预约演示

更新于:2025-05-07

IL-4Rα x IL-13R

更新于:2025-05-07

关联

5

项与 IL-4Rα x IL-13R 相关的药物作用机制 IL-13R抑制剂 [+1] |

在研适应症 |

非在研适应症 |

最高研发阶段临床前 |

首次获批国家/地区- |

首次获批日期1800-01-20 |

作用机制 IL-13R抑制剂 [+1] |

在研适应症 |

非在研适应症- |

最高研发阶段临床前 |

首次获批国家/地区- |

首次获批日期1800-01-20 |

10

项与 IL-4Rα x IL-13R 相关的临床试验NCT00941577

A Phase 2a, Multi-Center, Randomized, Double-Blind, Placebo-Controlled, Parallel Group, Bronchial Allergen Challenge Study to Assess the Safety, Tolerability, and Efficacy of Inhaled AIR645 in Subjects With Mild Allergic Asthma

To assess the efficacy of inhaled AIR645 in the suppression of the Asthmatic Responses in subjects with mild asthma inhaling an allergen.

开始日期2009-10-01 |

申办/合作机构 |

EUCTR2007-006545-41-GB

A PHASE IIB STUDY TO INVESTIGATE THE TREATMENT-SPARING EFFECTS OF AEROVANT™ (AER 001 INHALATION POWDER) IN ASTHMA PATIENTS NOT FULLY CONTROLLED ON CURRENT THERAPY - AEROVANT

开始日期2009-03-29 |

申办/合作机构 |

NCT00801853

A Phase IIb Study to Investigate the Treatment-Sparing Effects of AEROVANT™ AER 001 Inhalation Powder in Asthma Patients Not Fully Controlled on Current Therapy

A multi-center, Phase IIb, double-blind, randomized, placebo controlled, parallel-group, repeated-dose study in male and female patients with moderate to severe asthma in which patients will be stabilized on AEROVANT then doses of inhaled corticosteroids and LABA will be tapered. The hypothesis is that AEROVANT will improve asthma symptom control and decrease the need for inhaled corticosteroids and LABA, thus improving exacerbation incidence compared to placebo. Incidence of asthma exacerbation is the primary endpoint.

开始日期2009-03-01 |

申办/合作机构 |

100 项与 IL-4Rα x IL-13R 相关的临床结果

登录后查看更多信息

100 项与 IL-4Rα x IL-13R 相关的转化医学

登录后查看更多信息

0 项与 IL-4Rα x IL-13R 相关的专利(医药)

登录后查看更多信息

78

项与 IL-4Rα x IL-13R 相关的文献(医药)2021-06-01·Immunity, Inflammation and Disease4区 · 医学

Ruxolitinib inhibits poly(I:C) and type 2 cytokines‐induced CCL5 production in bronchial epithelial cells: A potential therapeutic agent for severe eosinophilic asthma

4区 · 医学

ArticleOA

作者: Kimura, Hirokazu ; Inui, Toshiya ; Hirata, Aya ; Honda, Kojiro ; Kurai, Daisuke ; Nakamoto, Keitaro ; Watanabe, Masato ; Sada, Mitsuru ; Takizawa, Hajime ; Nakamura, Masuo ; Saraya, Takeshi ; Ishii, Haruyuki

2020-04-01·American Journal of Physiology-Gastrointestinal and Liver Physiology3区 · 医学

Signaling through the interleukin-4 and interleukin-13 receptor complexes regulates cholangiocyte TMEM16A expression and biliary secretion

3区 · 医学

Article

作者: Khimji, Al-karim ; Kresge, Charles ; Getachew, Yonas ; Dutta, Amal K. ; Boggs, Kristy ; Feranchak, Andrew P. ; Wang, Youxue ; Rockey, Don C.

2018-02-01·Journal of Neuro-Oncology2区 · 医学

Analysis of the cancer genome atlas (TCGA) database identifies an inverse relationship between interleukin-13 receptor α1 and α2 gene expression and poor prognosis and drug resistance in subjects with glioblastoma multiforme

2区 · 医学

Article

作者: Puri, Raj K ; Han, Jing

8

项与 IL-4Rα x IL-13R 相关的新闻(医药)2025-04-29

·抗体圈

这篇文章于2022年发表在ImmuneNetw.,主要总结了自身免疫性疾病靶向免疫治疗最新进展。摘要: 在过去的几十年里,靶向炎性细胞因子、免疫细胞和细胞内激酶的生物药物和小分子抑制剂已成为治疗自身免疫性疾病的标准护理。抑制TNF、IL-6、IL-17和IL-23彻底改变了类风湿性关节炎、强直性脊柱炎和银屑病等自身免疫性疾病的治疗。使用抗CD20mAb的B细胞耗竭疗法在神经炎症性疾病患者中显示出有希望的结果,抑制B细胞存活因子被批准用于治疗系统性红斑狼疮。靶向Ag呈递细胞和T细胞上表达的共刺激分子也有望通过调节T细胞功能在自身免疫性疾病中具有治疗潜力。 最近,靶向JAK家族(负责多个受体信号转导)的小分子激酶抑制剂在自身免疫和血液疾病领域引起了极大的兴趣。然而,在治疗效果和安全性方面仍存在未满足的医疗需求。新兴疗法旨在使用先进的分子工程技术在不影响免疫功能的情况下诱导免疫耐受。【NO.1】背景介绍 自身免疫性疾病是以自身抗原炎症失调为特征的病理性疾病,影响3%-10%的普通人群。自身免疫性疾病的常规治疗方法抑制了一般免疫功能以调节不受控制的炎症。然而,这些治疗方法在异质性患者群体中并未完全成功,其疗效以牺牲副作用为代价,特别是感染风险增加,通常来自非选择性免疫抑制。为了克服传统疗法的局限性,目前的治疗方法旨在更选择性地抑制炎症信号,同时最大限度地减少对稳态免疫功能的破坏。 最近在了解疾病发病机制和新药制造技术方面取得的进展导致靶向免疫疗法广泛用于治疗自身免疫性疾病。此外,先进的分子工程技术催生了靶向可溶性介质或细胞表面标志物的重组蛋白治疗药物,如mAb和receptor-Ab融合蛋白。自1990年代首次批准靶向TNF的选择性蛋白质疗法用于类风湿性关节炎(RA)以来,靶向免疫疗法已成为治疗自身免疫性疾病的游戏规则改变者。根据全球药品市场报告,阿达木单抗多年来一直是全球最畅销的药物,其次是其他靶向免疫疗法,如pembrolizumab、ibrutinib和ustekinumab。 随着对疾病发病机制的了解迅速增加,许多靶向炎症信号通路的生物药物正在开发中,以治疗顽固性炎症性疾病。在成功引入生物疗法治疗自身免疫性疾病后,分子靶点已扩展到细胞内激酶。小分子激酶抑制剂阻断收敛信号在治疗效果和长期安全性方面具有重要意义。 本文总结了目前针对自身免疫性疾病发病机制中涉及的信号通路的治疗方法,并介绍了旨在诱导免疫耐受的新兴免疫疗法。由于靶向免疫疗法市场正在迅速增长,因此我们专注于已获得临床批准用于治疗自身免疫性疾病的药物。【NO.2】自身免疫性疾病中的炎症 炎症是生物体修复组织损伤并防止外来物质侵害的自然过程。然而,针对自身抗原的免疫反应失调会导致免疫耐受丧失和自身免疫性疾病的发展。自身免疫源于耐受性检查点的中枢和外周缺陷以及不耐受免疫细胞的激活。自身抗原可通过从免疫特权位点释放自身抗原、产生新自身抗原以及自身蛋白与外来物质的分子模拟来诱导。 自身免疫的临床表现多种多样,从存在自身抗体的无症状疾病到导致危及生命的器官损伤的暴发性自身免疫性疾病。自身免疫性疾病的发展可由遗传易感个体的环境因素触发。环境触发因素,包括压力、吸烟和感染,会诱导先天免疫的促炎功能,并促进适应性免疫的病理反应。 尽管自身免疫的传统概念是适应性免疫系统的失调,但越来越多的证据表明,先天免疫系统对自身免疫性疾病的发生和发展也至关重要。作为先天免疫的关键参与者,巨噬细胞和树突状细胞(DC)对于抗原呈递和促炎细胞因子(如TNF、IL-1β、IL-6、IL-23、B细胞激活因子(BAFF,也称为Blys或TNFSF13B)和增殖诱导配体(APRIL,也称为TNFSF13A)的产生至关重要。1型IFN与系统性红斑狼疮(SLE)及其相关疾病的发病机制密切相关,主要由浆细胞样DC(pDC)产生,浆细胞样DC是DC的一个特殊亚群。巨噬细胞/DC和T细胞/B细胞之间的相互作用进一步促进了自身免疫性炎症。 初始CD4+Th细胞根据细胞因子环境分化为不同的T细胞亚群。T细胞通过自身抗原识别、细胞因子产生和增强的细胞毒性,在自身免疫性疾病的发病机制中发挥关键作用。近几十年来,产生IL-17和FOXP3+Tregs的Th17细胞已被强调为自身免疫性疾病的治疗靶点。 自身反应性B细胞是适应性免疫的另一个主要组分,它产生病理性自身抗体,并通过Ag呈递和细胞因子产生激活T细胞。自身抗体的产生是各种自身免疫性疾病(包括RA和SLE)的标志。RA中的抗瓜氨酸肽抗体和SLE中的抗dsDNA抗体是导致临床表现和疾病活动度的代表性致病性自身抗体。由于B细胞在自身免疫中的重要作用,B细胞表面分子是各种自身免疫性疾病的治疗靶点。 来自活化免疫细胞的可溶性介质通过与它们的同源受体结合来转导炎症信号。一旦被炎性细胞因子结合,受体就会激活JAK家族,以诱导STAT的磷酸化、二聚化和核转位。STAT的基因转录促进细胞增殖和分化以及多种炎症介质的产生,进一步加剧自身免疫性炎症。 尽管每种自身免疫性疾病的病理生理机制不同,但几种常见的炎症途径可能是免疫治疗的治疗靶点。基于我们目前对自身免疫性炎症发病机制的理解,治疗自身免疫性疾病的关键治疗靶点如图1所示。表1、2、3列出了已批准用于自身免疫性疾病或正在临床开发的靶向免疫疗法,具体如下。本文重点介绍靶向免疫治疗在免疫介导的炎症性疾病领域的临床应用。图1.自身免疫性疾病发病机制中的关键治疗靶点表1.用于治疗自身免疫性疾病的细胞因子靶向疗法靶细胞因子结构药物临床应用正在调查中(IIb或III期)TNF-ɑsTNFR2-IgG1Fc依那西普RA、pJIA、AS、银屑病、PsA抗TNF单克隆抗体英夫利昔单抗RA、AS、银屑病、PsA、UC、CD超说明书使用:BD、结节病阿达木单抗RA、pJIA、AS、银屑病、PsA、UC、CD、化脓性毛突炎、葡萄膜炎超说明书使用:BD戈利木单抗RA、AS、PsA、UC赛妥珠单抗RA、AS、银屑病、PsA、CDIL-1IL-1R拮抗剂阿那白滞素RA、大写字母川崎病(NCT04656184)超说明书使用:AOSD、sJIA、痛风、复发性心包炎等IL-1R1-IgGFc利洛西普CAPS、DIRA、复发性心包炎超说明书使用:AOSD、痛风等IL-1β抗体抗卡纳单抗AOSD、sJIA、CAPS、TRAPS、HIDS/MKD、FMFCOVID19相关CRS(12)超说明书使用:痛风和许多其他IL-6(英语)IL-6单克隆抗体抗体西鲁尤单抗RA(13,14)*奥洛珠单抗RA(15)(NCT02760407,NCT02760433,NCT03120949)克拉扎奇珠单抗RA(NCT02015520)PsA(16)COVID19相关CRS(NCT04343989)西妥昔单抗CAR-T相关CRS(NCT04975555)IL-6R抗体抗体托珠单抗RA、sJIA、pJIA、SSc相关ILD、巨细胞动脉炎、CRSPMR(NCT02908217)超说明书使用:AOSD、Takayasu动脉炎NMOSD(17)COVID19肺炎(18,19)(NCT04409262)沙利尤单抗RA类COVID19相关CRS(20)(NCT04315298)沃巴利珠单抗RA(NCT02518620)IL-17(英语)IL-17单克隆抗体抗体依奇珠单抗银屑病、PsA、轴向SpA苏金单抗AS、银屑病、PsA系统性红斑狼疮(NCT04181762)轴向SpA(21)(NCT04156620,NCT04732117)Hiradenitissupprativa(NCT03713619,NCT03713632,NCT04179175)巨细胞动脉炎(NCT04930094)Grave眼病(NCT03713619)IL-17R抗体溴达利尤单抗牛皮癣轴向SpA(22)PsA(23)不锈钢(NCT03957681)IL17A/F抗体比莫珠单抗AS(NCT03928743)轴向SpA(NCT03928704,NCT04436640)银屑病(24,25)(NCT03598790,NCT03766685)PsA(NCT03895203、NCT03896581、NCT04009499NCT04109976)Hiradenitissuppruativa(NCT04242446,NCT04242498,NCT04901195)IL-23抗p40mAb抗体乌司奴单抗银屑病、PsA、UC、CD特发性炎性肌炎(NCT03981744)高安动脉炎(NCT04882072)抗p19mAb抗体古塞利尤单抗银屑病,PsAUC(NCT04033445)CD(NCT03466411,NCT04397263)瑞沙珠单抗牛皮癣PsA(26,27)UC(NCT03398135,NCT03398148)CD(NCT03104413、NCT03105102、NCT03105128NCT04524611)替尔拉奇珠单抗牛皮癣PsA(NCT03552276、NCT04314544、NCT04314531NCT04991116)米利珠单抗银屑病(NCT03482011、NCT03535194NCT03556202)UC(NCT03518086、NCT03519945NCT03524092)CD(NCT03926130,NCT04232553)1型IFN抗IFNR1单克隆抗体Anifrolumab系统性红斑狼疮备注:该表包括具有一种或多种已批准自身免疫性疾病适应症的药物。该适应症仅涵盖自身免疫性疾病领域。pJIA,多关节幼年特发性关节炎;UC,溃疡性结肠炎;CD,克罗恩病;BD,白塞病;sJIA,系统性幼年特发性关节炎;DIRA,IL-1受体拮抗剂缺乏;TRAPS,TNF受体相关周期性综合征;HIDS/MKD、高免疫球蛋白D综合征/甲羟戊酸激酶缺乏症;FMF,家族性地中海热;CRS,细胞因子释放综合征;CAR-T,嵌合Ag受体-T细胞;SSc相关ILD、系统性硬化症相关间质性肺病、PMR、风湿性多肌痛、NMOSD、视神经脊髓炎谱系疾病;中轴型SpA,中轴型脊柱关节炎。*尽管III期临床试验取得了积极结果,但由于安全性问题,FDA并未推荐将sirukumab用于治疗RA。表2.用于治疗自身免疫性疾病的细胞靶向疗法靶细胞结构药物临床应用正在调查中(IIb或III期)B细胞抗CD20mAb抗体利妥昔单抗RA类寻常型天疱疮(28)GPA、MPA超说明书使用:MS、免疫性血小板减少症奥瑞珠单抗女士奥法木单抗女士乌布利妥昔单抗MS(NCT03277261、NCT03277248NCT04130997)抗CD19mAb抗体因比利珠单抗NMOSDIgG4RD(NCT04540497)重症肌无力(NCT04524273)抗BAFF单克隆抗体贝利尤单抗系统性红斑狼疮抗BAFF-R单克隆抗体伊那单抗系统性红斑狼疮(NCT05126277)pSS(29)T细胞CTLA4-IgG1Fc阿巴西普RA,pJIApSS(NCT02067910,NCT02915159)PsA(30)特发性炎性肌炎(NCT02971683)GPA(NCT02108860)CD40mAb抗体伊斯卡利单抗pSS(NCT03905525)备注:该表包括已批准用于自身免疫性疾病或基于II期试验的积极结果正在临床开发的药物。GPA,肉芽肿性多血管炎;MPA,显微镜下多血管炎;NMOSD,视神经脊髓炎谱系疾病;IgG4RD,免疫球蛋白G4相关疾病;pJIA,多关节幼年特发性关节炎。表3.用于治疗自身免疫性疾病的激酶靶向疗法靶标激酶结构药物临床应用正在调查中(IIb或III期)杰克JAK1/3抑制剂托法替布RA类贾(31)(NCT01500551,NCT03000439)PsAAS(32))UC(英语)JAK1/2抑制剂巴瑞替尼RA类系统性红斑狼疮(NCT03843125,NCT03616912,NCT03616964)JIA(NCT03773965,NCT03773978)sJIA(NCT04088396)特应性皮炎(33,34)葡萄膜炎(NCT04088409)JAK1选择性抑制剂乌帕替尼RA类CD(NCT03345823、NCT03345836NCT03345849)PsA加州大学(35)(NCT03006068,NCT03653026)轴向SpA(NCT04169373)特应性皮炎(36,37)(NCT03661138,NCT04195698)高安动脉炎(NCT04161898)巨细胞动脉炎(NCT03725202)非戈替尼RA(由EMA和日本提供)统一(38)(NCT02914535)CD(NCT02914561,NCT02914600)TYKTYK2选择性抑制剂Deucravacitinib银屑病(NCT03624127,NCT03611751)PsA(NCT04908189,NCT04908202)BTK公司BTK抑制剂Evobrutinib(依布替尼)MS(NCT04338022,NCT04338061)托布替尼MS(NCT04410978、NCT04410991、NCT04411641NCT04458051)重症肌无力(NCT05132569)非布替尼MS(NCT04544449、NCT04586010NCT04586023)利扎布替尼寻常型天疱疮(NCT03762265)免疫性血小板减少症(NCT04562766)备注:该表包括已批准用于自身免疫性疾病或基于II期试验的积极结果正在临床开发的药物。UC,溃疡性结肠炎;sJIA,系统性幼年特发性关节炎;CD,克罗恩病;中轴型SpA,中轴型脊柱关节炎。【NO.3】细胞因子靶向治疗肿瘤坏死因子(TNF) TNF是一种主要由髓系细胞和活化T细胞产生的促炎细胞因子。RA滑膜中TNF表达的增加和TNF转基因小鼠中关节炎的发展表明TNF在慢性炎症中的致病作用。抗TNF治疗的成功彻底改变了RA患者的治疗策略。自1998年英夫利昔单抗和依那西普首次获批以来,已有4种单克隆抗体(英夫利昔单抗、阿达木单抗、戈利木单抗和赛妥珠单抗)和1种受体-Fc融合蛋白(依那西普)获批,目前可用于治疗慢性免疫介导的疾病,包括RA、幼年特发性关节炎(JIA)、强直性脊柱炎(AS)、银屑病和银屑病关节炎(PsA)。这种mAb也适用于治疗炎症性肠病和非感染性葡萄膜炎。 尽管TNF具有促炎作用,但它是一种多效性细胞因子,依赖于TNF受体(TNFR)的结合。TNFR1在几乎所有有核细胞上组成性表达,主要负责TNF的炎症功能,而TNFR2仅在特定细胞类型上表达,例如髓源性抑制细胞、Treg细胞和单核细胞,与TNF的调节功能相关。源自TNFR1和TNFR2的不同信号转导通路已在其他地方进行了综述。目前可用的抗TNF疗法同时抑制TNFR1和TNFR2。由于TNF的调节方面,TNF阻断可能反常地诱导Th1/Th17细胞扩增和IFN反应失调,这可以解释抗TNF治疗期间治疗失败、自身抗体生成和反常银屑病的原因。因此,正在研究抑制TNFR1和增强TNFR2的更多选择性治疗。IL-1 IL-1α和IL-1β是IL-1家族的成员,是促炎细胞因子,与先天免疫反应密切相关。尽管IL-1α和IL-1β通过与IL-1受体1(IL-1R1)结合而具有共享生物学功能,但IL-1α与IL-1β的几个特征是不同的。在间充质细胞中组成型表达的pro-IL-1α具有生物活性,而巨噬细胞产生的pro-IL-1β需要被caspase-1切割才能成为活性IL-1β。pro-IL-1β的Caspase-1依赖性裂解是通过激活包含核苷酸结合结构域成员和包含亮氨酸富集重复序列的[NLR]蛋白家族(例如NLR家族含pyrin结构域的[NLRP]1、NLRP3、NLR家族CARD结构域4)或包含PYRIN-HIN-200结构域的蛋白家族成员(例如,在黑色素瘤2中不存在)的炎性小体激活来介导的)。此外,与IL-1β相反,IL-1α在体循环中未检测到,这表明IL-1α在自身免疫性疾病中的致病作用是局部的,而不是全身的。目前,IL-1β被认为比IL-1α与多种风湿性疾病更密切相关,包括全身性JIA、成人发病斯蒂尔病(AOSD)和痛风,以及与遗传性自身炎症性疾病的相关性,例如冷热蛋白相关周期性综合征(CAPS)和家族性地中海热。 被IL-1α或IL-1β占据后,IL-1R1与IL-1R3形成异源三聚体复合体,以募集髓样分化初级反应基因88(MYD88),从而触发随后的激酶级联反应(IL-1R相关激酶[IRAK]、IκB激酶、IκB和NF-κB),从而促进促炎状态。IL-1的这种炎症活性受来自同一IL-1家族的天然IL-1R拮抗剂(IL-1Ra)的调节。IL-1Ra占据IL-1R1导致构象变化,阻碍异源三聚体复合物与IL-1R3的形成,从而阻碍IL-1介导的炎症过程。 目前,已有3种蛋白质疗法被批准用于抗IL-1疗法:canakinumab,一种抗IL-1βmAb;anakinra,一种重组IL-1受体拮抗剂;和rilonacept,一种IL-1R1-Fc融合蛋白。根据它们的分子结构,所有3种药物都阻断IL-1β,阿那白滞素和利洛西普也抑制IL-1α。作为一种抑制IL-1信号转导的新治疗方法,口服NLRP3抑制剂,包括达潘舒腈(OLT177),正在研究中。 在早期临床开发中,阿那白滞素被测试为RA的治疗方法。尽管阿那白滞素在RA患者中的治疗效果已得到证实,但由于其成本效益低,因此不推荐将阿那白滞素作为一线生物疗法。抗IL-1疗法更广泛地用于自身炎症性疾病,如全身性JIA、AOSD和CAPS。其他具有高炎症负荷的疾病,例如痛风和复发性心包炎,也可通过IL-1靶向治疗进行控制。由于IL-1在炎症性疾病中的广泛作用,IL-1阻断有望在治疗顽固性自身免疫性疾病(包括SLE和系统性硬化症)以及控制过度的促炎反应(如细胞因子释放综合征和巨噬细胞激活综合征)方面提供临床益处。IL-6 IL-6是一种多效性细胞因子,由各种细胞类型在感染、炎症和恶性肿瘤的情况下产生。IL-6最初被鉴定为T细胞分泌的“B细胞分化因子”或“B细胞刺激因子”。尽管抗IL-6疗法在B细胞成熟中起着关键作用,但其对多发性骨髓瘤患者的治疗效果不佳。然而,托珠单抗(第一种抗IL-6R阻断单克隆抗体)的IL-6靶向治疗被证明在RA中具有显着的临床益处,甚至在疗效上优于阿达木单抗。托珠单抗目前被批准用于治疗RA、JIA、AOSD、巨细胞动脉炎和细胞因子释放综合征,因为它能够调节全身性过度炎症。最近,已研究抗IL-6疗法在SLE、视神经脊髓炎和系统性硬化症中的治疗应用。 IL-6在生理和病理条件下具有多种生物学功能。在生理状态下,IL-6负责巨噬细胞分化为M2状态,通过成骨细胞上RANK配体表达的增加进行破骨细胞生成,以及通过肝脏中的JAK-STAT通路进行急性期反应。在病理(炎症)条件下,IL-6通过调节FOXP3、RORC和IL-23R表达,关键参与Th17分化。IL-6对滤泡辅助性T细胞的发育和B细胞的成熟也很重要。 IL-6信号转导通过IL-6R和糖蛋白130(gp130)的复合物转导。gp130二聚化依次激活多个信号转导通路,包括JAK-STAT、MAPK、PI3K和YES相关蛋白1,这些蛋白转位到胞核并控制与细胞生长、增殖和炎症相关的基因转录。为了干扰IL-6信号通路,抗IL6疗法可以靶向IL-6、IL-6R、gp130、JAK和STAT3。然而,对副作用的担忧限制了gp130和STAT3作为治疗靶点的潜力。因此,抗IL6mAb、抗IL-6RmAb和JAK抑制剂已被用于阻断IL-6信号转导,并且使用可溶性gp130抑制IL-6/IL-6R复合体的可能性正在研究中。IL-17 IL-17A,通常称为IL-17,是CD4+T细胞Th17亚群的标志性细胞因子,但它也由CD8+T细胞(Tc17)、γδT细胞、自然杀伤T细胞、第3组先天性淋巴细胞和中性粒细胞产生。在生理状态下,Th17细胞通过募集中性粒细胞、宿主对细菌和真菌的防御以及皮肤和粘膜部位的组织修复来促进先天免疫。在病理条件下,IL-17A与TNF和其他炎性趋化因子协同作用,促进自身免疫。炎症性关节炎和神经炎症的动物模型表明,Th17细胞而不是Th1细胞在这些疾病的发展中起主要作用。 Th17细胞在IL-1β、IL-6和TGF-β存在下,通过抑制FOXP3并激活STAT3和RORC来源于初始CD4+初始T细胞。随后,IL-23稳定致病性Th17细胞的增殖和存活。与IL-17A结合后,IL-17R亚基A(IL-17RA)和亚基C(IL-17RC)的称为SEF/IL-17R的独特胞质结构域募集接头蛋白Act1,从而触发TNF受体相关因子(TRAF)6的泛素化,随后激活NF-κB、MAPK和激活蛋白1(AP1)通路和C/EBP转录因子。 来自动物和人类研究的越来越多的证据表明,IL-23/IL-17轴是多种自身免疫性疾病(如AS、PsA和RA)的极好治疗靶标。目前的抗IL-17疗法包括IL-17A(苏金单抗和依奇珠单抗)和IL-17RA(brodalumab)的mAb。正如预期的那样,抗IL-17疗法在银屑病、PsA和AS中产生了显著的反应。出乎意料的是,这种方法在RA(一种Th17依赖性疾病)患者中未能显示出显着的临床疗效。这种不令人满意的结果可以通过疾病本身的异质性或IL-17A的不同致病作用来解释,具体取决于RA分期(例如早期与晚期)。IL-23 IL-23是一种由DC和活化的巨噬细胞分泌的促炎细胞因子。作为IL-12家族的一员,IL-23是一种异二聚体,由IL-12共有的p40亚基(IL-12/IL-23p40)和IL-23特有的p19亚基(IL-23p19)组成。尽管IL-12和IL-23共享一个结构亚基,但IL-23更重要、更广泛地参与自身免疫性疾病的发病机制。最重要的是,IL-23通过维持Th17特征基因、抑制抑制因子、上调IL-23R表达和诱导效应基因来稳定Th17细胞的致病特征。它还作为自分泌因子促进DC和巨噬细胞的促炎功能。 IL-23与由IL-12Rβ1(与IL-12/IL-23p40结合)和IL-23R(与IL-23p19结合)组成的受体复合体相互作用,它们分别与酪氨酸激酶(TYK)2和JAK2结合。TYK2和JAK2的激活导致STAT的磷酸化和核转位,主要是STAT3。通过靶向抑制IL-12/IL-23p40或IL-23p19,可以阻断IL-23信号传导。作为一种抗IL-12/IL-23p40mAb,乌司奴单抗可阻断IL-12和IL-23,而抗IL-23p19mAb(guselkumab、tildrakizumab、risankizumab和mirikizumab)仅抑制IL-23。 与抗IL-17治疗类似,IL-23抑制可有效治疗银屑病和PsA。然而,与抗IL17治疗相比,靶向p40和p19亚基的mAb均未能改善AS的临床病程。尽管IL-23在AS的临床前模型中具有明显的致病作用,但这种意外结果表明,IL-23在人类自身免疫性疾病的组织和时间依赖性环境中发挥着不同的作用。在克罗恩病中,乌司奴单抗成功改善了临床结局,抗IL-23p19mAb的临床试验正在进行中(表1)。1型IFN 1型IFN,包括IFN-α、IFN-β、IFN-ε、IFN-κ和IFN-ω,最初被鉴定为可溶性抗病毒因子。随后的研究表明,IFN-α在自身免疫性疾病,尤其是SLE的发病机制中起着至关重要的作用。SLE患者的临床数据显示1型IFN特征的表达显著增加。重组IFN-α治疗后SLE样综合征的发展也表明1型IFN在自身免疫性疾病中的病理作用。 虽然大多数有核细胞可以产生1型IFN,但主要的细胞来源是pDC。含核酸的细胞外刺激,例如分别与抗RNA和DNA自身抗体复合的RNA和DNA,与pDC中的Toll样受体7(TLR7)和TLR9相互作用,以募集MYD88并激活IRAK和TRAF,从而导致IFN调节家族(IRF)7易位并导致IFN-α转录)。1型IFN与由IFNAR1和IFNAR2组成的IFN-α/β受体(IFNAR)结合。与1型IFN结合后,IFNAR1和IFNAR2分别激活JAK1和TYK2,从而导致STAT1和STAT2磷酸化和核转位。在胞核中,STAT1/STAT2与IRF9一起诱导IFN刺激基因的表达。在SLE中,IFN-α通过刺激髓系DC、Th1细胞和B细胞以及抑制Treg来促进促炎反应。 IFN-α在SLE中的病理生理学意义导致了1型IFN靶向免疫治疗的发展。在SLE中测试了Rontalizumab和sifalimumab中和干扰素α的单克隆抗体,但未能控制疾病活动。尽管IFN-α以外的IFN的作用尚不清楚,但仅抑制IFN-α而保持IFN-β和IFN-κ活性可能解释了SLE治疗效果不足的原因。最近,anifrolumab是一种靶向IFNAR1以阻断所有1型IFN生物学功能的人单克隆抗体,已被批准用于中度至重度SLE。Anifrolumab在减少疾病活动、口服皮质类固醇使用和年化发作方面显示出一致的临床益处。然而,狼疮性肾炎和神经精神性狼疮患者被排除在临床试验之外。 几种阻断1型IFN的新治疗方法正在研究中。为了减少1型IFN的产生,药物靶向pDC和信号转导分子,如TLR、MyD88和IRAK4。激酶抑制剂也正在临床开发中,用于治疗各种自身免疫性疾病,具体取决于它们抑制IFNAR下游信号通路的能力。【NO.4】细胞靶向治疗B细胞 随着我们对B细胞功能的理解不断扩大,B细胞被认为是自身免疫性疾病的积极参与者。有趣的是,B细胞耗竭疗法在RA和多发性硬化症(MS)中的成功突出了B细胞在自身免疫中的病理意义。除了在Ab产生中发挥作用外,B细胞还通过Ag呈递、三级淋巴组织的形成和细胞因子(如IL-6、TNF、IFN-γ和GM-CSF)的产生积极参与自身免疫。B细胞的Ab非依赖性功能解释了RA和MS中B细胞耗竭疗法的治疗效果,尽管没有自身抗体减少。 B细胞在骨髓中产生,并在外周组织中依次分化为Ag特异性B细胞。B细胞分化通过体细胞超突变和免疫球蛋白的类别转换重组,伴随着B细胞表面标志物的变化,继续增加对Ag的亲和力。CD20仅在从前B细胞到记忆B细胞的B细胞谱系中表达,但不在浆细胞中表达(图1)。在过去的几十年里,抗CD20疗法一直是B细胞耗竭的主要工具。利妥昔单抗是一种嵌合抗CD20mAb,可将CD20再分布到脂筏中,然后激活补体依赖性细胞毒性和Ab依赖性细胞毒性(ADCC)。利妥昔单抗有效消除CD20+B细胞会耗尽分泌Ab的浆母细胞的细胞来源,并阻止不依赖Ab的B细胞功能,从而减轻自身免疫性炎症。随着利妥昔单抗在RA和MS中的临床成功,已经开发了具有不同结合表位、不同给药途径和先进治疗效果的多种抗CD20疗法。Ocrelizumab和ofatumumab是人源化抗CD20mAb,已被批准用于复发性MS,其他抗CD20mAbobinutuzumab和ublituximab的临床试验正在进行中(表2)。 但是,利妥昔单抗在治疗SLE方面并未完全成功,SLE是刻板的B细胞介导的疾病之一。除了SLE患者的异质性外,利妥昔单抗治疗失败还可能由于存在自身反应性CD20−(但CD19+)长寿命浆细胞、外周血和组织中B细胞不完全耗竭或B细胞重建过程中的疾病发作。为了广泛抑制对抗CD20治疗耐药的B细胞,B细胞耗竭疗法靶向CD19,CD19在CD20+B细胞以及CD20-浆母细胞和一些浆细胞上表达。人源化抗CD19mAbinebilizumab被批准用于治疗视神经脊髓炎谱系疾病,并且正在进行临床试验以治疗其他炎症性神经系统疾病(表2)。 抑制B细胞的另一种方法是阻断B细胞存活因子,特别是BAFF和APRIL。BAFF与其3种不同受体连接后,与B细胞成熟和存活密切相关:1)BAFF受体(BAFF-R,称为TNFRSF13C),在除浆细胞外的大多数B细胞亚群上表达;2)跨膜激活剂、钙调节剂和亲环蛋白配体相互作用剂(TACI;称为TNFRSF13B),在边缘区B细胞、记忆B细胞和浆细胞上表达;3)B细胞成熟Ag(BCMA;称为TNFRSF17)在浆母细胞和浆细胞上表达。与BAFF-R不同,TACI和BCMA也与APRIL结合,这对Ab类别转换和浆细胞存活很重要。 鉴于B细胞成熟、增殖和存活的重要作用,BAFF/APRIL系统被认为是SLE及其相关自身免疫性疾病中一个有前途的治疗靶点。贝利尤单抗是一种人源化抗BAFFmAb,是FDA批准用于SLE的第一个靶向免疫疗法。然而,贝利尤单抗并不总是对所有SLE患者具有普遍的治疗益处。Ianalumab是一种抗BAFF-R的单克隆抗体,在原发性干燥综合征(pSS)患者的II期试验中显示出有希望的结果。作为B细胞耗竭疗法,ianalumab有2种作用模式:通过增强ADCC裂解B细胞和阻断BAFF信号传导。Telitacicept是一种TACI-Ig融合蛋白,基于其对BAFF/APRIL系统的抑制作用,也正在临床开发中。T细胞 作为适应性免疫的关键调节因子,T细胞在自身免疫的发生和发展中起着关键作用。T细胞效应器功能需要TCR的Ag识别和共刺激受体的额外参与。因此,已经研究了这些共刺激分子的调节用于自身免疫性疾病和恶性肿瘤的T细胞靶向治疗。 CD28信号转导是通过激活MAPK、AKT和NF-κB通路进行T细胞激活和分化的一种众所周知的共刺激通路。CD4+T细胞上表达的CD28与Ag呈递细胞上的CD80或CD86结合,CTLA-4作为CD28的抑制性对应物共享。基于CD28和CTLA-4的反调节,开发了一种由CTLA4胞外结构域和IgGFc区(CTLA4-Ig)组成的融合蛋白,通过占据CD80和CD86来抑制CD28信号传导。第一个CTLA4-Ig阿巴西普被批准用于治疗RA和JIA,已证实对控制炎症性关节炎有效。随后,另一种与CD80和CD86结合改善的CTLA4-Igs(包括belatacept和MEDI5256)已被研究用于临床应用。尽管贝拉西普于2011年被批准用于肾移植受者,但贝拉西普在基于钙调磷酸酶抑制剂的常规方案之外的额外临床益处存在争议。 CD40通路是T细胞效应器功能的主要激活信号。CD40L与CD40连接后,CD80和CD86表达上调。当活化T细胞上的CD40L与靶细胞上的CD40结合时,多个激酶级联反应会激活转录因子,如NF-κB和AP1,以诱导细胞存活、增殖和分化。CD40信号转导对于参与T细胞依赖性Ab反应、生发中心形成和记忆B细胞分化的B细胞-T细胞相互作用尤为重要。由于其在B细胞功能中的关键作用,靶向CD40信号转导的治疗潜力已在临床前和临床研究中得到研究。iscalimab(一种人源化抗CD40mAb)最近的II期试验显示pSS患者的临床改善,随后的III期试验正在进行中(表2)。 靶向其他共刺激信号转导的免疫疗法,如诱导型T细胞共刺激因子(ICOS)和OX40通路,也正在开发中,以抑制自身免疫性疾病中的T细胞效应功能。作为在活化的CD4+T细胞上表达的共刺激分子,ICOS和OX40参与T细胞的存活、分化和活化。【NO.5】激酶靶向治疗 如前所述,将可溶性炎症介质与其同源受体结合通过激活细胞内激酶(通常是JAK家族)来转导信号。JAK家族由JAK1、JAK2、JAK3和TYK2组成,与细胞因子受体(包括IL-2R、IL-4R、IL-5R、IL-6R、IL-13R和1型IFN)、生长激素和促红细胞生成素有关。JAK家族的激活导致STAT的磷酸化、二聚化和核转化。在细胞核中,STAT有助于参与细胞分化、增殖和存活、细胞因子产生和血管生成的基因转录。 由于JAK在造血中的关键作用,JAK抑制剂首次被评估用于治疗血液病,尤其是骨髓增生性肿瘤。自ruxolitinib(一种JAK1和JAK2抑制剂)于2011年首次被批准用于治疗骨髓纤维化以来,许多激酶抑制剂已被批准或研究用于治疗血液系统恶性肿瘤和炎症性疾病。几种JAK抑制剂已根据其经证实的临床疗效被批准用于RA、PsA和溃疡性结肠炎。每种JAK抑制剂对JAK的选择性不同,但尚未证明JAK抑制剂之间的治疗效果存在差异。Tofacitinib和baricitinib分别主要靶向JAK1/3和JAK1/2。Upadacitinib和filgotinib是第二代JAK抑制剂,可选择性抑制JAK1。 与上述调节细胞外间隙细胞激活信号的免疫疗法相比,JAK抑制剂靶向细胞内间隙的信号通路。JAK靶向治疗会抑制来自多个细胞因子受体的收敛信号,并破坏反馈回路。因此,即使部分阻断选定的激酶也可以有效地下调多种炎症信号通路,减轻自身免疫性炎症。应该注意的是,在一项头对头的随机对照试验中,巴瑞替尼显示出比抗TNFmAb阿达木单抗更好的临床反应。 除JAK抑制剂外,选择性TYK2抑制剂deucravacitinib正在等待临床批准,作为银屑病的首个口服靶向治疗。TYK2介导源自IL-12、IL-23和1型IFN的细胞内炎症信号。根据对PsA、炎症性肠病和SLE患者的机制见解,目前正在研究deucravacitinib在PsA、炎症性肠病和SLE患者中的治疗潜力(表3)。 布鲁顿酪氨酸激酶(BTK)抑制剂也有望通过调节B细胞功能来改善自身免疫性炎症。目前正在研究BTK抑制剂在各种自身免疫性疾病中的应用,包括RA、MS、pSS和SLE。最近一些使用BTK抑制剂的II期试验在复发性MS患者中显示出有希望的结果。 激酶抑制的未来方向是基于先进的分子技术开发更具选择性的抑制剂,具有最小的脱靶效应和更高的器官特异性。此外,应广泛研究由不受调节的细胞行为引起的除改善炎症以外的靶向效应。最近的证据表明,接受托法替布治疗的患者面临心脏事件、恶性肿瘤、血栓形成和死亡的风险增加,FDA已决定修改JAK抑制剂的黑框警告。自身免疫性疾病的慢性病程引发了对长期药物使用的安全性担忧,这会严重影响患者和医生的药物选择。【NO.6】新兴免疫疗法 随着对自身免疫性疾病免疫发病机制的更好理解和生物技术的不断进步,许多具有新治疗靶点和先进疗效的药物不断被开发出来,显示出有希望的疗效。尽管如此,仍然存在未满足的医疗需求,例如异质性治疗效果和免疫抑制引起的不良事件。为了克服当前治疗的局限性,炎症性疾病的治疗方法已经多样化和个体化。在这里,我们简要介绍了由先进分子工程技术实现的靶向免疫治疗的新视角。嵌合抗原受体(CAR)T细胞疗法 CART细胞疗法的基本概念是施用含有基因工程TCR的自体T细胞,以捕获肿瘤特异性Ag并通过增加细胞毒性来消除肿瘤细胞。在弥漫性大B细胞淋巴瘤患者治疗成功后,CD19CART细胞疗法被批准用于治疗B细胞淋巴瘤和急性淋巴细胞白血病。 CAR是由胞外Ag识别结构域、跨膜结构域和胞内T细胞激活结构域组成的工程化受体。细胞外结构域,也称为单链Fv,被设计为单克隆抗体的可变重链和轻链。细胞外结构域对Ag的识别会激活细胞内结构域上基于免疫受体酪氨酸的激活基序,导致细胞因子的产生和靶细胞的裂解。为了提高治疗效果,细胞内结构域由一个激活结构域CD3ζ和一个共刺激结构域(如CD28)组成。 尽管CART细胞最初被引入肿瘤学领域,但它们消除病理细胞的治疗潜力延伸到自身免疫性炎症性疾病的治疗。最近,Mougiakakos等人报道了自体CD19CART细胞疗法在常规治疗难治性SLE患者中的快速临床缓解。在该患者中,单次给药后7周内可在外周血中检测到输注的CD19CART细胞,抗dsDNA抗体快速且持续下降。这是一个有希望的结果,因为目前抗CD20mAb的B细胞耗竭需要定期注射并注意免疫原性以维持初始治疗效果。 随着工程T细胞疗法的发展,嵌合自身抗原受体(CAAR)T细胞和CARTreg疗法作为自身免疫性疾病的新型治疗策略而受到关注。CAART细胞的胞外结构域表达一种自身抗原,该抗原可与Ag特异性自身反应性B细胞和T细胞相互作用。CAART细胞疗法可能对具有已知自身抗原的自身免疫性疾病有效。CARTreg细胞的设计也期望产生Ag特异性免疫调节反应,而输注多克隆Treg细胞无法充分实现这种反应。然而,这种针对自身免疫性疾病的工程化T细胞疗法尚未得到广泛研究。此外,尽管工程化T细胞疗法具有假设的治疗效果,但细胞因子释放综合征和神经毒性可能会限制对细胞疗法在自身免疫性疾病中使用的热情,尤其是在高炎症微环境中。低剂量IL-2疗法 IL-2是Treg细胞分化、激活和存活的关键细胞因子,主要由活化的CD4+T细胞产生。Treg定义为CD4+FOXP3+CD25+CD127低表达,通过分泌抗炎细胞因子(IL-10、肿瘤生长因子-β和IL-35)、DC诱导免疫抑制酶(吲哚胺2,3-双加氧酶)、效应T细胞和NK细胞失活以及对CD8+T细胞和NK细胞的直接细胞毒性。Treg细胞缺陷和/或功能障碍常见于RA、SLE、pSS和AS等各种自身免疫性疾病。 除了激活Treg细胞外,IL-2还诱导效应T细胞的存活和增殖,并抑制Th17细胞分化。基于其对常规T细胞的刺激作用,大剂量IL-2疗法首次被批准用于转移性肾细胞癌和转移性黑色素瘤。然而,后来的研究表明,IL-2的主要作用是通过在Treg细胞上表达的高亲和力IL-2R介导的。IL-2R以单体、二聚体和三聚体变体表达,三聚体IL-2R的亲和力高于单体和二聚体形式。由于Treg细胞在高水平上组成性表达三聚体IL-2R,因此Treg细胞对IL-2比效应记忆CD4+T细胞高度敏感。因此,已在自身免疫性疾病中评估了低剂量IL-2疗法(0.3至300万国际单位/天),预计它将通过Treg刺激诱导免疫耐受,同时对效应T细胞的影响最小。 在自身免疫性疾病(包括SLE、PsA和丙型肝炎病毒诱导的冷球蛋白血症血管炎)患者中,低剂量IL-2疗法改善了临床结果,这与Treg细胞的增加一致。在临床试验中,低剂量IL-2具有可耐受的安全性,并且与感染风险增加无关。此外,在小鼠中,低剂量IL-2长期治疗不会损害对疫苗接种、感染和癌症的免疫反应。 良好的临床试验结果导致开发了氨基酸序列改变的工程化IL-2蛋白(IL-2突变蛋白),以提高选择性并减少不良反应。IL-2与生物疗法(如TNF和IL-6抑制)的组合也正在研究中。免疫耐受诱导 在不破坏免疫系统其他部分的情况下诱导对自身抗原的免疫耐受是治疗自身免疫性疾病的理想方法。在这方面,可以诱导Ag特异性免疫耐受的口服耐受性已经研究了一个多世纪。肠道相关淋巴组织(GALT)是最大的免疫器官,可维持对大量食物和共生微生物的耐受性。鉴于GALT在肠道稳态和全身调节中的作用,饲喂Ags对系统性自身免疫性疾病的耐受性影响已在临床前和临床试验中得到广泛研究。在动物模型中,发现口服耐受诱导可有效预防甚至治疗各种炎症性疾病,包括炎症性关节炎、实验性自身免疫性脑炎、糖尿病和葡萄膜炎。根据Ag的剂量,低剂量的Ag会促进分泌IL-4、IL-10和TGF-β的Treg细胞的产生,而高剂量的Ag会促进特定T细胞的克隆缺失或无反应。然而,这种免疫耐受机制并不排斥,可以重叠。 口服耐受诱导的早期试点试验和II期试验也显示出对RA、MS和葡萄膜炎患者有希望的结果,而没有治疗相关的毒性。然而,在RA和MS患者中进行Ag喂养的III期试验显示治疗效果不佳。尽管Ag喂养具有实验效果和可接受的安全性,但仍需要解决未解决的问题才能成功诱导免疫耐受:(1)Ag喂养方案(Ag的剂量和类型、粘膜佐剂的使用和给药频率);(2)与常规免疫抑制药物联合治疗;(3)反映口服耐受性发展有效性的生物和免疫标志物;4)选择适合诱导口服耐受的患者(年龄、疾病发作和脱敏史)。 抗原特异性耐受性的另一种方法是递送自身抗原的耐耐受性疫苗。致耐受性疫苗已成功诱导Ag特异性Treg细胞,并在自身免疫性疾病的动物模型中促进自身反应性T细胞无反应和细胞凋亡。已经研究了几种耐受性原疫苗平台,包括基于蛋白质/肽、纳米颗粒、细胞和DNA/RNA的疫苗,以增强MS临床前和临床研究中的免疫原性。尽管使用肽疫苗的III期试验未能显示出临床益处,但仍在使用MS患者的多种疫苗平台对耐受性方法进行研究。 最近,Krienke等人报道了在髓鞘少突胶质细胞糖蛋白(MOG35-55)诱导的实验性自身免疫性脑脊髓炎小鼠模型中,使用基于非炎性mRNA的疫苗成功诱导免疫耐受。尽管双链RNA分子在细胞外环境中具有固有的促炎性,但用1-甲基假尿苷(m1Ψ)取代尿苷会降低其促炎性质。MOG35-55编码m1Ψ修饰的单链mRNA疫苗可预防小鼠疾病的发展和进展。致耐受性疫苗诱导MOG35-55特异性FOXP3+Treg细胞并抑制MOG33-35特异性Th1和Th17细胞。PD1和CTLA4等抑制分子在Ag特异性细胞上的表达上调,疫苗的保护作用被PD1和CTLA-4靶向检查点抑制剂消除。 尽管如此,耐受性疫苗的开发具有挑战性,因为哪些自身抗原对自身免疫性疾病具有特异性尚无定论且存在争议,并且多种自身抗原可能涉及大多数自身免疫性疾病。【NO.7】结论 过去几十年来靶向免疫治疗的进步彻底改变了自身免疫性疾病患者的治疗和临床结果。目前的靶向免疫疗法通过阻断炎性细胞因子、细胞表面分子和细胞内激酶来抑制主要的促炎信号通路。尽管靶向治疗在自身免疫性疾病中取得了巨大成功,但在药物疗效和长期安全性方面仍未满足医疗需求。除了阻断炎症信号通路外,未来的疗法还旨在诱导长期的免疫耐受,同时保持保护性免疫功能。希望生物技术的进步和疾病知识将为开发具有更高治疗效果和最小不良反应的新药提供机会。此外,考虑到炎症介质和免疫细胞的多方面作用,需要开发更具选择性和特异性的药物,同时更精确地了解疾病发病机制。识别微信二维码,添加抗体圈小编,符合条件者即可加入抗体圈微信群!请注明:姓名+研究方向!本公众号所有转载文章系出于传递更多信息之目的,且明确注明来源和作者,不希望被转载的媒体或个人可与我们联系(cbplib@163.com),我们将立即进行删除处理。所有文章仅代表作者观点,不代表本站立场。

免疫疗法

2024-09-29

OTC2024类器官前沿应用与3D细胞培养论坛圆满落幕,点击图片可查看会后报告,咨询OTC2025类器官论坛请联系:王晨 180 1628 8769

随着对自免发病机制的了解,靶向炎性细胞因子、免疫细胞和细胞内激酶的生物药和小分子抑制剂已成为治疗自免疾病的标准手段,也成了创新药竞相争夺的一块肥肉!

图注:部分已上市产品的获批适应症布局(人工整理,累惨本猫,或有偏颇,持续修订)

今天我们聊一聊自免领域能够成药的靶点,都有哪些?

01

细胞因子

1.1 TNF

TNF是一种主要由髓系细胞和活化T细胞分泌促炎细胞因子,和多种自免疾病的发病有关。

阻断TNF通路可以对多种自免疾病起到治疗作用,包括,类风关(RA)RA、幼年特发性关节炎(JIA)、强直性脊柱炎(AS)、银屑病和银屑病关节炎(PsA)等。

而这个靶点也造就了曾经的全球“药王”阿达木单抗!除此外还有多款该靶点药物获得FDA批准,相关药物以及批准适应症情况如下表:

1.2 IL-17

IL-17A,通常称为IL-17,是Th17细胞亚群的标志性细胞因子,关于靶点的基本介绍在我们之前的文章也有写过(在文后有统一的合集,欢迎感兴趣的读者查看)。

来自动物和临床研究的证据表明,IL-23/IL-17轴是多种自身免疫性疾病(如AS、PsA和RA)的治疗靶标。目前靶向IL-17药物包括,IL-17A(苏金单抗和依奇珠单抗)和IL-17RA(Brodalumab)等。

1.3 IL-23

IL-23作为IL-12家族的一员,是一种由DC和活化的巨噬细胞分泌的促炎细胞因子。IL-23和IL-12共用p40 亚基,但IL-23更广泛地参与自身免疫性疾病的发病机制。

通过靶向IL-12/IL-23p40或IL-23p19,可以阻断IL-23信号。IL-23的阻断可有效治疗银屑病和PsA。

从目前上市的药物看,靶向IL-12/IL-23p40抗体药物为乌司奴单抗,可阻断IL-12和IL-23;靶向IL-23p19的药物包括:Guselkumab、Tildrakizumab、Risankizumab和Mirikizumab,这些药物仅抑制IL-23。

1.4 IL-1

IL-1家族包括IL-1α和IL-1β,是和先天免疫反应密切相关的促炎细胞因子。IL-1和受体的结合,需要IL-1R1与IL-1R3形成异源三聚体,随后募集髓MYD88,并触发随后的激酶级联反应,从而促进炎症反应。

目前研究认为在自免中IL-1β比IL-1α更重要。靶向IL-1的药物已有3种被批准:Canakinumab和Gevokizumab,这两种抗体药均靶向IL-1β;Anakinra,重组IL-1受体拮抗剂;Rilonacept,IL-1R1-Fc融合蛋白。

抗IL-1疗法更广泛地用于自身炎症性疾病,如全身性 JIA、AOSD和 CAPS。其他具有高炎症负荷的疾病,如痛风和复发性心包炎,也可通过 IL-1 靶向治疗进行控制。

另外,由于IL-1在炎症性疾病中的广泛作用,IL-1阻断有望在治疗顽固性自身免疫性疾病(包括SLE和系统性硬化症)及控制过度的促炎反应(如细胞因子释放综合征和巨噬细胞活化综合征)方面提供临床益处。

1.5 IL-6

IL-6是一种多效细胞因子,由各种类型细胞在感染、炎症和恶性肿瘤的情况下产生。

IL-6在生理和病理条件下具有多种生物学功能。生理状态下,IL-6负责巨噬细胞分化为M2状态,通过成骨细胞RANK配体表达的增加进行破骨细胞生成,及通过肝脏中的JAK-STAT通路进行急性期反应。

病理(炎症)条件下,IL-6 通过调节FOXP3、RORC和IL-23R表达,参与Th17分化,同时IL-6对滤泡辅助性T细胞的发育和B细胞的成熟也很重要。

阻断IL6通路可以通过靶向IL-6、IL-6R、gp130、JAK和STAT3来实现。这其中由于副作用,gp130和STAT3无法成药。目前抗IL-6抗体、抗IL-6R抗体和JAK抑制剂已被批准用于自免疾病的治疗。

经典的IL-6抗体药物托珠单抗,目前被批准用于治疗RA、JIA、AOSD、巨细胞动脉炎和细胞因子释放综合征。

1.6 I型IFN

I型IFN,包括IFN-α、IFN-β、IFN-ε、IFN-κ和IFN-ω。研究表明,IFN-α在自身免疫性疾病,尤其是SLE的发病机制中起着至关重要的作用,IFN-α以外的IFN 的作用尚不清楚。

在SLE中,IFN-α通过刺激髓系DC、Th1细胞和B细胞及抑制Treg细胞来促进促炎反应,使用重组IFN-α治疗后产生的SLE样综合征的发展也表明 1 型IFN 在自身免疫性疾病中的病理作用。

IFN-α在SLE中的病理生理学意义,使得导致了I型IFN靶向免疫治疗的发展。Rontalizumab和Sifalimumab是靶向IFN-α的抗体,但在SLE中未能控制疾病活动。

02

靶向B细胞

随着对B细胞功能的研究,B细胞被认为是自身免疫性疾病的积极参与者。B细胞耗竭疗法在RA和多发性硬化症(MS)中的成功也证明了B细胞在自免中的病理意义。

除了在抗体产生中发挥作用外,B细胞还通过抗原呈递、三级淋巴组织的形成和细胞因子(如IL-6、TNF、IFN-γ和GM-CSF)的产生参与到自身免疫中。

2.1 CD20

CD20仅在pro-B细胞到记忆B细胞谱系中表达,不在浆细胞中表达。过去几十年,抗CD20疗法一直是B细胞耗竭的主要工具。

利妥昔单抗是一种靶向CD20的嵌合抗体,可有效消除 CD20+ B细胞,耗尽分泌自身抗体的浆母细胞的细胞来源,并阻止不依赖抗体的B细胞功能,从而减轻自身免疫性炎症,已经在RA和MS中获得临床试验的成功。

除利妥昔单抗外,多种具有不同结合表位、不同给药途径和效果的抗CD20药物在开发中。其中Ocrelizumab和Ofatumumab是人源化抗CD20 抗体,已被批准用于复发性MS。

2.2 CD19

CD19在CD20+ B 细胞以及 CD20- 浆母细胞和一些浆细胞上表达,可以起到针对抗 CD20 治疗耐药的B 细胞耗竭作用。

人源化抗CD19抗体Inebilizumab已经被批准用于治疗视神经脊髓炎谱系疾病,并且正在进行临床试验以治疗其他炎症性神经系统疾病。

2.3 B细胞活化靶点

抑制B细胞的另一种方法是阻断与B 细胞成熟和存活密切相关的因子这包括:BAFF受体(BAFF-R),在除浆细胞外的大多数B 细胞亚群上表达;B细胞成熟抗原(BCMA),在浆母细胞和浆细胞上表达。

贝利尤单抗是一种人源化抗BAFF抗体药物,是FDA批准的用于SLE的第一个靶向免疫疗法。然而,贝利尤单抗并不对所有SLE患者具有疗效。Ianalumab是一种抗BAFF-R的单克隆抗体,在原发性干燥综合征(pSS)患者的II期试验中显示出有希望的结果。

Telitacicept是一种TACI-Ig融合蛋白,基于其对BAFF/APRIL系统的抑制作用,也正在临床开发中。

03

靶向T细胞

作为适应性免疫的关键参与者,T细胞在自身免疫的发生和发展中起着关键作用。因此靶向T细胞也是自免靶向药物开发的重要考量因素。

3.1 CD28

CD28信号通过激活MAPK、AKT和NF-κB通路激活T细胞。

CTLA-4是CD28的负反馈调节因子通过占据 CD80 和CD86 来抑制 CD28 信号传导。基于CTLA-4的负向调节,设计了CTLA4 胞外结构域和IgG Fc 区(阿巴西普,CTLA4-Ig)组成的融合蛋白,目前阿巴西普已经被批准用于治疗RA 和 JIA,已证实对控制炎症性关节炎有效。

其它类似药物还包括Belatacept 和MEDI5256,正处于临床研究阶段。

3.2 CD40

CD40通路是T细胞的主要激活信号,与CD40L连接后,上调CD80和 CD86 表达。活化T 细胞的CD40L与靶细胞CD40结合时,多个激酶级联反应会激活转录因子,如NF-κB和AP1,以诱导细胞存活、增殖和分化。

CD40信号转导对于参与T 细胞依赖的抗体产生、生发中心形成和记忆 B 细胞分化的B 细胞-T 细胞相互作用尤为重要。

由于其在 B 细胞功能中的关键作用,靶向CD40 信号转导的治疗潜力已在临床前和临床研究中得到研究。Iscalimab(一种人源化抗 CD40 mAb)最近的II 期试验显示pSS 患者的临床改善,随后的 III 期试验正在进行中。

3.3 其它

靶向其他共刺激信号转导的免疫疗法,如ICOS和OX40 通路,也正在开发中,以抑制自身免疫性疾病中的 T 细胞效应功能。

作为在活化的CD4+ T 细胞上表达的共刺激分子,ICOS和OX40参与T细胞的存活、分化和活化。

04

激酶靶向治疗

JAK家族由JAK1、JAK2、JAK3和TYK2组成,与细胞因子受体(包括IL-2R、IL-4R、IL-5R、IL-6R、IL-13R 和1型IFN)、生长激素和促红细胞生成素有关。

由于JAK在细胞因子通路的关键作用,JAK抑制剂已经被批准用于RA、PsA和溃疡性结肠炎。

除JAK抑制剂外,布鲁顿酪氨酸激酶(BTK)抑制剂也有望通过调节 B 细胞功能来改善自身免疫性炎症。目前正在研究 BTK 抑制剂在各种自身免疫性疾病中的应用,包括 RA、MS、pSS 和SLE。

05

结论

过去几十年,靶向免疫药物的进步彻底改变了自免疾病患者的治疗和临床结果。

目前的靶向免疫疗法通过阻断炎性细胞因子、细胞表面分子和细胞内激酶来抑制主要的促炎信号通路。尽管靶向治疗在自身免疫性疾病中取得了巨大成功,但在药物疗效和长期安全性方面仍未满足医疗需求。

除了阻断炎症通路外,未来的疗法还旨在诱导长期的免疫耐受,同时保持保护性免疫功能。希望生物技术的进步和疾病知识将为开发具有更高治疗效果和最小不良反应的新药提供机会。

END

免责声明:本文仅作知识交流与分享及科普目的,不涉及商业宣传,不作为相关医疗指导或用药建议。文章如有侵权请联系删除。

OTC2024类器官前沿应用与3D细胞培养论坛圆满落幕,点击图片可查看会后报告,咨询OTC2025类器官论坛请联系:王晨 180 1628 8769

申请上市上市批准

2024-04-12

In a preliminary review of blinded data from the ongoing TREK-DX study, 45% (10/22) of patients achieved at least a 90% reduction in their EASI score (EASI-90) after 16 weeks. 56% (5/9) of patients with prior inadequate response to dupilumab achieved EASI-90 and 56% (5/9) of patients achieved a vIGA score of 0 or 1 (clear or almost clear skin) after 16 weeks. Topline, unblinded data from the full dataset expected at the end of 2024.

Phase 2 proof-of-concept trial of farudodstat in alopecia areata (the FAST-AA study) has recruited close to 75% of patients; topline data readout expected in Q3 2024. Positive opinion received from European Patent Office on new patent application of farudodstat with potential to extend protection until at least 2043.

SAN MATEO, Calif. and SINGAPORE, April 12, 2024 (GLOBE NEWSWIRE) -- ASLAN Pharmaceuticals Pte Ltd (Nasdaq: ASLN), a clinical-stage, immunology-focused biopharmaceutical company developing innovative treatments to transform the lives of patients, today announced financial results for the fourth quarter and full year ended December 31, 2023, and provided an update on recent corporate activities.

“2023 marked a significant year for ASLAN, most notably because of the announcement of positive topline results from the TREK-AD Phase 2b study of eblasakimab in patients with moderate-to-severe atopic dermatitis (AD), and also a number of other advancements across our clinical pipeline. We initiated the FAST-AA clinical study of farudodstat in alopecia areata, and generated compelling translational data on eblasakimab that demonstrated the differentiated effects of targeting IL-13R versus IL-4R in the treatment of AD and supports the potential of eblasakimab as a biologic therapy for COPD,” said Dr Carl Firth, CEO, ASLAN Pharmaceuticals. “The blinded data we recently disclosed from the ongoing TREK-DX study of eblasakimab in dupilumab-experienced AD patients supports the potential of eblasakimab to treat AD patients that do not achieve an optimal response to dupilumab, a significant and underserved population with limited safe and long-term alternative treatment options. We look forward to the topline readout of the full, unblinded dataset from TREK-DX and the topline interim data from the FAST-AA study later this year.”

Fourth quarter 2023 and recent business highlights

Q4 and recent clinical developments

In October 2023, positive topline data from TREK-AD Phase 2b study of eblasakimab in moderate-to-severe AD presented in late-breaker oral presentation. New data from the Phase 2b TREK-AD study of eblasakimab for the treatment of moderate-to-severe AD was presented in a late-breaking oral presentation at the 32nd Annual European Congress of Dermatology and Venereology.

In October 2023, hosted a key opinion leader (KOL) event on the changes in the clinical trial and treatment landscape in AD. ASLAN co-hosted an investor event with a leading Clinical Research Organization and KOLs, Jonathan Silverberg, MD PhD MPH (The George Washington University School of Medicine and Health Sciences), and April W. Armstrong, MD MPH (UCLA). In new analyses of more severe patients (baseline EASI 18 or higher) from the TREK-AD study presented at the event, 55.6% of patients treated with 600mg eblasakimab once every 4 weeks saw at least a 75% reduction in their EASI score (EASI-75) versus 15.4% of patients on placebo, and 30.6% of patients achieved a validated Investigator Global Assessment (vIGA) score of 0 or 1 (clear or almost clear skin) versus 8.0% on placebo. A replay is available here.

In November 2023, data presented in an indication beyond AD for eblasakimab for the first time. At the Dermatology Drug Development Summit, ASLAN demonstrated the potential utility of eblasakimab in an indication beyond AD via a human translational model of chronic obstructive pulmonary disease (COPD). The data showed that eblasakimab was effective in reducing IL-4 and IL-13 driven airway hyperresponsiveness.

In December 2023, blinded safety data from the ongoing Phase 2a FAST-AA study of farudodstat in alopecia areata (AA) was disclosed. The data showed no liver or other major safety concerns to date in patients enrolled, supporting farudodstat’s improved safety pro to the first-generation of approved dihydroorotate dehydrogenase (DHODH) inhibitors. Farudodstat, a highly selective, oral DHODH inhibitor, has the potential to be a first-in-class treatment for AA. The FAST-AA study has now recruited close to 75% of patients and topline interim data from the study is expected to be available in Q3 2024.

In February 2024, received a favorable opinion from the European Patent Office (EPO) on composition of matter patent application for farudodstat. The EPO is acting as the International Examiner on a polymorph patent application for farudodstat, which, if granted in the national stages, will extend effective patent protection for farudodstat until at least 2043.

In March 2024, announced positive translational data from a head-to-head study of eblasakimab versus dupilumab in a human tissue model of COPD. In the study, eblasakimab performed better than dupilumab in improving airway function and enhancing bronchodilation at the same concentrations, providing further support for the potential of eblasakimab as a biologic therapy for COPD. The data has been submitted for presentation at an upcoming scientific conference.

In March 2024, announced preliminary blinded data from the TREK-DX study. In a review of data from 22 patients treated in the TREK-DX study, 45% (10/22) of patients saw at least a 90% reduction in their EASI score (EASI-90) and 50% (11/22) of patients achieved a vIGA score of 0 or 1 after 16 weeks. Of the 9 patients who previously had an inadequate response to dupilumab, 5 patients (56%) achieved EASI-90 and 5 patients (56%) a vIGA score of 0 or 1. TREK-DX is the first and only randomized, double-blind, placebo-controlled study to be conducted in a dupilumab-experienced AD patient population. Topline unblinded data from the full dataset is expected at the end of 2024.

Corporate updates

In December 2023, ASLAN amended the terms of its loan agreement with K2 HealthVentures. In order to substantially reduce the total payments due to K2 HealthVentures during 2024 and extend the date from which the Company is required to make monthly repayments to January 2025, ASLAN made a prepayment of $12.0 million which was applied to the outstanding principal under the loan agreement. $13.0 million of principal now remains outstanding under the loan agreement. The prepayment allowed the Company to reduce total cash burn for 2024.

In March 2024, in line with evaluating the potential use of eblasakimab as a therapy to treat COPD, ASLAN appointed respiratory experts Dr Ramaswamy Krishnan, MS MPhil PhD, Associate Professor in Emergency Medicine, Harvard Medical School, and Dr Reynold Panettieri, Jr, MD, Vice Chancellor, Translational Medicine and Science, Rutgers University to ASLAN’s Scientific Advisory Board.

In March 2024, ASLAN completed a $5.0 million registered direct offering for the purchase and sale of 5,000,000 of the Company’s American Depositary Shares (“ADSs”), each ADS representing twenty-five (25) ordinary shares, at an offering price of $1.00 per ADS. In addition, in a concurrent private placement, the Company issued unregistered warrants to purchase up to 5,000,000 ADSs with an exercise price of $1.00 per ADS.

Anticipated upcoming milestones

Presentation of positive translational data from a head-to-head study of eblasakimab versus dupilumab in a human tissue model of COPD at an upcoming scientific congress in Q2 2024

Topline interim data from the farudodstat Phase 2a study in AA expected in Q3 2024

Topline data from the TREK-DX trial of eblasakimab expected at the end of 2024

Selection of a development partner to advance eblasakimab into Phase 3 testing in AD and other indications

Fourth quarter 2023 financial highlights

Cash used in operations for the fourth quarter of 2023 was $7.6 million compared to $12.0 million in the same period in 2022.

Research and development expenses were $9.6 million in the fourth quarter of 2023 compared to $10.7 million in the fourth quarter of 2022. The decrease was due to lower clinical development and manufacturing costs for eblasakimab studies following the TREK-AD topline data readout.

General and administrative expenses were $3.2 million in the fourth quarter of 2023 compared to $2.7 million in the fourth quarter of 2022.

Net loss attributable to stockholders for the fourth quarter of 2023 was $13.5 million compared to a net loss of $14.5 million for the fourth quarter of 2022.

The weighted average number of ADSs outstanding in the computation of basic loss per share for the fourth quarter of 2023 was 17.3 million (representing 432.1 million ordinary shares) compared to 13.9 million (representing 348.7 million ordinary shares) for the fourth quarter of 2022. One ADS is the equivalent of twenty-five ordinary shares.

Full-year 2023 financial highlights

Cash used in operations for the year ended December 31, 2023, was $46.6 million compared to $38.4 million in 2022.

Research and development expenses were $42.5 million for the year ended December 31, 2023, compared to $38.0 million in 2022. The increase was driven primarily by the increase in clinical development and manufacturing costs for eblasakimab and the initiation of the FAST-AA study.

General and administrative expenses were $13.2 million for the year ended December 31, 2023, compared to $9.9 million in 2022. The increase was mainly due to costs related to financing activities and an increase in corporate activities.

Net loss attributable to stockholders for the year ended December 31, 2023, was $44.2 million compared to a loss of $51.4 million in 2022. The decrease in 2023 was driven by the licensing revenue of $12.0 million recognized in 2023.

Cash and cash equivalents total $21.3 million as of December 31, 2023, compared to $56.9 million as of December 31, 2022. On March 12, 2024, ASLAN raised additional funds of $5.0 million in gross proceeds in a registered direct offering.

The weighted average number of ADSs outstanding in the computation of basic loss per share for the year ended December 31, 2023, was 16.4 million (representing 411.2 million ordinary shares) compared to 13.9 million (representing 348.7 million ordinary shares) for the year ended 2022. One ADS is the equivalent of twenty-five ordinary shares.

ASLAN Pharmaceuticals Limited

CONSOLIDATED BALANCE SHEETS

(In US Dollars, other than shares or share data)

December 31, 2022

(audited)

December 31, 2023

(audited)

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

56,902,077

$

21,252,058

Other assets

3,976,350

2,877,934

Total current assets

$

60,878,427

$

24,129,992

NON-CURRENT ASSETS

Investments in equity instrument at financial asset at fair value through other comprehensive income

—

235,567

Investment in associate company

8,587

—

Property, plant and equipment

43,140

29,268

Right-of-use assets

249,601

229,982

Intangible assets

5,836

1,716

Total non-current assets

307,164

496,533

TOTAL ASSETS

$

61,185,591

$

24,626,525

LIABILITIES AND EQUITY

CURRENT LIABILITIES

Trade payables

$

12,784,485

$

7,918,607

Other payables

2,325,038

3,081,329

Lease liabilities - current

215,671

226,187

Current borrowings

7,748,831

1,800,387

Financial liabilities at fair value through profit or loss

90,213

88,394

Total current liabilities

23,164,238

13,114,904

NON-CURRENT LIABILITY

Long-term borrowings

29,656,133

24,798,552

Total non-current liability

29,656,133

24,798,552

Total liabilities

52,820,371

37,913,456

EQUITY ATTRIBUTABLE TO STOCKHOLDERS OF THE COMPANY

Ordinary shares

63,019,962

63,931,993

Capital surplus

223,910,955

243,791,693

Accumulated deficits

(278,386,749

)

(321,067,236

)

Other reserves

(178,948

)

56,619

Total equity attributable to stockholders of the Company

8,365,220

(13,286,931

)

Total equity/(capital deficiency)

8,365,220

(13,286,931

)

TOTAL LIABILITIES AND EQUITY/(CAPITAL DEFICIENCY)

$

61,185,591

$

24,626,525

ASLAN Pharmaceuticals Limited

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(In US Dollars, other than shares or share data)

For the Three Months Ended

December 31 (unaudited)

For the Twelve Months Ended

December 31 (audited)

2022

2023

2022

2023

NET REVENUE

$

—

$

—

$

—

$

12,000,000

COST OF REVENUE

—

—

—

—

GROSS PROFIT

—

—

—

12,000,000

OPERATING EXPENSES

General and administrative expenses

$

(2,708,055

)

$

(3,245,717

)

$

(9,881,993

)

$

(13,240,218

)

Research and development expenses

(10,685,486

)

(9,600,766

)

(38,000,494

)

(42,495,379

)

Total operating expenses

(13,393,541

)

(12,846,483

)

(47,882,487

)

(55,735,597

)

LOSS FROM OPERATIONS

(13,393,541

)

(12,846,483

)

(47,882,487

)

(43,735,597

)

NON-OPERATING INCOME AND EXPENSES

Interest income

224,018

10,110

354,457

404,981

Other income

162,711

386,908

386,138

462,321

Other gains and losses

(571,079

)

(25,275

)

(29,583

)

3,121,606

Finance costs

(778,257

)

(997,735

)

(3,675,689

)

(4,331,661

)

Total non-operating income and expenses

(962,607

)

(625,992

)

(2,964,677

)

(342,753

)

Share in losses of associated company, accounted for using equity method

(45,516

)

—

(436,032

)

(8,587

)

LOSS BEFORE INCOME TAX

(14,401,664

)

(13,472,475

)

(51,283,196

)

(44,086,937

)

INCOME TAX EXPENSE

(79,379

)

(39,916

)

(99,221

)

(132,667

)

NET LOSS FOR THE PERIOD

(14,481,043

)

(13,512,391

)

(51,382,417

)

(44,219,604

)

OTHER COMPREHENSIVE INCOME

Unrealized gain on investments in equity instruments at fair value through other comprehensive income

—

235,567

—

235,567

TOTAL COMPREHENSIVE LOSS FOR THE PERIOD

$

(14,481,043

)

$

(13,276,824

)

$

(51,382,417

)

$

(43,984,037

)

NET LOSS ATTRIBUTABLE TO:

Stockholders of the Company

$

(14,481,043

)

$

(13,512,391

)

$

(51,382,417

)

$

(44,219,604

)

Non-controlling interests

—

—

—

—

$

(14,481,043

)

$

(13,512,391

)

$

(51,382,417

)

$

(44,219,604

)

TOTAL COMPREHENSIVE LOSS ATTRIBUTABLE TO:

Stockholders of the Company

$

(14,481,043

)

$

(13,276,824

)

$

(51,382,417

)

$

(43,984,037

)

Non-controlling interests

—

—

—

—

$

(14,481,043

)

$

(13,276,824

)

$

(51,382,417

)

$

(43,984,037

)

LOSS PER ORDINARY SHARE

Basic and diluted

$

(0.04

)

$

(0.03

)

$

(0.15

)

$

(0.11

)

LOSS PER EQUIVALENT ADS - AFTER THE ADS RATIO CHANGE

Basic and diluted

$

(1.04

)

$

(0.78

)

$

(3.68

)

$

(2.69

)

Weighted-average number of ordinary shares in the computation of basic loss per ordinary share

348,723,365

432,076,252

348,723,365

411,242,644

Weighted-average number of equivalent ADS in the computation of basic loss per ADS – after the ADS Ratio Change

13,948,935

17,283,050

13,948,935

16,449,706

About ASLAN Pharmaceuticals

ASLAN Pharmaceuticals (Nasdaq: ASLN) is a clinical-stage, immunology-focused biopharmaceutical company developing innovative treatments to transform the lives of patients. ASLAN is developing eblasakimab, a potential first-in-class antibody targeting the IL-13 receptor in moderate-to-severe atopic dermatitis (AD) with the potential to improve upon current biologics used to treat allergic disease, and has reported positive topline data from a Phase 2b dose-ranging study in moderate-to-severe AD patients. ASLAN is also developing farudodstat, a potent oral inhibitor of the enzyme dihydroorotate dehydrogenase (DHODH) as a potential first-in-class treatment for alopecia areata (AA) in a Phase 2a, proof-of-concept trial with an interim readout expected in Q3 2024. ASLAN has teams in San Mateo, California, and in Singapore. For additional information please visit the ASLAN website or follow ASLAN on LinkedIn.

Forward looking statements

This release contains forward-looking statements. These statements are based on the current beliefs and expectations of the management of ASLAN Pharmaceuticals Limited and/or its affiliates (the "Company"). These forward-looking statements may include, but are not limited to statements regarding the Company’s business strategy and clinical development plans; statements related to the safety and efficacy of eblasakimab, including preliminary blinded data; the Company’s plans and expected timing with respect to clinical trials, clinical trial enrollment and clinical trial results for eblasakimab and farudodstat; the potential of eblasakimab as a first-in-class treatment for atopic dermatitis and of farudodstat as a first-in-class treatment for alopecia areata; the Company’s cash runway; expectations regarding the terms of patents and ability to obtain and maintain intellectual property protection for product candidates; and the anticipated selection of a development partner to advance eblasakimab into Phase 3 testing in AD and other indications. The Company’s estimates, projections and other forward-looking statements are based on management's current assumptions and expectations of future events and trends, which affect or may affect the Company’s business, strategy, operations, or financial performance, and inherently involve significant known and unknown risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of many risks and uncertainties, which include, unexpected safety or efficacy data observed during preclinical or clinical studies; risks that future clinical trial results may not be consistent with interim, initial or preliminary results or results from prior preclinical studies or clinical trials; risks that trends or characteristics based on preliminary blinded data may not be consistent with unblinded data; clinical site activation rates or clinical trial enrollment rates that are lower than expected; the impact of health epidemics or pandemics, or geopolitical conflicts on the Company’s operations, research and development and clinical trials and potential disruption in the operations and business of third-party manufacturers, contract research organizations, other service providers and collaborators with whom the Company conducts business; general market conditions; changes in the competitive landscape; and the Company’s ability to obtain sufficient financing to fund its strategic and clinical development plans. Other factors that may cause actual results to differ from those expressed or implied in such forward-looking statements are described in the Company’s US Securities and Exchange Commission filings and reports (Commission File No. 001- 38475), including the Company’s Annual Report on Form 20-F filed with the US Securities and Exchange Commission on April 12, 2024. All statements other than statements of historical fact are forward-looking statements. The words “believe,” “may,” “might,” “could,” “will,” “aim,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “plan,” or the negative of those terms, and similar expressions that convey uncertainty of future events or outcomes are intended to identify estimates, projections, and other forward-looking statements. Estimates, projections, and other forward-looking statements speak only as of the date they were made, and, except to the extent required by law, the Company undertakes no obligation to update or review any estimate, projection, or forward-looking statement.

ASLAN Media and IR contacts

Emma Thompson

Spurwing Communications

Tel: +65 6206 7350

Email: ASLAN@spurwingcomms.com

Ashley R. Robinson

LifeSci Advisors, LLC

Tel: +1 (617) 430-7577

Email: arr@lifesciadvisors.com

临床结果临床2期财报临床1期

分析

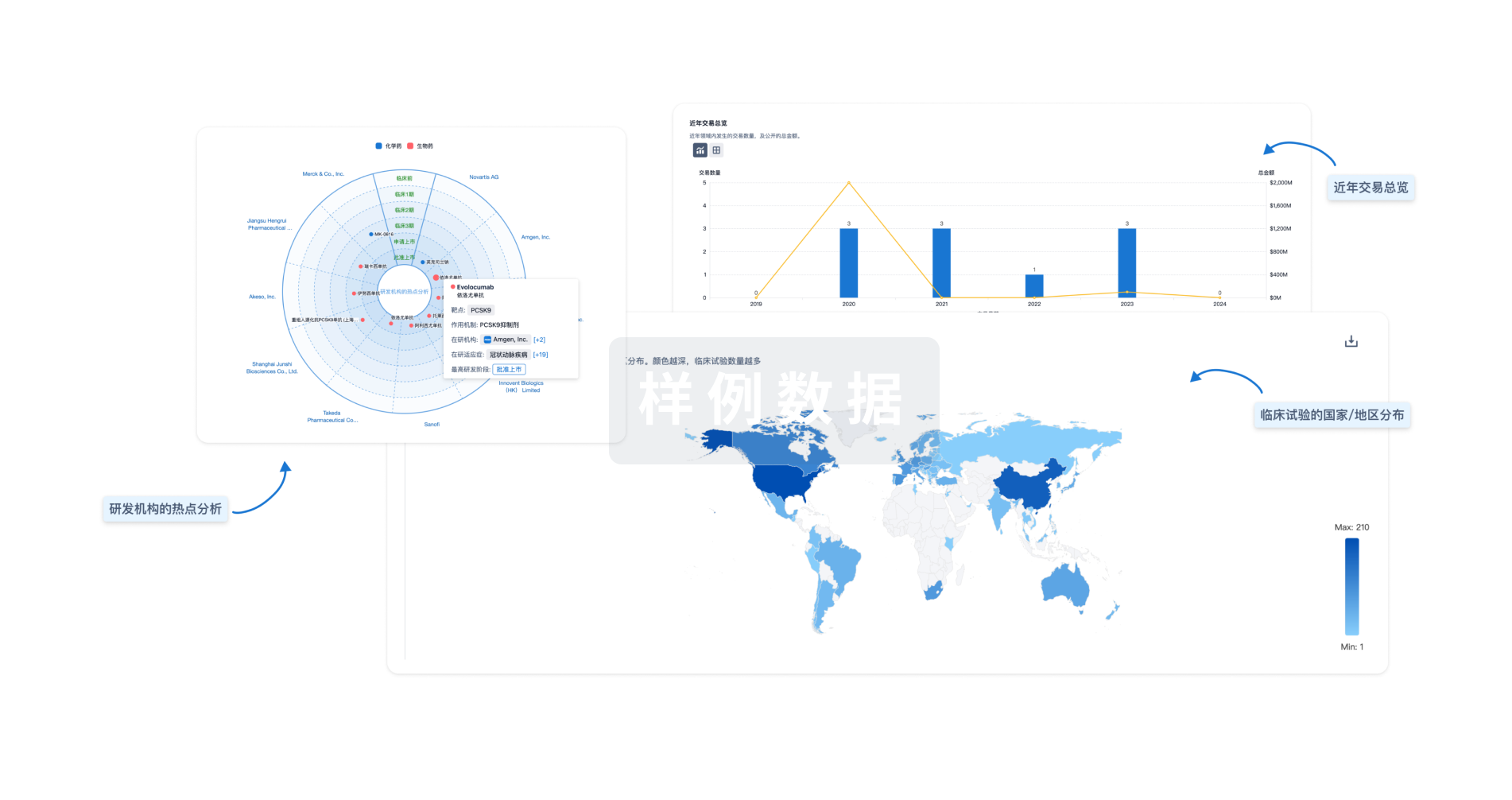

对领域进行一次全面的分析。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用