预约演示

更新于:2025-05-07

Punctate corneal epithelial defects

点状角膜上皮缺损

更新于:2025-05-07

基本信息

别名 Punctate corneal epithelial defects |

简介- |

关联

1

项与 点状角膜上皮缺损 相关的药物作用机制 thymosin beta 4激动剂 |

在研机构 |

原研机构 |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期1800-01-20 |

5

项与 点状角膜上皮缺损 相关的临床试验CTR20180772

评价生发肽滴眼液在健康志愿者中耐受性、安全性 和药代动力学特征的I期临床试验

评价生发肽滴眼液在中国健康志愿者的安全性和耐受性,以及在健康志愿者体内的药代动力学特征。

开始日期2018-10-29 |

申办/合作机构 |

NCT03652415

Dry Eye Outcome and Prescription Study

The DRy eye Outcome and Prescription Study (DROPS) is a large observational multicentre study exploring the 'real world' effectiveness of artificial tears in dry eye disease and determinants of efficacy. The aim is to include at least 635 symptomatic dry eye patients who are prescribed artificial tears. All trainees and fellows in London are invited to become collaborators: collaborators are asked to consent patients, assess signs at baseline, and give patients questionnaires at baseline and 4 weeks (for home completion). In tandem, we are conducting a qualitative review of ophthalmologists' prescribing behaviours for dry eye disease.

开始日期2018-08-23 |

申办/合作机构 |

NCT03163641

A Randomized, Masked (Reading Center), Prospective Pilot Study of the Safety and Effectiveness of the EyeGate Ocular Bandage Gel, a 0.75% Crosslinked Hyaluronic Acid Applied Topically, Versus a Bandage Contact Lens for Acceleration of Re-epithelialization of Large Corneal Epithelial Defects in Patients Having Undergone Photorefractive Keratectomy (PRK).

This is a prospective, randomized (Reading Center), masked, controlled study in up to 45 subjects who have undergone bilateral PRK with epithelial removal using alcohol in a 9.0 mm well or trephine at the time of surgery to ensure consistency of the size of the ablation area.

开始日期2018-08-05 |

申办/合作机构 |

100 项与 点状角膜上皮缺损 相关的临床结果

登录后查看更多信息

100 项与 点状角膜上皮缺损 相关的转化医学

登录后查看更多信息

0 项与 点状角膜上皮缺损 相关的专利(医药)

登录后查看更多信息

456

项与 点状角膜上皮缺损 相关的文献(医药)2025-03-04·Cureus

Ocular Manifestations Leading to the Diagnosis of Ichthyosis: A Case Report

Article

作者: Khadamy, Joobin

2025-03-01·Ophthalmology Science

Substance P- and Insulin-like Growth Factor 1-derived Tetrapeptides for Neurotrophic Keratopathy Related to Leprosy: A Clinical Trial

Article

作者: Iraha, Satoshi ; Okano, Yoshiko ; Kondo, Shoko ; Tokunaga, Shoji

2025-02-01·Cornea

Quantum Molecular Resonance Electrotherapy for the Treatment of Pediatric Ocular Rosacea

Article

作者: Palioura, Sotiria ; Surapaneni, Leena ; Giachos, Ioannis

14

项与 点状角膜上皮缺损 相关的新闻(医药)2025-02-01

Jan. 29, 2025 -- Vyluma, Inc. (“Vyluma”), a biopharmaceutical company advancing novel treatments for refractive errors, announced today that the National Medical Products Administration (NMPA) of China has accepted the drug application from Zhaoke Ophthalmology Limited (“Zhaoke”) for its lead compound, NVK002 (low-dose atropine 0.01%), as a potential treatment for myopia progression in children. NVK002, developed by Vyluma and licensed to Zhaoke, is a proprietary, investigational, preservative-free eye drop administered nightly, targeting pediatric patients with myopia.

Acceptance of the drug application by the NMPA marks an essential step in introducing NVK002 as a potential therapeutic option for managing myopia in children across China.

“NMPA acceptance of the drug application for NVK002 is a significant milestone for Vyluma and underscores our commitment to addressing the global pediatric myopia epidemic,” said George Zorich, Chairman and CEO of Nevakar, Inc., and acting President of Vyluma, Inc. “China is home to one of the highest rates of pediatric myopia in the world, making this approval process critical for ensuring access to an innovative treatment that could dramatically impact the vision and quality of life for millions of children later in life. This acceptance is a testament to our dedication to advancing effective, science-based solutions for pediatric eye health worldwide.”

The drug application is based on the first Phase III clinical trial (“Mini-CHAMP”) conducted by Zhaoke in China. The trial involved 16 centers and enrolled 526 patients. Mini-CHAMP successfully met its primary efficacy endpoint, achieving statistically and clinically meaningful differences versus placebo, and demonstrated strong safety and efficacy and high patient tolerance.

A second Phase III clinical trial (“China CHAMP”) from Zhaoke completed the last patient last visit in August 2024. The trial involves 18 centers and enrolled 777 patients. The top-line results of China-CHAMP showed significant efficacy and favorable safety profile of NVK002, further supporting the drug as a potential treatment for myopia progression in children.

With its acceptance by the NMPA, NVK002 is now under regulatory review across three major global markets: the United States, the European Union, and China. This milestone reinforces Vyluma’s vision of bringing innovative pharmaceutical solutions to children worldwide and advancing the treatment of myopia progression globally.

Vyluma is a clinical-stage biopharmaceutical company with a focus on pharmaceutical treatments for refractive errors of the eye. Vyluma’s pipeline of therapies is led by NVK002, an investigational, preservative-free, low-dose atropine eye drop to treat the progression of myopia in children aged 3 years and older. Vyluma has a robust pipeline of other assets in various stages of development which address important unmet treatment needs of patients with refractive errors or eye pain.

Vyluma itself is a subsidiary of Nevakar Inc., a holding company whose subsidiaries are engaged in developing products for the ophthalmic and injectable markets. For additional information please visit www.vyluma.com.

Nevakar Inc. is a fully integrated privately held, late-stage biopharmaceutical company with an extensive portfolio of products in the ophthalmic and injectable areas. Founded in 2015, and headquartered in Bridgewater, New Jersey, the Company is focused on developing and commercializing innovative products to address unmet medical needs, thereby improving patients’ quality of life and healthcare outcomes. Nevakar utilizes the US 505(b)(2) regulatory pathway, along with its proven expertise in the development of novel and proprietary sterile pharmaceutical products to identify, develop, and obtain regulatory approval for its products. Additional information is available at www.nevakar.com.

Founded in 2017 in China, Zhaoke (SEHK: 6622) is a leading ophthalmic pharmaceutical company dedicated to the research and development, manufacturing and commercialization of therapies that address significant unmet medical needs in the world. The company was listed on the Main Board of the Hong Kong Stock Exchange on 29 April 2021.

Zhaoke Ophthalmology has a comprehensive drug portfolio of innovative and generic treatments covering major eye diseases across both the front- and the back-of-the-eye. Currently, the company is focusing on major near-term development programs that are in the pre-registration stage, pivotal phase III clinical trial and other stages in clinical trial for the treatment of five respective major ophthalmic diseases, i.e. dry eye disease, myopia, wet AMD, presbyopia and cornea epithelial defects. Many of the drugs are being produced in its state-of-the-art and fully functional development and production facility in Nansha, Guangzhou, Guangdong Province in China.

Through its ambitious growth strategy, including partnering with domestic and international pharmaceutical companies, Zhaoke Ophthalmology’s goal is to become a global leader in ophthalmology.

The content above comes from the network. if any infringement, please contact us to modify.

临床结果

2023-08-25

Demodex blepharitis impacts approximately 25 million eye care patients in the U.S. – or 1 out of every 12 adults.

XDEMVY is indicated for all adult patients with Demodex blepharitis and is available via prescription from an eye care provider

Sales force deployed, calling on ophthalmologists and optometrists nationwide

Tarsus Pharmaceuticals, Inc. (NASDAQ: TARS), whose mission is to focus on unmet needs and apply proven science and new technology to revolutionize treatment for patients, starting with eye care, announced that XDEMVY™ (lotilaner ophthalmic solution) 0.25% is now available at pharmacies nationwide for prescription. The U.S. Food and Drug Administration (FDA) approved XDEMVY on July 24, 2023, for the treatment of Demodex blepharitis.

“We are delighted that within weeks of FDA approval, XDEMVY is now available to millions of patients with Demodex blepharitis,” said Bobak Azamian, MD, PhD, Chief Executive Officer and Chairman of Tarsus. “The efforts of our team have created incredible interest in XDEMVY, the first and only approved solution for this highly prevalent disease. I’m so appreciative of our team and our partners who’ve worked diligently to bring this product to eye care providers and patients quickly and seamlessly following regulatory approval. We are proud to introduce XDEMVY to the eye care community and look forward to its potential to significantly change the way this disease is treated.”

XDEMVY is the only FDA approved treatment to directly target Demodex mites, the root cause of Demodex blepharitis. Demodex blepharitis is characterized by redness, inflammation, missing or misdirected eyelashes, itching along the eyelid base, and the presence of collarettes. XDEMVY is a prescription eye drop that is administered with one drop in each eye twice daily (approximately 12 hours apart) for 6 weeks.

Tarsus is committed to ensuring that patients have affordable and broad access to XDEMVY and developed Tarsus Connect, a suite of assistance programs that provide financial support for eligible patients. More information about Tarsus Connect can be found on xdemvy.com or by calling: 1-866-846-3092.

About Demodex Blepharitis

Blepharitis is a common lid margin disease that is characterized by eyelid margin inflammation, redness and ocular irritation. Demodex blepharitis is caused by an infestation of Demodex mites, the most common ectoparasite found on humans and accounts for over two-thirds of all blepharitis cases. Demodex blepharitis may affect as many as 25 million Americans based on an extrapolation from the Titan study indicating 58% of patients presenting to U.S. eye care clinics have collarettes, a pathognomonic sign of Demodex mite infestation, and that at least 45 million people annually visit an eye care clinic. Demodex blepharitis can have a significant clinical burden and negative impact on patients’ daily lives. The Titan study also showed that current management tools, such as tea tree oil and lid wipes, are ineffective at targeting the root cause of Demodex blepharitis.

About XDEMVY™

XDEMVY (lotilaner ophthalmic solution) 0.25%, formerly known as TP-03, is a novel prescription eye drop for the treatment of Demodex blepharitis and is designed to target and eradicate the root cause of the disease – Demodex mite infestation. The active ingredient in XDEMVY is lotilaner, a well-characterized agent that eradicates Demodex mites by selectively inhibiting the GABA-Cl channels. It is a highly lipophilic molecule, which may promote its uptake in the oily sebum of the eyelash follicles where the mites reside. XDEMVY was evaluated in two pivotal trials collectively involving more than 800 patients. Both trials met the primary endpoint and all secondary endpoints, with statistical significance and no serious treatment-related adverse events. Most patients found XDEMVY to be neutral to very comfortable. The most common ocular adverse reactions observed in the studies were site stinging and burning which was reported in 10% of patients. Other ocular adverse reactions reported by less than 2% of patients were chalazion/hordeolum (stye) and punctate keratitis.

About Tarsus Pharmaceuticals, Inc.

Tarsus Pharmaceuticals, Inc. applies proven science and new technology to revolutionize treatment for patients, starting with eye care. Tarsus is advancing its pipeline to address several diseases with high unmet need across a range of therapeutic categories, including eye care, dermatology, and infectious disease prevention. Tarsus is studying three investigational medicines in clinical trials. In addition to XDEMVY (lotilaner ophthalmic solution) 0.25%, which is FDA approved in the United States for the treatment of Demodex blepharitis, Tarsus is also investigating TP-03 for the treatment of Meibomian Gland Disease, which is currently being studied in a Phase 2a clinical trial. In addition, Tarsus is developing TP-04 for the potential treatment of Rosacea and TP-05, an oral tablet for the prevention of Lyme disease. TP-04 and TP-05 are both currently being studied in Phase 2a clinical trials to evaluate safety, tolerability, and proof-of activity.

The content above comes from the network. if any infringement, please contact us to modify.

临床结果上市批准临床2期

2023-08-21

EYLEA HD is indicated for the treatment of wet age-related macular degeneration. Credit: Image Point Fr/Shutterstock.com.

The US Food and Drug Administration (FDA) has granted approval to

Regeneron Pharmaceuticals’ EYLEA HD 8mg injection

(0.07mL of 114.3mg/mL solution).

Jointly developed by Regeneron and

Bayer

, EYLEA HD (aflibercept) is indicated for the treatment of wet age-related macular degeneration (wAMD), diabetic retinopathy (DR) and diabetic macular oedema (DME).

Recommended Reports

Reports

LOA and PTSR Model - Ensartinib Hydrochloride in Sarcomas

GlobalData

Reports

LOA and PTSR Model - Pazopanib Hydrochloride in Gliosarcoma

GlobalData

View all

Companies Intelligence

Bayer AG

DME Corporation

Photon, Inc.

Regeneron GmbH

Pulsar LLC

View all

The recommended dose across all indications is EYLEA HD 8mg every four weeks for the initial three months.

EYLEA HD is then given every eight to 16 weeks in wAMD and DME and every eight to 12 weeks for DR.

The approval is based on two active-controlled, double-masked pivotal trials, PULSAR in wAMD and PHOTON in DME.

Bayer is the lead sponsor for PULSAR and Regeneron for PHOTON.

Conducted in multiple centres worldwide, these studies compared EYLEA HD to EYLEA (aflibercept) injection 2mg for 48 weeks.

Patients who received EYLEA HD in both trials had three initial monthly doses while those treated with EYLEA received three initial doses of PULSAR and five of PHOTON.

Both PULSAR in wAMD (N=1,009) and PHOTON in DME (N=658) met their primary endpoint demonstrating non-inferior and clinically equivalent vision gains with EYLEA HD.

The majority of patients randomised at baseline to EYLEA HD 12 or 16-week dosing regimens also maintained these dosing intervals through the 48-week period.

The most common adverse reactions reported in patients treated with EYLEA HD were increased intraocular pressure, conjunctival haemorrhages and cataracts.

Other adverse reactions included retinal haemorrhage, corneal epithelium defects, vitreous detachment, vitreous floaters, eye irritation and blurred vision.

Regeneron chief scientific officer, president, board co-chair and EYLEA principal inventor George Yancopoulos stated: “Our continued commitment to retinal diseases resulted in an important scientific innovation – evolving the proven efficacy and safety of EYLEA into a new treatment, EYLEA HD, that provides lasting vision control with even fewer injections to further benefit those living with wet age-related macular degeneration or diabetic retinal diseases.”

上市批准临床结果

分析

对领域进行一次全面的分析。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

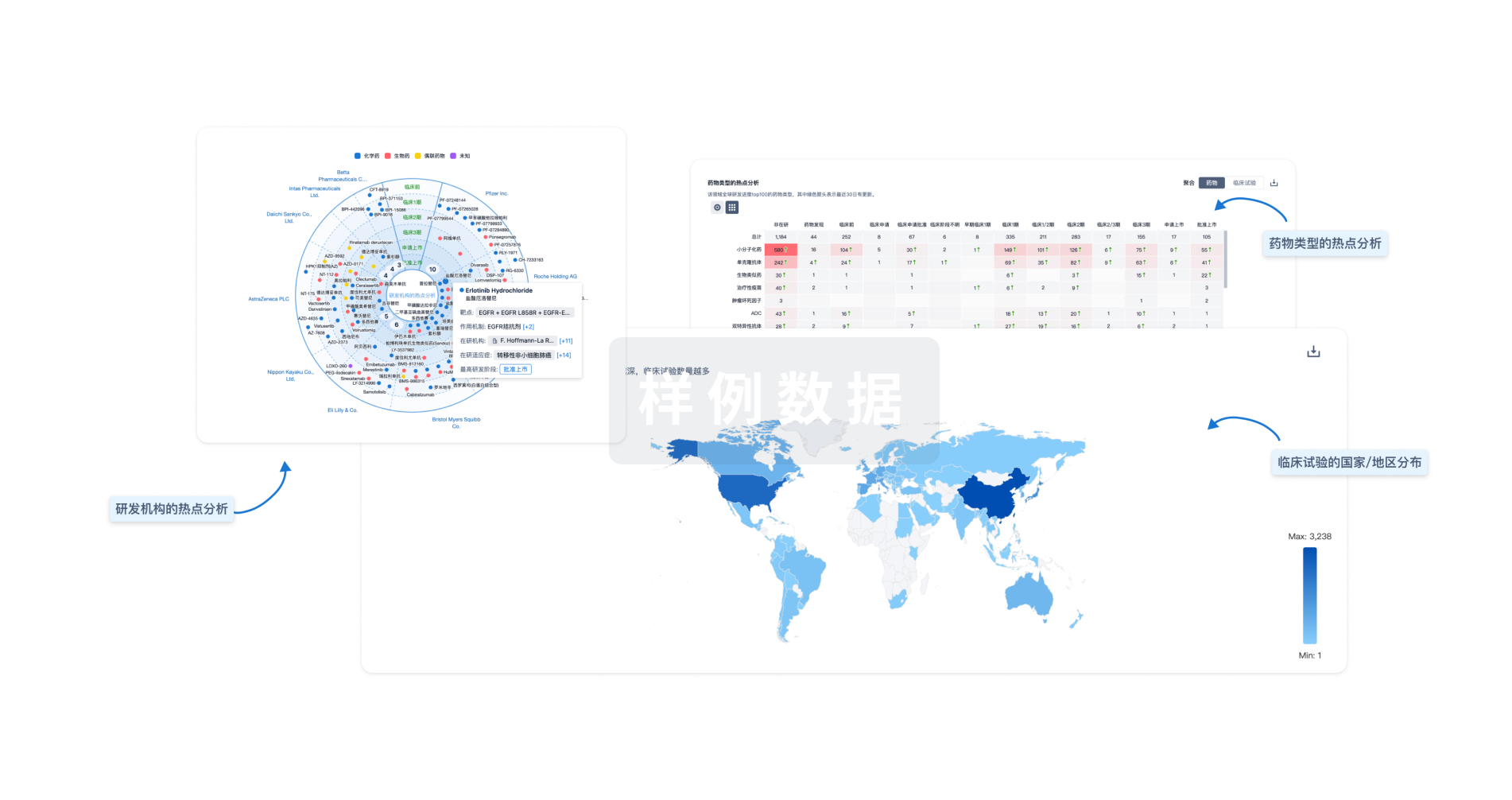

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用