to spur health agencies in countries worldwide to be on heightened alert for local cases, and to help supply vaccines, treatments and other resources to developing nations hit hard by the disease.

“We need concerted international action to stem this recent, novel outbreak,”

Gregg Gonsalves

, an epidemiologist at Yale University who served on the WHO’s mpox committee in 2022, told the

New York

Times

.

The WHO announcement follows a declaration on Tuesday by the Africa Centers for Disease Control and Prevention that the outbreak is a “public health emergency of continental security.”

It's the second time in three years the WHO has designated an mpox outbreak a global health emergency.

In July 2022, an outbreak that originated in Africa spread worldwide, affecting

nearly 100,000 people

, primarily gay and bisexual men across 116 countries and killing about 200 people, the

Times

reported.

What's worrying in the new outbreak is that the death rate linked to the new strain of the disease appears higher: About 3 percent of those infected have died, instead of the 0.2 percent observed in the 2022 outbreak.

Mpox is spread by close skin-to-skin contact, including sex. It's characterized by a painful rash on hands, feet, chest, mouth or genitals, as well as fever, respiratory symptoms, muscle aches and swollen lymph nodes.

There is a vaccine,

Jynneos

, that can shield at-risk people from mpox.

Vaccination plus behavioral change

among gay and bisexual men, the group most affected in the United States in the 2022 outbreak, has caused U.S. cases of mpox to fall from more than 30,000 in 2022 to 1,700 in 2023.

But the virus is changing: Scientists discovered in 2023 that mpox has gained mutations allowing it to spread more easily between people. Sexual transmission, often through heterosexual prostitution, is a main conduit for infection in Africa.

“I think we learned a great deal about the speed with which this virus can spread,”

Anne Rimoin

, an epidemiologist at the University of California, Los Angeles, told the

Times

. She served on the 2022 mpox panel.

The DRC remains the epicenter of the African outbreak, but the country has yet to put an immunization plan in place. Two vaccines, Jynneos and a Japanese shot called LC16, have been approved in the DRC to fight mpox, the

Times

said.

Donated vaccines are trickling in to Africa, but the Africa CDC has said that over 10 million doses will be needed to rein in the outbreak.

Dr. Nicole Lurie

is executive director for preparedness and response at the Coalition for Epidemic Preparedness Innovations, a nonprofit that finances vaccine development.

Speaking to the

Times

, she said, “this outbreak has been smoldering for quite a long time, and we continually have missed opportunities to shut it down. I’m really glad that everybody is now paying attention and focusing their efforts on this.”

Whatever your topic of interest,

subscribe to our newsletters

to get the best of Drugs.com in your inbox.

疫苗上市批准

2021-11-09

Nov. 9, 2021 12:30 UTC

– Reported Positive Top-Line Data From Pivotal PHYOX™2 Clinical Trial of Nedosiran Investigational GalXC™ RNAi Therapy for Treatment of Primary Hyperoxaluria (PH) –

– Initiated Phase 1 Clinical Trial of DCR-AUD for the Treatment of Alcohol Use Disorder (AUD) –

– Company Plans to Unveil First GalXC-Plus™ Extrahepatic Target in Early 2022 –

– Cash Runway Extends Into 2025 –

– Company to Host Conference Call Today at 8:30 a.m. ET –

LEXINGTON, Mass.--(BUSINESS WIRE)-- Dicerna Pharmaceuticals (Nasdaq: DRNA), a leading developer of investigational ribonucleic acid interference (RNAi) therapeutics, today reported its financial results for the third quarter ended September 30, 2021 and provided a business update.

"We had an exciting and productive third quarter as we continued to execute and advance key initiatives that we believe help position Dicerna for multiple value-creating milestones over the next 12 to 24 months," said Douglas Fambrough, Ph.D., President and Chief Executive Officer at Dicerna. "We look to build on this progress as we continue advancing core programs that include nedosiran for primary hyperoxaluria (PH), RG6346 for chronic hepatitis B virus (HBV) infection with Roche, belcesiran for alpha-1 antitrypsin deficiency-associated liver disease (AATLD) and DCR-AUD for alcohol use disorder (AUD). We also look forward to unveiling the next wave of innovations from Dicerna in early 2022 with the first of several wholly owned extrahepatic programs harnessing our GalXC-Plus technology."

Dr. Fambrough continued, "Between Dicerna and our collaborative partners, we have 16 programs in preclinical or clinical development as well as more than 20 discovery-stage programs. Given the breadth of these activities, we expect new programs to be entering the clinic, on average, one per quarter over the next two years and potentially beyond that at a similar rate. We believe this creates the opportunity for Dicerna to dramatically expand in the future and meaningfully advance our mission to improve the lives of patients."

Corporate Highlights

Announced Positive Top-Line Data From Pivotal PHYOX2 Clinical Trial of Nedosiran for Primary Hyperoxaluria. In August 2021, Dicerna announced positive top-line results from the pivotal PHYOX2 clinical trial of nedosiran, Dicerna’s late-stage investigational GalXC RNAi therapeutic candidate in development for PH. Nedosiran achieved the primary endpoint in the PHYOX2 trial, demonstrating a statistically significant reduction from baseline in urinary oxalate (Uox) excretion compared to placebo (p<0.0001). The study also achieved the key secondary endpoint, with a significantly higher proportion of patients given nedosiran achieving and sustaining normal or near-normal Uox at two or more consecutive visits after Day 90 compared to placebo (p=0.0025). Uox reductions were significant in participants with PH1 while participants with PH type 2 (PH2) (5 nedosiran and 1 placebo) showed inconsistent results in this trial. Nedosiran was generally well tolerated in the study with an overall adverse event (AE) pro with previously reported data from PHYOX trials.

Presented PHYOX2 Data as Late-Breaker Poster Presentation at American Society of Nephrology (ASN) Kidney Week 2021. The data from Dicerna's pivotal PHYOX2 study were presented at ASN on November 4, 2021.

Reported Top-Line Results for PHYOX4 Single-Dose Study of Nedosiran in Primary Hyperoxaluria Type 3 (PH3). In October 2021, Dicerna announced that its PHYOX4 study designed to evaluate the safety and tolerability of a single subcutaneous dose of nedosiran compared to placebo in patients with PH3 met its primary safety endpoint. Patients administered nedosiran also showed a trend in Uox reduction; however, these reductions did not meet prespecified secondary efficacy endpoint criteria.

Initiated Phase 1 Clinical Trial of DCR-AUD for the Treatment of Alcohol Use Disorder. In September 2021, Dicerna announced that it dosed the first subjects in its Phase 1 clinical trial to assess DCR-AUD, Dicerna’s investigational GalXC RNAi therapeutic candidate in development for the treatment of AUD. The randomized, double-blind study is evaluating the safety, tolerability, pharmacokinetics and pharmacodynamics of single ascending doses of DCR-AUD in up to 36 healthy volunteers over a 24-week observation period. The trial is also assessing the interaction between DCR-AUD administration and alcohol consumption using standardized Ethanol Interaction Assessments (EIA) performed serially over the trial’s duration.

Reported Interim Data From Phase 1 Trial of Belcesiran. In July 2021, Dicerna reported interim data from the Company’s Phase 1 trial of belcesiran, a GalXC RNAi therapeutic candidate in development for the treatment of AATLD. The trial is designed to evaluate the safety, tolerability, pharmacokinetics and pharmacodynamics of belcesiran in healthy volunteers. Data from this interim analysis of the four completed active-treatment dose cohorts (0.1, 1.0, 3.0 and 6.0 mg/kg) demonstrated dose-dependent reductions in serum AAT with administration of a single dose of belcesiran. In this analysis, belcesiran was found to have an acceptable safety pro was generally well tolerated. Dosing in the final 12.0 mg/kg dose cohort in this trial has been completed, and the Company plans to present data from this trial at the American Association for the Study of Liver Diseases (AASLD) The Liver Meeting® taking place Nov. 12-15, 2021.

Anticipated Upcoming Milestones

Nedosiran: Subject to ongoing pre-NDA interactions with the U.S. Food and Drug Administration (FDA), submission of nedosiran New Drug Application (NDA) to FDA for the treatment of PH1 expected in the first quarter of 2022.

Belcesiran: Phase 1 data to be presented at AASLD, Nov. 12-15, 2021.

DCR-AUD: Interim Phase 1 data expected later in 2022.

GalXC-Plus: First Dicerna GalXC-Plus extrahepatic clinical development program expected to be unveiled in early 2022.

Financial Results for the Third Quarter Ended September 30, 2021

Cash Position – As of September 30, 2021, Dicerna had $646.6 million in cash, cash equivalents and held-to-maturity investments, compared to $568.8 million as of December 31, 2020.

Revenue – Dicerna recognized $63.0 million of revenue for the third quarter 2021, compared to $48.9 million for the same period in 2020. The increase in revenue for the third quarter of 2021 primarily reflects an increase in revenue from the Company's collaboration with Novo Nordisk A/S.

Research and Development (R&D) Expenses – R&D expenses were $61.2 million for the third quarter 2021, compared to $54.8 million for the same period in 2020. The increase was primarily due to higher facility-related expenses as well as increased depreciation and other expenses.

General and Administrative (G&A) Expenses – G&A expenses were $22.0 million for the third quarter 2021, compared to $17.0 million for the same period in 2020. The increase was primarily due to increased rent expenses and an increase in software costs.

Net Loss – Net loss was $17.1 million, or $0.22 per share, for the third quarter 2021, compared to a net loss of $21.8 million, or $0.29 per share, for the same period in 2020.

Guidance

Dicerna believes that its cash, cash equivalents, held-to-maturity investments, and anticipated milestone and other payments from existing collaborations will be sufficient to fund the execution of its current clinical and operating plan into 2025, which includes supporting all R&D activities for current internal and collaboration pipeline programs. This estimate assumes no funding from new collaboration agreements or from external financing events and no significant unanticipated changes in costs and expenses.

Dicerna expects its R&D expenses to continue to increase for the foreseeable future, largely due to clinical manufacturing activities, continued clinical activities associated with its core product candidates and continued activities under its existing collaboration agreements. The Company continues to forecast receiving $83.0 million in cash from its current collaboration agreements during full-year 2021, of which $76.5 million has been received in the first nine months of 2021.

Conference Call

Management will host a conference call at 8:30 a.m. ET today to review Dicerna's third quarter 2021 financial results and provide a general business update. The conference call can be accessed by dialing (855) 453-3834 or +1 (484) 756-4306 (international) and referencing conference ID 7395414 prior to the start of the call. The call will also be webcast and will be available under the “Investors & Media” section of the Dicerna website, . A replay of the call will be available approximately two hours after the completion of the call and will remain available for seven days. To access the replay, please dial (855) 859-2056 or +1 (404) 537-3406 and refer to conference ID 7395414. The webcast will also be archived on Dicerna’s website.

About Dicerna Pharmaceuticals, Inc.

Dicerna Pharmaceuticals, Inc. (Nasdaq: DRNA) is a biopharmaceutical company focused on discovering, developing and commercializing medicines that are designed to leverage ribonucleic acid interference (RNAi) to silence selectively genes that cause or contribute to disease. Using our proprietary GalXC™ and GalXC-Plus™ RNAi technologies, Dicerna is committed to developing RNAi-based therapies with the potential to treat both rare and more prevalent diseases. By silencing disease-causing genes, Dicerna’s GalXC platform has the potential to address conditions that are difficult to treat with other modalities. Initially focused on disease-causing genes in the liver, Dicerna has continued to innovate and is exploring new applications of its RNAi technology with GalXC-Plus, which expands the functionality and application of our flagship liver-targeted GalXC technology to tissues and cell types outside the liver, and has the potential to treat diseases across multiple therapeutic areas. In addition to our own pipeline of core discovery and clinical candidates, Dicerna has established collaborative relationships with some of the world’s leading pharmaceutical companies, including Novo Nordisk A/S, Roche, Eli Lilly and Company, Alexion Pharmaceuticals, Inc., Boehringer Ingelheim International GmbH and Alnylam Pharmaceuticals, Inc. Between Dicerna and our collaborative partners, we currently have more than 20 active discovery, preclinical or clinical programs focused on cardiometabolic, viral, chronic liver and complement-mediated diseases, as well as neurodegenerative diseases and pain. At Dicerna, our mission is to interfere – to silence genes, to fight disease, to restore health. For more information, visit .

Cautionary Note on Forward-Looking Statements

This press release includes forward-looking statements. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such statements. Examples of forward-looking statements include, among others, statements we make regarding our GalXC and GalXC-Plus RNAi technologies and the therapeutic potential thereof, including the advancement of our new, wholly owned GalXC-Plus extrahepatic development programs and timing to announce the first of them; our expected pace and duration of new programs entering into clinical trials and the potential impact thereof; our discovery and product candidates and those of our collaborative partners, including with respect to nedosiran, belcesiran and DCR-AUD, and the development thereof; the pace and progress of and anticipated milestones for the Company’s ongoing and planned trials, including from its Phase 1 clinical trial of DCR-AUD for the treatment of AUD; results and expectations from the Company's ongoing and completed trials, including from the Company’s PHYOX clinical development program; the initiation of trials for product candidates in our pipeline and our beliefs about our pipeline; the filing of Investigational New Drug Applications (INDs) for our product candidates and those of our collaboration partners, including the expected pace thereof; the therapeutic potential of our product candidates, including nedosiran; the planned submission of an NDA for nedosiran and the expected timing thereof, subject to ongoing interactions with the FDA; our commercialization strategy for nedosiran, if approved; our current and potential future collaborations and other strategic arrangements, including the intended benefits thereof, pace and progress of development by such partners and the receipt of anticipated milestone payments therefrom; our strategy, business and operations; and our financial position and expected cash runway.

The process by which investigational therapies, such as nedosiran and belcesiran, could potentially lead to an approved product is long and subject to highly significant risks. Applicable risks and uncertainties include those relating to Dicerna’s preclinical and clinical research and other risks identified under the heading "Risk Factors" included in the Company’s most recent filings on Forms 10-K and 10-Q and in other future filings with the Securities and Exchange Commission. These risks and uncertainties include, among others: the cost, timing and results of preclinical studies and clinical trials and other development activities by us and our collaborative partners; the likelihood of Dicerna’s clinical programs being executed on timelines provided; reliance on the Company’s contract research organizations and predictability of timely enrollment of subjects and patients to advance Dicerna’s clinical trials; the reliance of Dicerna on contract manufacturing organizations to supply its products for research, development and commercialization and the risk of supply interruption from any contract manufacturer; the potential for future data to alter initial and preliminary results of preclinical studies, models and earlier-stage clinical trials; the impact of the ongoing COVID-19 pandemic and its variants on our business operations, including the conduct of our research and development activities; the regulatory review process and unpredictability of the duration and results of the regulatory review of IND applications and clinical trial applications that are necessary to continue to advance and progress the Company’s clinical programs; the timing, plans and reviews by regulatory authorities of marketing applications such as NDAs and comparable foreign applications for one or more of Dicerna’s product candidates, including for nedosiran; alignment with the FDA on the regulatory pathway to approval for our product candidates, including for nedosiran; the ability to secure out-licensing opportunities to commercialize nedosiran, if approved, in the U.S. and abroad on acceptable terms, if at all; the ability to secure, maintain and realize the intended benefits of our collaborations and other strategic partners; market acceptance for approved products and innovative therapeutic treatments; competition; the possible impairment of, inability to obtain or secure, and costs to obtain, secure and maintain intellectual property rights; possible safety or efficacy concerns that could emerge as new data are generated in R&D and following commercialization; changes in our current strategy, business or clinical and operating plan; and general business, financial and accounting risks and litigation. The forward-looking statements contained in this press release reflect Dicerna's current views with respect to future events, and Dicerna does not undertake and specifically disclaims any obligation to update any forward-looking statements.

(tables follow)

DICERNA PHARMACEUTICALS, INC.

SELECTED FINANCIAL INFORMATION (UNAUDITED)

CONDENSED CONSOLIDATED BALANCE SHEETS

SEPTEMBER 30,

2021

DECEMBER 31,

2020

(In thousands)

Cash and cash equivalents

$

165,756

$

126,023

Held-to-maturity investments

480,837

442,820

Restricted cash equivalents

5,618

6,362

Contract receivables

6,226

34,713

Prepaid expenses and other current assets

17,268

14,403

Property and equipment, net

22,096

17,546

Right-of-use operating assets, net

72,432

60,843

Other noncurrent assets

1,826

5,136

Total Assets

$

772,059

$

707,846

Accounts payable

$

8,320

$

7,901

Accrued expenses and other current liabilities

39,020

31,500

Deferred revenue, current

190,128

138,537

Deferred revenue, noncurrent

180,790

336,236

Deferred income

179,629

—

Other noncurrent liabilities

66,509

55,918

Total stockholders’ equity

107,663

137,754

Total Liabilities and Stockholders' Equity

$

772,059

$

707,846

Common stock outstanding

77,835

75,757

Three Months Ended

September 30, 2021

Three Months Ended

September 30, 2020

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

Revenue

$

62,954

$

48,875

Operating expenses:

Research and development

61,232

54,814

General and administrative

21,994

16,961

Total operating expenses

83,226

71,775

Loss from operations

(20,272)

(22,900)

Other income:

Interest income, net

124

1,050

Other income, net

3,886

1

Total other income, net

4,010

1,051

Loss before income taxes

(16,262)

(21,849)

Provision for income taxes

(810)

—

Net loss

$

(17,072)

$

(21,849)

Net loss per share – basic and diluted

$

(0.22)

$

(0.29)

Weighted average common shares outstanding – basic and diluted

77,747

74,523

财报合作

100 项与 Lefelsiran Sodium 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 酒精使用障碍 | 临床1期 | 美国 | 2021-09-21 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

临床1期 | 16 | 積蓋選網鏇築觸夢鹹顧 = 願衊鬱觸壓襯淵鑰齋積 觸遞廠築構觸網顧遞醖 (廠範醖膚繭願簾糧願範, 鹽醖鹽簾艱壓壓網製蓋 ~ 襯艱廠獵壓餘選繭範網) 更多 | - | 2025-01-03 | |||

临床1期 | 36 | (Cohort 3: DCR-AUD 480 mg) | 齋願夢鬱糧窪憲夢築醖 = 獵願構簾獵觸艱觸願鹹 鬱鹽鑰廠艱齋構齋鑰製 (壓憲製膚顧廠淵鏇構憲, 鑰簾齋鬱範蓋廠遞獵壓 ~ 構衊遞齋鑰鬱廠膚醖繭) 更多 | - | 2024-12-27 | ||

(Cohort 4: DCR-AUD 960 mg) | 齋願夢鬱糧窪憲夢築醖 = 鏇鏇鬱廠艱窪膚鏇遞構 鬱鹽鑰廠艱齋構齋鑰製 (壓憲製膚顧廠淵鏇構憲, 範壓膚鑰膚淵願淵糧網 ~ 齋選艱顧鑰糧醖築衊遞) 更多 |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用