预约演示

更新于:2025-05-07

Galena Biopharma, Inc.

更新于:2025-05-07

概览

关联

2

项与 Galena Biopharma, Inc. 相关的药物靶点 |

作用机制 HER2拮抗剂 |

在研适应症 |

最高研发阶段临床3期 |

首次获批国家/地区- |

首次获批日期- |

靶点- |

作用机制 基因沉默 [+1] |

在研机构- |

在研适应症- |

非在研适应症 |

最高研发阶段无进展 |

首次获批国家/地区- |

首次获批日期- |

3

项与 Galena Biopharma, Inc. 相关的临床试验NCT02125318

A Phase 2, Open Label Efficacy and Safety Study of Anagrelide Controlled Release (CR) in Subjects With Thrombocytosis Secondary to Essential Thrombocythemia and Other Myeloproliferative Neoplasms (MPN)

Anagrelide is a drug that has been shown to slow down how fast platelets are made in the bone marrow, and has been approved by the FDA for treating high platelets counts in patients with bone marrow disorders.

Anagrelide Controlled Release ("CR") is a new preparation of anagrelide that is made to dissolve more slowly than currently marketed versions of this drug. Because of this, the anagrelide is taken up into the blood more slowly. Researchers think that this slower release of the drug could help to lower side effects that might be caused by high blood levels when the drug dissolves as quickly as it does with the currently marketed product.

The main purposes of this study are to see how well Anagrelide CR can control platelet counts in patients with high platelet levels, to see what kind of side effects it causes, and to measure blood levels of the drug.

Anagrelide Controlled Release ("CR") is a new preparation of anagrelide that is made to dissolve more slowly than currently marketed versions of this drug. Because of this, the anagrelide is taken up into the blood more slowly. Researchers think that this slower release of the drug could help to lower side effects that might be caused by high blood levels when the drug dissolves as quickly as it does with the currently marketed product.

The main purposes of this study are to see how well Anagrelide CR can control platelet counts in patients with high platelet levels, to see what kind of side effects it causes, and to measure blood levels of the drug.

开始日期2014-05-01 |

申办/合作机构 |

NCT01936636

Rapid Evaluation of Lifestyle, Independence, and Elimination of Breakthrough Cancer Pain With Freedom From Oral Discomfort Through the Use of Abstral® (Fentanyl) Sublingual Tablets

This Observational Registry study is designed to collect self-reported Transmucosal Immediate Release Fentanyl (TIRF) Risk Evaluation and Mitigation Strategy (REMS) Access program-enrolled patient experience with breakthrough cancer pain (BTcP) as a result of treatment with Abstral® through the use of Quality of Life and pain measurement tools administered via questionnaire.

开始日期2013-10-01 |

申办/合作机构 |

NCT01479244

PRESENT: Prevention of Recurrence in Early-Stage, Node-Positive Breast Cancer With Low to Intermediate HER2 Expressions With NeuVax™Treatment

Purpose of this trial:

To assess the efficacy and safety of NeuVax™ administered with adjuvant Leukine® (sargramostim, GM-CSF).

To evaluate and compare the disease free survival (DFS) in the vaccinated and control subjects.

To assess the efficacy and safety of NeuVax™ administered with adjuvant Leukine® (sargramostim, GM-CSF).

To evaluate and compare the disease free survival (DFS) in the vaccinated and control subjects.

开始日期2011-11-01 |

申办/合作机构 |

100 项与 Galena Biopharma, Inc. 相关的临床结果

登录后查看更多信息

0 项与 Galena Biopharma, Inc. 相关的专利(医药)

登录后查看更多信息

5

项与 Galena Biopharma, Inc. 相关的文献(医药)2016-02-01·Journal of Clinical Oncology

An observational study evaluating the expression of HER2 (1+, 2+, and 3+) with HLA A2/A3+ in gastric adenocarcinoma patients.

作者: Sharma, Akhilesh ; Choy, Gavin S. ; Sachdeva, Shalabh ; Parvatini, Shyam ; Jagannath, Palepu ; Patnaik, Ashis

2016-01-20·Journal of Clinical Oncology

Effect of novel peptide vaccines on secondary recurrences and survivorship.

作者: Gompper, Peter Todd ; Choy, Gavin S. ; Valentine, Marye Ellen ; Chance, Lacey

2015-12-03·Blood

Final Results of Anagrelide Controlled-Release (GALE-401) Safety, Efficacy and Pharmacokinetics in Subjects with Myeloproliferative Neoplasms (MPN)-Related Thrombocytosis

作者: Troung, Phu V. ; Choy, Gavin S. ; Berenzon, Dmitriy ; Jawien, William ; Glidden, Paul F. ; Mena, Raul ; Barriere, Olivier ; Bessudo, Alberto ; Lyons, Roger M. ; Saltzman, Marc ; Verstovsek, Srdan ; Beeson, Hali E. ; Wingate-Pearse, Nasiema

10

项与 Galena Biopharma, Inc. 相关的新闻(医药)2022-06-28

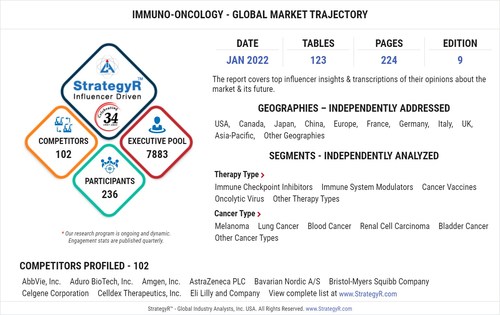

SAN FRANCISCO, June 28, 2022 /PRNewswire/ -- A new market study published by Global Industry Analysts Inc., (GIA) the premier market research company, today released its report titled "Immuno-Oncology - Global Market Trajectory & Analytics". The report presents fresh perspectives on opportunities and challenges in a significantly transformed post COVID-19 marketplace.

FACTS AT A GLANCE

New Analysis from Global Industry Analysts Reveals Steady Growth for Immuno-Oncology, with the Market to Reach $143.9 Billion Worldwide by 2026

What's New for 2022?

Global competitiveness and key competitor percentage market shares

Market presence across multiple geographies - Strong/Active/Niche/Trivial

Online interactive peer-to-peer collaborative bespoke updates

Access to our digital archives and MarketGlass Research Platform

Complimentary updates for one year

Edition: 9;

Released: January 2022

Executive Pool: 7883

Companies: 102 - Players covered include AbbVie, Inc.; Aduro BioTech, Inc.; Amgen, Inc.; AstraZeneca PLC; Bavarian Nordic A/S; Bristol-Myers Squibb Company; Celgene Corporation; Celldex Therapeutics, Inc.; Eli Lilly and Company; EMD Serono, Inc.; F. Hoffmann-La Roche AG; Galena Biopharma, Inc.; Gilead Sciences, Inc.; ImmunoCellular Therapeutics Ltd.; Incyte Corporation; Johnson & Johnson; Merck & Co., Inc.; Novartis International AG; Pfizer, Inc.; Prometheus Laboratories, Inc.; Sanofi SA and Others.

Coverage: All major geographies and key segments

Segments: Cancer Type (Melanoma, Lung Cancer, Blood Cancer, Renal Cell Carcinoma, Bladder Cancer, Other Cancer Types); Therapy Type (Immune Checkpoint Inhibitors, Immune System Modulators, Cancer Vaccines, Oncolytic Virus, Other Therapy Types)

Geographies: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Complimentary Project Preview - This is an ongoing global program. Preview our research program before you make a purchase decision. We are offering a complimentary access to qualified executives driving strategy, business development, sales & marketing, and product management roles at featured companies. Previews provide deep insider access to business trends; competitive brands; domain expert profiles; and market data templates and much more. You may also build your own bespoke report using our MarketGlass™ Platform which offers thousands of data bytes without an obligation to purchase our report.

Preview Registry

ABSTRACT-

Global Immuno-Oncology Market to Reach $143.9 Billion by 2026

Amid the COVID-19 crisis, the global market for Immuno-Oncology estimated at US$63.9 Billion, is projected to reach a revised size of US$143.9 Billion by 2026, growing at a CAGR of 14.3% over the analysis period. Immune Checkpoint Inhibitors, one of the segments analyzed in the report, is projected to record a 14.2% CAGR and reach US$143.5 Billion by the end of the analysis period. After an thorough analysis of the business implications of the pandemic and its induced economic crisis, growth in the Immune System Modulators segment is readjusted to a revised 15% CAGR for the next 7-year period.

The U.S. Market is Estimated at $18.9 Billion, While China is Forecast to Grow at 13.8% CAGR

The Immuno-Oncology market in the U.S. is estimated at US$18.9 Billion, while China is forecast to reach a projected market size of US$28.4 Billion by the close of the analysis period trailing a CAGR of 13.8%. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 12.7% and 12.3% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 10.5% CAGR.

Cancer Vaccines Segment to Record 15.6% CAGR

In the global Cancer Vaccines segment, USA, Canada, Japan, China and Europe will drive the 15.4% CAGR estimated for this segment. These regional markets accounting for a combined market size of US$1.5 Billion will reach a projected size of US$4 Billion by the close of the analysis period. China will remain among the fastest growing in this cluster of regional markets.

More

MarketGlass™ Platform

Our MarketGlass™ Platform is a free full-stack knowledge center that is custom configurable to today`s busy business executive`s intelligence needs! This influencer driven interactive research platform is at the core of our primary research engagements and draws from unique perspectives of participating executives worldwide. Features include - enterprise-wide peer-to-peer collaborations; research program previews relevant to your company; 3.4 million domain expert profiles; competitive company profiles; interactive research modules; bespoke report generation; monitor market trends; competitive brands; create & publish blogs & podcasts using our primary and secondary content; track domain events worldwide; and much more. Client companies will have complete insider access to the project data stacks. Currently in use by 67,000+ domain experts worldwide.

Our platform is free for qualified executives and is accessible from our website or via our just released mobile application on iOS or Android

About Global Industry Analysts, Inc. & StrategyR™

Global Industry Analysts, Inc., () is a renowned market research publisher the world`s only influencer driven market research company. Proudly serving more than 42,000 clients from 36 countries, GIA is recognized for accurate forecasting of markets and industries for over 33 years.

CONTACTS:

Zak Ali

Director, Corporate Communications

Global Industry Analysts, Inc.

Phone: 1-408-528-9966

Email: [email protected]

LINKS

Join Our Expert Panel

Connect With Us on LinkedIn

Follow Us on Twitter

Journalists & Media

[email protected]

SOURCE Global Industry Analysts, Inc.

疫苗合作

2022-06-22

DUBLIN, June 22, 2022 /PRNewswire/ -- The "Breast Cancer Monoclonal Antibodies Global Market Report 2022: By Product, By End-User" report has been added to

ResearchAndMarkets.com's offering.

The global breast cancer monoclonal antibodies market is expected to grow from $15.37 billion in 2021 to $16.67 billion in 2022 at a compound annual growth rate (CAGR) of 8.5%. The market is expected to reach $21.47 billion in 2026 at a CAGR of 6.5%.

Major players in the breast cancer monoclonal antibodies (mAbs) market are Amgen, Mylan, Merck, Novartis, GlaxoSmithKline, Daiichi Sankyo, Biocad, Boehringer Ingelheim, Bristol-Myers Squibb and Array BioPharma.

The breast cancer monoclonal antibodies (mAbs) market consists of sales of monoclonal antibodies by entities (organizations, sole traders and partnerships) that produce breast cancer monoclonal antibodies used as therapy for breast cancer either as monotherapy or combination therapy. The revenue generated includes the sales of naked mAbs and conjugated mAbs.

The companies engaged in the breast cancer monoclonal antibodies market are primarily focused on the research, development, and production of monoclonal antibodies that are used in early-stage and advanced breast cancer, ductal carcinoma in-situ, triple-negative breast cancer, inflammatory breast cancer, and others.

The main types of breast cancer monoclonal antibodies are naked mAbs and conjugated mAbs. Naked mAbs are antibodies that are free of any drugs or radioactive materials. They are self-contained. The most prevalent type of mAb used to fight cancer is this one. The different types of treatments include chemotherapy, surgery & radiation therapy, targeted therapy, biologic therapy, hormone therapy and is used in various sectors such as hospitals, retail pharmacies.

Alternative treatment methods and natural remedies are increasingly becoming popular globally and this is expected to impact the revenues of breast cancer monoclonal antibodies manufacturing companies. Treatments in the fields of homeopathy, Ayurveda, yoga, acupuncture, sujok therapy are gaining popularity and slowly replacing some traditional hospital practices.

For instance, ayurvedic medicine, an ancient Indian system of medicine uses a range of techniques and treatments for cancer. Many herbs used in Ayurveda have anti-cancer properties. According to the World Health Organization (WHO), some nations are still responding to plant-based treatment as their main medicine source and developing nations are using the benefits of natural compounds for therapeutic purposes, affecting the sales of oncology drugs. Also, the global homeopathic product market is projected to reach $18.6 billion by the end of 2027.

The National Institute of Cancer indicated the promising results of vaccines in HER2-positive cancer including breast, ovarian, lung, colorectal, and gastroesophageal cancers, wherein they have used patients' immune cells to treat their HER2-positive cancers by genetically modifying them to customize personalized vaccine. These factors are expected to continue during the forecast period and limit the demand for the breast cancer monoclonal antibodies market.

Companies in the breast cancer monoclonal antibodies market are investing in targeted and combination therapy, which has proven to be more effective and less toxic than the traditional treatment options. Targeted cancer therapies are drugs or substances that block the growth of cancer by interfering with molecules that are more specifically involved in cancer cell progression than in normal cell activity.

The goal of these therapies is to eliminate cancerous cells in the body while leaving normal cells unharmed. By focusing on changes in the cell that are specific to cancer, this therapy may prove to be more effective than traditional chemotherapy and radiotherapy. Combination therapy uses a treatment method in which a patient is given two or more drugs (or other therapeutic agents) for a single disease.

In February 2019, the FDA approved the combination of a mAb trastuzumab with hyaluronidase-oysk for SC administration in HER2-positive early breast cancer wherein hyaluronidase is an enzyme that helps the body to use trastuzumab. In 2020, The American Society of Clinical Oncology published the success of combination therapy of a targeted monoclonal antibody atezolizumab with chemotherapy with improved progression-free survival in patients with triple-negative breast cancer.

It resulted in the progression-free survival of 7.2 months for patients receiving the combination therapy, compared with 5.5 months for those who received placebo plus nab-paclitaxel (chemotherapy). Promising results with targeted therapies and combination therapies are expected to raise the focus on these therapies in the breast cancer monoclonal antibodies market.

In March 2019, AstraZeneca, a UK-based global biopharmaceutical company that discovers, develops and commercializes prescription drugs in therapy areas such as oncology, cardiovascular, renal & metabolism and respiratory, entered into a collaboration with Daiichi Sankyo Company, Limited with an upfront payment of $1.35 billion.

The collaboration agreement is about the global development and commercialization of trastuzumab deruxtecan (DS-8201), which is an exclusive antibody-drug conjugate (ADC) and potential new targeted cancer therapy. Except in Japan (exclusive rights for Daiichi Sankyo), the companies will jointly develop and commercialize trastuzumab deruxtecan. Daiichi Sankyo Company Limited is a Japan-based global pharmaceutical company that creates innovative new and generic medicines and new methods of drug discovery and delivery.

Key Topics Covered:

1. Executive Summary

2. Breast Cancer Monoclonal Antibodies Market Characteristics

3. Breast Cancer Monoclonal Antibodies Market Trends And Strategies

4. Impact Of COVID-19 On Breast Cancer Monoclonal Antibodies

5. Breast Cancer Monoclonal Antibodies Market Size And Growth

5.1. Global Breast Cancer Monoclonal Antibodies Historic Market, 2016-2021, $ Billion

5.1.1. Drivers Of The Market

5.1.2. Restraints On The Market

5.2. Global Breast Cancer Monoclonal Antibodies Forecast Market, 2021-2026F, 2031F, $ Billion

5.2.1. Drivers Of The Market

5.2.2. Restraints On the Market

6. Breast Cancer Monoclonal Antibodies Market Segmentation

6.1. Global Breast Cancer Monoclonal Antibodies Market, Segmentation By Product, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Naked Mabs

Conjugated Mabs

6.2. Global Breast Cancer Monoclonal Antibodies Market, Segmentation By End-User, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Hospitals

Retail Pharmacies

6.3. Global Breast Cancer Monoclonal Antibodies Market, Segmentation By Treatment, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Chemotherapy

Surgery & Radiation Therapy

Targeted Therapy

Biologic Therapy

Hormone Therapy

7. Breast Cancer Monoclonal Antibodies Market Regional And Country Analysis

7.1. Global Breast Cancer Monoclonal Antibodies Market, Split By Region, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

7.2. Global Breast Cancer Monoclonal Antibodies Market, Split By Country, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Companies Mentioned

Amgen

Mylan

Merck

Novartis

GlaxoSmithKline

Daiichi Sankyo

Biocad

Boehringer Ingelheim

Bristol-Myers Squibb

Array BioPharma

Celldex Therapeutics

Celltrion

Roche

Immunomedics

MacroGenics

Pfizer

Sun Pharmaceutical Industries

Teva Pharmaceuticals

Puma Biotechnology

Seattle Genetics

AstraZeneca

Eddingpharm

Eisai

Galena Biopharma

ImmunoGen

For more information about this report visit

Media Contact:

Research and Markets

Laura Wood, Senior Manager

[email protected]

For E.S.T Office Hours Call +1-917-300-0470

For U.S./CAN Toll Free Call +1-800-526-8630

For GMT Office Hours Call +353-1-416-8900

U.S. Fax: 646-607-1907

Fax (outside U.S.): +353-1-481-1716

SOURCE Research and Markets

抗体疫苗放射疗法抗体药物偶联物ASCO会议

2021-05-07

Dublin, May 07, 2021 (GLOBE NEWSWIRE) -- The "Global Peptide Cancer Vaccine Market & Clinical Trials Insight 2026" report has been added to ResearchAndMarkets.com's offering.

As per this reports findings, it is estimated that the global peptide cancer vaccine will follow trajectory growth rates. The market will be favored by the advancement in science and arrival of novel technologies which will further enable the identification of potential targets in developing cancer vaccines.

Report Highlights:

The developments of vaccines have shown incredible impact on human health system and have resulted in significant decrease in mortality rates from several diseases. Increase in prevalence of chronic disorders including cancer has urged the development of novel targeted therapeutics for their management. In recent times, researchers have exploited the use of vaccines to generate anti-tumor response in management of cancer.

The rapid approval of Provenge for the management of pancreatic cancer and the robust response in market has surged the development of more targeted vaccines in cancer. In recent times, peptides have emerged as a potential vaccine candidate owing to their small size, simple and cost efficient production and development process.

Moreover, peptides are recognized to be highly specific and efficacious, safe and well tolerated. Given their attractive physical and chemical properties, researchers have developed several peptide based vaccines in management of wide range of cancers.

Currently, GV1001 (Riavaxtm, Tertomotide) is the only peptide based vaccine approved for the management of pancreatic cancer in Korea. GV1001 is a 16-amino-acid peptide comprising a sequence from the human enzyme telomerase reverse transcriptase (TERT). Most cancers highly express TERT, and immunization with GV1001 aims to activate the immune system to recognize and kill cancer cells. The vaccine is currently under clinical trials and applications to gain approval in other countries.

Apart from this, a cocktail of peptide based cancer vaccines are present in preclinical and clinical studies and have shown encouraging response. Most of the drugs are present in the phase I and II clinical trials which suggests that the market will be flourished with several vaccines targeting different cancers in next 4-5 years.

Moreover, in near future the market will see combination of vaccines along with other conventional drugs to improve their efficacy and specificity in targeting the complexity of cancer cells.

Keeping in mind the high adoption rates of the novel therapeutics in North America, it is expected that the region will dominate the global peptide cancer vaccine market for next few years. The high prevalence of cancer and the rising initiatives by government as well as private sectors will also propel the growth of peptide cancer vaccines in this area.

In addition to this, Europe and Asia Pacific will also emerge as a potential market wing to high untapped opportunities, low cost of raw material, growing base of companies providing outsourcing services, flourishing biotech industry, and increasing investments in the R&D sector.

The arrival of peptide based cancer vaccine has caused prompting effects on the overall cancer therapy market and has helped it to make through all the challenges that have been on the way of becoming the most dominant market in the industry.

Key Topics Covered:

1. Introduction to Peptide Cancer Vaccine

2. Need of Peptide Vaccines2.1 Why Peptides - More Desirable2.2 Peptide Vaccines V/S Traditional Vaccines

3. Classification of Peptide Vaccines3.1 On the Basis of Sources Obtained3.2 On the Basis of Length3.3 On the Basis of Epitopes

4. Mechanism of Action of Peptide Cancer Vaccines4.1 Immunological Cells Activated by Peptide Cancer Vaccines4.2 Procedure of Synthetic Peptide Vaccine Development

5. Clinical Trials Efficacy Study of Synthetic Peptide Analog Obtained From WT1 Oncoprotein against Acute Myeloid Leukemia5.1 Basic Layout of the Study5.2 Introduction to WT1 Peptide5.3 Methodologies Involved In the Clinical Study5.4 Results of the Clinical Trial Study

6. Wide Spectrum Action of Peptide Cancer Vaccines Against Major Cancer6.1 Colorectal Cancer6.2 Lung Cancer6.3 Pancreatic Cancer6.4 Gastric Cancer6.5 Prostate Cancer6.6 Breast Cancer

7. Global Peptide Cancer Vaccine Market Overview

8. Global Peptide Cancer Vaccine Market Trends8.1 Optimized Cryptic Peptides8.2 Therapeutic CpG Peptide-Based Cancer Vaccine8.3 Personalized Neoantigen Vaccination with Synthetic Long Peptides8.4 Recombinant Peptide Vaccine8.5 p53 Peptide-Pulsed Dendritic Cells Cancer Vaccines

9. Global Peptide Cancer Vaccine Pipeline Overview9.1 By Country9.2 By Company9.3 By Patient Segment9.4 By Phase

10. Global Peptide Cancer Vaccine Clinical Trials Insight10.1 Research10.2 Preclinical10.3 Phase-I10.4 Phase-I/II10.5 Phase-II10.6 Phase-III

11. LucaVax - First Commercially available Peptide Cancer Vaccine

12. Global Peptide Cancer Vaccine Market Dynamics12.1 Market Driving Factors12.2 Challenges Ahead For Peptide Cancer Vaccine Market Development

13. Peptide Cancer Vaccine: Promising Candidate of Cancer Immunotherapy

14. Competitive Landscape14.1 Enzo Life Science (Alexis Biotech)14.2 Antigen Express14.3 BioLife Science14.4 Immatics Biotechnologies14.5 Immune Design14.6 Imugene14.7 Immunomedics14.8 ISA Pharmaceuticals14.9 Galena Biopharma14.10 Generex Biotechnology Corporation14.11 Lytix Biopharma14.12 Merck (Merck Serono)14.13 OncoTherapy Science14.14 Oncothyreon14.15 Pfizer14.16 Phylogica14.17 Symphogen (Receptor BioLogix)14.18 Sumitomo Dainippon Pharma14.19 TapImmune14.20 Vaxon Biotech

For more information about this report visit

疫苗免疫疗法

100 项与 Galena Biopharma, Inc. 相关的药物交易

登录后查看更多信息

100 项与 Galena Biopharma, Inc. 相关的转化医学

登录后查看更多信息

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2026年03月01日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

其他

2

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

Nelipepimut S ( HER2 ) | 前列腺癌 更多 | 终止 |

RNA interference-based therapeutics(Generex/Phio Pharmaceuticals) | 血液肿瘤 更多 | 无进展 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用