预约演示

更新于:2025-05-07

Epilepsy, Generalized

全身性癫痫

更新于:2025-05-07

基本信息

别名 Convulsive Epilepsies, Generalized、Convulsive Epilepsy, Generalized、Convulsive Generalized Seizure Disorder + [86] |

简介 Recurrent conditions characterized by epileptic seizures which arise diffusely and simultaneously from both hemispheres of the brain. Classification is generally based upon motor manifestations of the seizure (e.g., convulsive, nonconvulsive, akinetic, atonic, etc.) or etiology (e.g., idiopathic, cryptogenic, and symptomatic). (From Mayo Clin Proc, 1996 Apr;71(4):405-14) |

关联

132

项与 全身性癫痫 相关的药物作用机制 GABAA receptor 正变构调节剂 |

在研机构 |

原研机构 |

非在研适应症 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2022-03-18 |

作用机制 5-HT1D receptor激动剂 [+4] |

在研机构 |

原研机构 |

在研适应症 |

非在研适应症 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2020-06-25 |

靶点 |

作用机制 电压门控钠离子通道阻滞剂 |

非在研适应症 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2019-11-21 |

570

项与 全身性癫痫 相关的临床试验NCT06924827

A Clinical Study of the Transition of Children From 'Artisanal' Cannabidiol to Epidiolex

The goal of this clinical trial is to learn the best way to switch children with Lennox-Gastaut Syndrome (LGS) or Dravet Syndrome (DS) taking 'artisanal' (non pharmaceutical-grade) cannabidiol (CBD) to Epidiolex for treatment of seizures. The main questions it aims to answer are:

* How well does a gradual switch from 'artisanal' CBD to Epidiolex work?

* Does the same dose of Epidiolex as 'artisanal' CBD work best?

* What side-effects or medical problems do participants have when switching from 'artisanal' CBD to Epidiolex?

Researchers will examine how successful switching from 'artisanal' CBD to Epidiolex is.

Participants will:

* Gradually increase their dose of Epidiolex and reduce their dose of 'artisanal' CBD until they are taking just Epidiolex

* Visit the clinic five times over 20 weeks for checkups and tests

* Keep a diary of their seizures, symptoms and the number of times they use a rescue seizure medication

* How well does a gradual switch from 'artisanal' CBD to Epidiolex work?

* Does the same dose of Epidiolex as 'artisanal' CBD work best?

* What side-effects or medical problems do participants have when switching from 'artisanal' CBD to Epidiolex?

Researchers will examine how successful switching from 'artisanal' CBD to Epidiolex is.

Participants will:

* Gradually increase their dose of Epidiolex and reduce their dose of 'artisanal' CBD until they are taking just Epidiolex

* Visit the clinic five times over 20 weeks for checkups and tests

* Keep a diary of their seizures, symptoms and the number of times they use a rescue seizure medication

开始日期2025-07-02 |

申办/合作机构 |

SLCTR/2025/015

Multicentre, randomized, controlled clinical trial on 7-day followed by maintenance therapy for 10 weeks vs. 14-day and no maintenance course of prednisolone for the treatment of infantile epileptic spasms syndrome (IESS)

开始日期2025-06-01 |

申办/合作机构 |

NCT06872125

EMPEROR: a Multicenter, Randomized, Double-blind, Sham-controlled, Parallel Group, Phase 3 Study Evaluating the Efficacy, Safety, and Tolerability of Zorevunersen (STK-001) in Patients with Dravet Syndrome

The purpose of the study is to evaluate the efficacy, safety, and tolerability of zorevunersen in Patients with Dravet syndrome.

开始日期2025-06-01 |

申办/合作机构 |

100 项与 全身性癫痫 相关的临床结果

登录后查看更多信息

100 项与 全身性癫痫 相关的转化医学

登录后查看更多信息

0 项与 全身性癫痫 相关的专利(医药)

登录后查看更多信息

28,512

项与 全身性癫痫 相关的文献(医药)2025-12-31·Annals of Medicine

Real-world experience of diagnosis, disability, and daily management in parents of children with different genetic developmental and epileptic encephalopathies: a qualitative study

Article

作者: Marconnot, Romain ; Garcia-Bravo, Cristina ; Velarde-García, Juan Francisco ; Pérez-Corrales, Jorge ; Alonso-Blanco, María Cristina ; Jimenez-Antona, Carmen ; Cuenca-Zaldivar, Juan Nicolas ; Aledo-Serrano, Ángel ; Güeita-Rodríguez, Javier ; Palacios-Ceña, Domingo

2025-12-31·Channels

Biophysical and structural mechanisms of epilepsy-associated mutations in the S4-S5 Linker of KCNQ2 channels

Article

作者: Yang, Yen-Yu ; Chang, Hsueh-Kai ; Yang, Shi-Bing ; Wong, Swee-Hee ; Lee, Inn-Chi

2025-12-01·Acta Epileptologica

Inhalation of 5% CO2 and activation of ASIC1a: a potential therapeutic approach for Dravet syndrome

Article

作者: Wang, Qiuhong ; Wang, Yangyang ; Zou, Liping ; Zhao, Haiqing ; Lu, Qian ; Wang, Jia ; Zhang, Qi

1,077

项与 全身性癫痫 相关的新闻(医药)2025-05-01

EPIDIOLEX has significant market potential due to the growing demand for alternative therapies and its effectiveness in treating rare seizure disorders like Lennox-Gastaut syndrome and Dravet syndrome. As awareness around the benefits of CBD in treating neurological conditions increases, EPIDIOLEX stands to benefit from expanding indications and market reach.

LAS VEGAS, May 1, 2025 /PRNewswire/ -- DelveInsight's '

EPIDIOLEX Market Size, Forecast, and Market Insight Report' highlights the details around EPIDIOLEX, the first FDA-approved prescription cannabidiol (CBD) to treat seizures associated with Lennox-Gastaut syndrome (LGS), Dravet syndrome, or tuberous sclerosis complex (TSC) in patients 1 year of age or older. The report provides product descriptions, patent details, and competitor products (marketed and emerging therapies) of EPIDIOLEX. The report also highlights the historical and forecasted sales from 2020 to 2034 segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Jazz Pharmaceuticals' EPIDIOLEX (cannabidiol) Overview

EPIDIOLEX (formerly known as GWP42003-P and marketed as EPIDYOLEX in Europe) is the first plant-based, prescription cannabis-derived oral medication developed by GW Pharmaceuticals. It represents a new category of antiepileptic drugs with a unique mechanism of action. The active compound, cannabidiol (CBD), is a naturally occurring cannabinoid found in the Cannabis sativa L. plant. While the exact way EPIDIOLEX works to reduce seizures in humans remains unclear, it is distinct from traditional anticonvulsants. CBD does not act through CB1 receptors or by blocking voltage-gated sodium channels, which are typical pathways for other antiepileptic drugs.

Instead, CBD is thought to work by influencing multiple internal pathways, potentially producing a combined anticonvulsant effect. These include enhancing neuronal inhibition (through synaptic and extrasynaptic GABA channels), affecting intracellular calcium levels (via TRPV channels, VDAC, and GPR55), and reducing inflammation, possibly via adenosine modulation. Importantly, CBD does not directly bind to or activate the CB1 or CB2 receptors at levels relevant to its seizure-reducing effects. Ongoing research is examining other possible mechanisms such as interactions with adenosine, glycine, GABAergic systems, and serotonin receptors.

EPIDIOLEX has received regulatory approval in numerous countries, including the U.S. (FDA), Europe (European Commission), Great Britain (MHRA), Australia (Therapeutic Goods Administration), Switzerland (Swissmedic), Israel (Ministry of Health), and New Zealand (Medicines and Medical Devices Safety Authority). It is formulated as an oral solution containing highly purified CBD. In the U.S., it is approved to treat seizures linked to Lennox-Gastaut syndrome (LGS), Dravet syndrome (DS), and tuberous sclerosis complex (TSC) in patients aged one year and older. In the European Union, under the name Epidyolex, it is approved as an add-on treatment with clobazam for LGS and DS in patients two years and older, and for TSC-associated seizures as well. Both the FDA and EMA have granted Orphan Drug Designation (ODD) for EPIDIOLEX/EPIDYOLEX for these conditions.

EPIDIOLEX/EPIDYOLEX net product sales rose by

15% to

USD 972.4 million in 2024 and by

14% to

USD 275.0 million in the fourth quarter of 2024, compared to the corresponding periods in 2023.

Learn more about EPIDIOLEX/EPIDYOLEX projected market size for DEE @

EPIDIOLEX Market Potential

Developmental and epileptic encephalopathies (DEE) encompass a group of severe neurological conditions marked by developmental delays and persistent epilepsy. These disorders typically present early in life and are linked to significant cognitive deficits. According to DelveInsight's analysis, there were approximately

287K diagnosed prevalent cases of DEE across the 7MM in 2024. This number is projected to increase due to the rise in neurological disorders, including epilepsy, as well as environmental and maternal health factors contributing to a higher DEE prevalence throughout the forecast period (2025−2034).

The US FDA has approved a range of medications for conditions like LGS, Dravet Syndrome, and CDKL5 Deficiency Disorder, including various drug classes such as sodium channel modulators, GABA receptor modulators, calcium channel blockers, receptor blockers, and others. Some of the available anti-epileptic drugs (AEDs) include

FINTEPLA, EPIDIOLEX, TOPAMAX, BANZEL, LAMICTAL, FELBATOL, ONFI, KLONOPIN, DIACOMIT, SABRIL, and more.

In 2024, the total market size for DEE in the 7MM was around

USD 2.3 billion, and this figure is expected to grow by 2034, driven by wider adoption of approved therapies due to label expansions and the introduction of emerging treatments.

Discover more about the DEE market in detail @

Developmental and Epileptic Encephalopathy Market Report

Emerging Competitors of EPIDIOLEX

Some of the drugs in the pipeline include

EPX-100 (Harmony Biosciences),

Bexicaserin (Lundbeck),

Zorevunersen (Stoke Therapeutics/Biogen),

Relutrigine (Praxis Precision Medicines), and others. In August 2024, the FDA removed a partial clinical hold as the company advances toward a Phase III registrational study of zorevunersen (STK-001) in children and adolescents with Dravet syndrome.

In

July 2024, Longboard Pharmaceuticals announced that the FDA had granted Breakthrough Therapy designation for its investigational drug bexicaserin for the treatment of seizures associated with DEEs for patients 2 years of age or older.

To know more about the number of competing drugs in development, visit @

EPIDIOLEX Alternatives

Key Milestones of EPIDIOLEX

In

August 2024, Jazz Pharmaceuticals reported top-line results from a Phase 3 open-label, single-arm study conducted in Japan, assessing the safety and effectiveness of its cannabidiol oral solution (marketed globally as EPIDIOLEX/EPIDYOLEX) as an add-on therapy for seizures linked to Lennox-Gastaut syndrome (LGS), Dravet syndrome (DS), or tuberous sclerosis complex (TSC). While the trial did not achieve its primary efficacy goal—defined as a pre-specified percentage reduction in seizure frequency during the up-to-16-week treatment period compared to baseline in Japanese pediatric patients—numerical improvements were noted in both the primary and several secondary measures. The study did not identify any new safety concerns.

In

May 2021, Jazz Pharmaceuticals acquired EPIDIOLEX as part of the acquisition of GW Pharmaceuticals plc, or GW, which expanded its growing neuroscience business with a global, high-growth childhood-onset epilepsy franchise.

In

April 2021, EPIDYOLEX was approved for adjunctive therapy of seizures associated with TSC for patients 2 years of age and older in the EU.

In

July 2020, EPIDYOLEX was approved for the treatment of seizures associated with TSC in patients one year of age and older. FDA also approved the expansion of all existing indications, LGS and DS, to patients one year of age and older.

In

September 2019, the European Commission approved EPIDYOLEX for use as adjunctive therapy of seizures associated with LGS or DS, in conjunction with clobazam, for patients two years of age and older.

In

June 2018, EPIDIOLEX was approved in the US for the treatment of seizures associated with two rare and severe forms of epilepsy, LGS and DS, in patients two years of age and older.

EPIDIOLEX Launch Status

EPIDIOLEX was launched on November 1, 2018, in the US market after FDA approval for the treatment of seizures associated with LGS or Dravet syndrome in patients two years of age and older.

EPIDYOLEX was launched in 2019 in Germany and the UK market for use as adjunctive therapy for seizures associated with LGS or Dravet syndrome, in conjunction with clobazam, for patients two years of age and older (GW Pharmaceuticals, 2019b).

In 2021, EPIDYOLEX was launched in Spain.

In the first quarter of 2022, the company launched EPIDYOLEX for LGS, Dravet syndrome, and TSC in Ireland, for TSC in Scotland and Wales.

In the third quarter of 2022, the company launched EPIDYOLEX for TSC in Italy and Switzerland.

In the fourth quarter of 2022, the company successfully completed the pricing and reimbursement process and commercial launch of EPIDYOLEX in France.

Discover how EPIDIOLEX/EPIDYOLEX is shaping the DEE treatment landscape @

EPIDIOLEX CBD

EPIDIOLEX Market Dynamics

EPIDIOLEX, the first

FDA-approved cannabidiol (CBD)-based medication for the treatment of rare forms of epilepsy, has had a significant impact on the pharmaceutical market since its approval in 2018. The drug is primarily used to treat seizures associated with Dravet syndrome and Lennox-Gastaut syndrome, two rare and severe forms of epilepsy. The market dynamic for EPIDIOLEX is shaped by several factors, including

increasing awareness of its therapeutic potential, the

expanding medical cannabis industry, and the

growing demand for alternative treatments to traditional anti-epileptic drugs.

One of the main drivers of the EPIDIOLEX market is the

rising acceptance of CBD-based therapies. As medical cannabis becomes more mainstream and research into its medicinal properties continues to grow, patients and healthcare providers are increasingly turning to EPIDIOLEX as a treatment option. The

growing body of clinical evidence supporting its effectiveness and safety has reinforced this trend. Additionally, as the stigma around cannabis-derived medications continues to fade, it opens up more

opportunities for EPIDIOLEX in both pediatric and adult patient populations.

However, the market for EPIDIOLEX is not without its challenges.

High treatment costs and insurance coverage issues can limit accessibility for some patients, especially in markets outside the United States. Despite its clinical efficacy, the

price point for EPIDIOLEX remains a point of contention, as it may not be affordable for all families, especially when compared to other conventional anti-epileptic drugs. Furthermore,

competition from other cannabinoid-based therapies, as well as

new developments in the broader epilepsy drug market, could impact the drug's market share over time.

Looking ahead, the market dynamics for EPIDIOLEX will likely continue to evolve as the

global regulatory landscape changes and

new clinical trials further establish its benefits in other neurological conditions. With increasing research into CBD's potential applications, there may be opportunities for EPIDIOLEX to expand its indications, providing a solid foundation for its continued growth. However, market growth will also depend on the

ability to address pricing concerns, improve insurance coverage, and navigate potential competitive pressures from both traditional and emerging therapies.

Dive deeper to get more insight into EPIDIOLEX/EPIDYOLEX's strengths & weaknesses relative to competitors @

EPIDIOLEX Market Drug Report

Table of Contents

Related Reports

Developmental and Epileptic Encephalopathies Market

Developmental and Epileptic Encephalopathies Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key DEE companies, including

vid Therapeutics, Stoke Therapeutics, Biogen, Harmony Biosciences, Lundbeck (Longboard Pharmaceuticals), Praxis Precision Medicines, SK Life Science, Cerecin Neurosciences, Encoded Therapeutics, Praxis Precision Medicines, among others.

Developmental and Epileptic Encephalopathies Pipeline

Developmental and Epileptic Encephalopathies Pipeline Insight

– 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key DEE companies, including

Denovo Biopharma, Cantex Pharmaceuticals, CNS Pharmaceuticals, CANbridge Pharmaceuticals, Vaximm, Inovio Pharmaceuticals, Mustang Bio, Bullfrog AI Holdings, Cantex, Chimeric Therapeutics, Philogen, Boehringer Ingelheim, Photonamic GmbH, Berg Pharma, Beyond Bio, Genenta Science, Polaris Pharmaceuticals, Telix Pharmaceuticals, Shanghai Simnova Biotechnology, NEONC Technologies, among others.

Dravet Syndrome Market

Dravet Syndrome Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key Dravet syndrome companies including

Biocodex, GW Pharmaceuticals, Zogenix, Ovid Therapeutics, PTC Therapeutics, among others.

Lennox-Gastaut Syndrome Market

Lennox-Gastaut Syndrome Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key Lennox-Gastaut syndrome companies, including

GlaxoSmithKline, Meda Pharmaceuticals, Roche, Lundbeck, Greenwich Biosciences, Janssen Pharmaceuticals, Eisai, Zogenix, Takeda, Ovid Therapeutics, among others.

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve

.

Contact Us

Shruti Thakur

[email protected]

+14699457679

Logo:

SOURCE DelveInsight Business Research, LLP

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

上市批准临床3期并购突破性疗法孤儿药

2025-04-29

Mr. Jafar is a distinguished international business leader and co-founder of the Loulou Foundation OXFORD, UK and CLEVELAND, Ohio, US, 29 April 2025 – The Oxford-Harrington Rare Disease Centre (‘OHC’), a partnership between the University of Oxford, UK and Harrington Discovery Institute at University Hospitals, Cleveland, Ohio, aimed at driving cutting-edge rare disease breakthroughs, announces the appointment of Mr. Majid Jafar to its Advisory Council. The Advisory Council, led by former UK Prime Minister David Cameron, supports the OHC’s mission to deliver new treatments for the nearly half a billion people affected by rare diseases worldwide. Council members are leaders of relevant industries and sectors, from different regions of the world who bring expertise, resources and networks towards the initial goal of developing 40 new drugs for rare diseases in the next 10 years. Mr. Jafar is a distinguished business leader serving as Vice-Chairman of the Crescent Group and CEO of Crescent Petroleum, based in the United Arab Emirates. He is a prominent, global rare disease advocate and philanthropist with a strong commitment to driving positive social change in healthcare and education, with extensive networks and interests in business, investment and philanthropy in the US, Europe and the Middle East. Among his roles, Mr. Jafar is the co-founder, with his wife Lynn, of the Loulou Foundation, a private non-profit foundation dedicated to advancing science and treatments for CDKL5 Deficiency Disorder (CDD), a rare neurogenetic disorder that affects their eldest daughter, Alia. The Loulou Foundation has funded important research projects at leading universities and institutions in the US, Europe and Asia, with a total of over 60 projects at 45 different institutions. Mr. Jafar also sits on various non-profit boards including the Board of Fellows of Harvard Medical School, where he co-chairs the Discovery Council, and is a member of the Academy of the University of Pennsylvania and the Global Precision Medicine Council of the World Economic Forum, as well as co-chairing the campaign for Cambridge Children’s Hospital in the UK. David Cameron, Chair of the OHC’s Advisory Council, said: “We are delighted to welcome Majid to the OHC Advisory Council. His extensive experience within the business and investment communities and in policy engagement - alongside his philanthropic efforts in education and healthcare - make him an invaluable addition to our team. Furthermore, as a parent of a child with a rare disease, Majid has a deep empathy with families in similar situations as they seek a diagnosis and treatment. We look forward to his contribution to the Council and to his support of the OHC as it continues its groundbreaking work in rare disease research and development of new treatments for patients worldwide.” Majid Jafar commented: “I am honoured to join the Oxford-Harrington Rare Disease Centre Advisory Council. Supporting the development of innovative treatments for rare diseases is a cause close to my heart with my family’s own experience deeply shaping my commitment to delivering urgently needed treatments to rare disease patients. I look forward to helping advance the OHC’s mission by fostering key partnerships in new regions and sourcing philanthropic investment that can accelerate progress for the many patients in need.” Matthew Wood, Director and Chief Scientific Officer of the OHC, added: “Majid brings a unique perspective to our Advisory Council, with his strong leadership background and dedication to advancing healthcare. His commitment to social impact, coupled with his ability to expand the OHC’s reach into new regions, will be instrumental as we work towards delivering rare disease drugs in the coming years. We are thrilled to have him on board and look forward to his contributions to our mission.” Majid Jafar joins Lord Cameron (Chair of the OHC’s Advisory Council and Former UK Prime Minister), Professor Sir John Bell (President, Ellison Institute of Technology Oxford, and former Regius Professor of Medicine at Oxford University), Baroness Nicola Blackwood (Chair of Genomics England and of Oxford University Innovation), John F. Crowley (President and CEO of the Biotechnology Innovation Association (BIO)), Ronald G. Harrington (a renowned entrepreneur and philanthropist, and co-founder of Harrington Discovery Institute), and Jonathan S. Stamler, MD (President and co-founder of Harrington Discovery Institute and Distinguished University Professor of Medicine), on the OHC Advisory Council. *** Notes to Editors About Majid JafarMajid Jafar serves as the Vice-Chairman of the Crescent Group and CEO of Crescent Petroleum, the core oil & gas company that founded the group. He is also the Board Managing Director of Dana Gas (PJSC), a leading publicly listed natural gas company in the Middle East. Prior to this, he gained international oil & gas experience at Shell Exploration & Production and Shell Gas & Power. Beyond his professional roles, Mr. Jafar serves on several influential non-profit boards, including the Queen Rania Foundation, Kalimat Foundation, the Arab Forum for Environment and Development (AFED), and the Iraq Energy Institute. He is also a member of the Board of Fellows at Harvard Medical School, the Panel of Senior Advisers at Chatham House, and the International Advisory Boards of The Prince's Trust International and The Atlantic Council. He was named a Young Global Leader by the World Economic Forum.Mr. Jafar holds a degree in Engineering (Fluid Mechanics and Thermodynamics) from Cambridge University, an MA in International Studies and Diplomacy from SOAS, and an MBA from Harvard Business School. About Rare DiseasesMore than 400 million people worldwide are living with a rare disease, and approximately 50 percent are children. There are about 7,000 known rare diseases, with new diseases being discovered every day. A rare disease affects one in 10 Americans, or 10 percent of the US population. In the Middle East, the prevalence of rare diseases is rising, and many countries in the region are now prioritising research and treatment options. The majority of all rare diseases are genetic in origin, which means they are present throughout a person’s life. Only five percent of rare diseases have a treatment approved by the US Food and Drug Administration (FDA) and similar estimates have been made for treatments approved by the European Medicine Agency (EMA). Therefore, someone with a rare disease today faces a lifelong, often life-threatening, condition with little hope for a cure, or even an effective treatment option. About Oxford-Harrington Rare Disease CentreThe Oxford-Harrington Rare Disease Centre (OHC) is a partnership between the University of Oxford, UK and Harrington Discovery Institute at University Hospitals, in Cleveland, Ohio, US. The OHC combines world-leading strengths in research and therapeutics development from across these organizations to set the science and innovation agenda and drive cutting-edge rare disease breakthroughs to address the unmet need in rare diseases across the globe to deliver major clinical impact for patients. For more information, visit: OxfordHarrington.org | LinkedIn | X About the University of OxfordThe University of Oxford is rated the best in the world for medicine and life sciences, and it is home to the UK’s top-ranked medical school. It has one of the largest clinical trial portfolios in the UK and great expertise in taking discoveries from the lab into the clinic. Partnerships with the local NHS Trusts enable patients to benefit from close links between medical research and healthcare delivery. For more information, visit: www.ox.ac.uk About Harrington Discovery InstituteHarrington Discovery Institute at University Hospitals in Cleveland, Ohio aims to advance academic discoveries into medicines to address unmet need. It was created in 2012 with a $50 million founding gift from the Harrington family and has supported more than 200 scientists throughout the US, UK. and Canada. Harrington Discovery Institute uses an innovation model that surrounds scientists with drug development and business expertise and employs both philanthropic funding and catalytic investment capital to advance projects into the clinic and through commercialization. For more information, visit: HarringtonDiscovery.org| LinkedIn | X Media contacts: UK/ EU – MEDiSTRAVA Sylvie Berrebi / Mark SwallowOHC@medistrava.com US – For University HospitalsAnsley Kelmansley.kelm@UHhospitals.org

Attachment

Majid Jafar _ Headshot

高管变更

2025-04-29

Achieved $13.8 million in ZURZUVAE® (zuranolone) collaboration revenue in the first quarter of 2025 (50% of the net revenues recorded by Biogen), representing a 21% increase from the fourth quarter

Sustained growth in shipments to women with postpartum depression; Greater than 3,000 shipments in first quarter of 2025 (22% increase from fourth quarter)

Cash, cash equivalents, and marketable securities of $424 million as of March 31, 2025 ; Cash runway expected to support operations to mid-2027

Strategic alternatives review process remains ongoing

CAMBRIDGE, Mass. --(BUSINESS WIRE)--Apr. 29, 2025-- Sage Therapeutics, Inc. (Nasdaq: SAGE), today reported business highlights and financial results for the first quarter ended March 31, 2025 .

“We delivered strong growth in revenue and shipments of ZURZUVAE during the first quarter of 2025 through the team’s disciplined execution and unwavering commitment to bringing ZURZUVAE to more women with postpartum depression,” said Barry Greene , Chief Executive Officer at Sage Therapeutics . “We remain focused on establishing ZURZUVAE as the standard of care for women with postpartum depression and driving our business strategy forward with the goal of creating value for shareholders.”

First Quarter 2025 Portfolio Updates

ZURZUVAE

ZURZUVAE was approved by the FDA in August 2023 as the first-and-only oral treatment indicated for adults with postpartum depression (PPD). ZURZUVAE was made commercially available in the U.S. in December 2023 . The current commercialization investment plan includes recent joint sales force expansions and marketing tactics intended to further accelerate ZURZUVAE growth in PPD, along with expanded disease state awareness efforts to support increased PPD screening and diagnosis. The Company anticipates these investments will help support the goal of significant topline revenue growth in 2025. As of the first quarter ended March 31, 2025 , the following results had been achieved:

Shipped greater than 3,000 prescriptions to women with PPD, representing a 22% increase from the fourth quarter. Generated $13.8 million in collaboration revenue from ZURZUVAE, representing a 21% increase from the fourth quarter of 2024. Collaboration revenue represents 50% of the net revenue recorded when Biogen ships ZURZUVAE to the distributors.

In terms of prescriber and patient trends:

In the first quarter of 2025, OBGYNs accounted for almost 80% of all prescriptions. OBGYNs are, on average, increasing the number of women with PPD they treat once they have prescribed ZURZUVAE, which we believe reflects the high unmet need in PPD and potential value of ZURZUVAE. More than 70% of women prescribed ZURZUVAE are receiving it as their first new treatment for PPD.

SAGE-319

SAGE-319 is an extrasynaptic-preferring GABAA receptor positive allosteric modulator (PAM) designed to have novel pharmacology and a differentiated clinical profile from other GABAA receptor PAMs in our portfolio. It is currently being investigated as a potential treatment for behavioral symptoms associated with certain neurodevelopmental disorders. The Company expects data from a Phase 1 multiple ascending dose (MAD) study by late 2025 and will evaluate next steps based on these data.

Pre-Clinical

The Company is continuing to explore targeted work within its NMDA receptor negative allosteric modulator (NAM) platform, focusing on potential treatments for neurodevelopmental disorders, with SAGE-817 and SAGE-039.

Areas In Evaluation

SAGE-324: The Company is evaluating potential indications, including seizures in developmental and epileptic encephalopathies (DEEs), and expects to provide an update on next steps, if any, in mid-2025.

Strategic Alternatives Review Process

As previously announced, Sage’s Board of Directors is evaluating a broad range of strategic alternatives to maximize value for shareholders. The Board’s review process remains ongoing. The Company has not set a timetable for the review process and does not intend to disclose further developments until it determines that disclosure is appropriate or necessary.

FINANCIAL RESULTS FOR THE FIRST QUARTER 2025

Cash Position: Cash, cash equivalents and marketable securities as of March 31, 2025 , were $424 million compared to $504 million at December 31, 2024 .

Revenue: Collaboration revenue from sales of ZURZUVAE was $13.8 million in the first quarter of 2025 compared to $6.2 million for the same period in 2024. Reported collaboration revenue is 50% of the net revenue Biogen records for ZURZUVAE in the U.S. There was no net revenue from sales of ZULRESSO in the first quarter of 2025 compared to $1.7 million in the same period of 2024.

Cost of Revenues: Cost of revenues were $0.7 million in the first quarter of 2025, which consisted of costs related to selling ZURZUVAE, compared to $1.3 million for the same period in 2024, which consisted of costs related to selling ZURZUVAE and ZULRESSO.

R&D Expenses: Research and development expenses were $22.8 million , including $2.1 million of non-cash stock-based compensation expense, in the first quarter of 2025 compared to $71.7 million , including $5.0 million of non-cash stock-based compensation expense, for the same period in 2024. The decrease in R&D expenses in the first quarter of 2025 as compared to the same period in 2024 was primarily related to the 2024 and 2023 reorganization cost savings measures, including reduced headcount, budgeted expenditures, reprioritization of early-stage pipeline programs, and completion or cancellation of ongoing clinical trials. The reimbursement from Biogen to Sage for R&D expenses pursuant to the Sage/Biogen Collaboration and License Agreement was $0.2 million in the first quarter of 2025 compared to $5.7 million in the same period of 2024. The primary reason for the decrease in net reimbursement from Biogen to Sage was a decrease in the collaboration costs incurred by Sage for clinical trials.

SG&A Expenses: Selling, general and administrative expenses were $57.6 million , including $4.9 million of non-cash stock-based compensation expense, in the first quarter of 2025 compared to $52.6 million , including $8.7 million of non-cash stock-based compensation expense, for the same period in 2024. The overall increase in SG&A expenses in the first quarter of 2025 as compared to the same period in 2024 was primarily related to increased collaboration commercialization efforts and legal expenses associated with the strategic alternatives review process. The reimbursement from Sage to Biogen for SG&A expenses pursuant to the Sage/Biogen Collaboration and License Agreement was $4.8 million in the first quarter of 2025 compared to $2.3 million in the same period of 2024. The primary reason for the increase in net reimbursement from Sage to Biogen was an increase in the collaboration costs incurred by Biogen in support of ongoing commercialization efforts for ZURZUVAE. Restructuring Expenses: Restructuring expenses were $0.5 million in the first quarter of 2025 due the October 2024 reorganization.

Net Loss: Net loss was $62.2 million for the first quarter of 2025 compared to $108.5 million for the same period in 2024.

FINANCIAL GUIDANCE

Based on the Company’s current operating plan, Sage anticipates that its existing cash, cash equivalents, and marketable securities as of March 31, 2025 , together with anticipated funding from ongoing collaborations and estimated revenues, excluding any potential milestone payments the Company may receive under its collaboration agreements, will support operations to mid-2027.

While ZURZUVAE joint commercialization investment will increase in 2025, the Company anticipates overall operating expenses will substantially decrease in 2025 relative to 2024.

Conference Call Information

Sage will host a conference call and webcast today, April 29, 2025 , at 4:30 p.m. ET to review its first quarter 2025 financial results and discuss recent corporate updates. The live webcast can be accessed on the investor page of Sage's website at investor.sagerx.com. A replay of the webcast will be available on Sage's website following the completion of the event and will be archived for up to 30 days.

About Sage Therapeutics

Sage Therapeutics (Nasdaq: SAGE) is a biopharmaceutical company committed to our mission of pioneering solutions to deliver life-changing brain health medicines, so every person can thrive. Sage developed the only two FDA-approved treatments indicated for postpartum depression and is advancing a pipeline to target unmet needs in brain health. Sage was founded in 2010 and is headquartered in Cambridge, Mass. Find out more at www.sagerx.com or engage with us on Facebook, LinkedIn, Instagram, and X.

Forward-Looking Statements

Various statements in this release concern Sage's future expectations, plans and prospects, including without limitation our statements regarding: our plans, expectations and goals for commercialization of ZURZUVAE for the treatment of women with PPD, including our goals to establish ZURZUVAE as the standard of care for women with PPD and to bring ZURZUVAE to more women with PPD; our beliefs in the potential for ZURZUVAE, including that ZURZUVAE will be successful and gain market acceptance as a transformative treatment helping women with PPD and be instrumental in accelerating progress in maternal mental health; our belief that OBGYNs are increasing the number of PPD patients they treat on average after trying ZURZUVAE, and that drivers of this trend include high unmet need and the potential value demonstrated by ZURZUVAE; our investment plans for ZURZUVAE and our expectations regarding the impact of increased investment, including recent joint sales force expansions and planned marketing tactics, in support of our goals to accelerate market growth in PPD; our plans for expanded disease state awareness efforts to support increased PPD screening and diagnosis; our plans and other goals related to other aspects of commercialization; anticipated timelines for our clinical development efforts, including the expected timing of readout of the multiple ascending dose study for SAGE-319; our belief in the potential profile and benefit of our product candidates, including potential indications for our product candidates; our plans to evaluate SAGE-324 in additional indications, including seizures in DEEs, and the timing of our announcement of next steps regarding the SAGE-324 program; our plans to explore targeted work within our NMDA receptor NAM platform with SAGE-817 and SAGE-039; our expectations related to the October 2024 reorganization and our pipeline prioritization efforts, including timing and anticipated cost savings; our expectations regarding our plans to explore strategic alternatives; our belief as to the key business drivers for our business and potential value creation opportunities; and the mission and goals for our business. These statements constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are neither promises nor guarantees of future performance, and are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements, including the risks that: our commercialization efforts in the U.S. with respect to ZURZUVAE for the treatment of women with PPD may not be successful, and we may be unable to generate revenues from sales of ZURZUVAE at the levels or on the timing we expect or at levels or on the timing necessary to support our goals; the number of women with PPD, the unmet need for additional treatment options, and the potential market for ZURZUVAE for the treatment of women with PPD may be significantly smaller than we expect; early positive signs, including ZURZUVAE results in 2024 and the first quarter of 2025, may not be a signal of future success; ZURZUVAE may not achieve, or even if achieved, maintain, the clinical benefit, clinical use or market acceptance for the treatment of PPD that we expect, including among OBGYNs, or we may encounter reimbursement, market access, process-related, or other issues, including competition in the market, or issues with our distribution network that impact the success of our commercialization efforts; ZURZUVAE may never become the standard of care for women with PPD; we may encounter delays in initiation, conduct, completion of enrollment or completion and reporting of data with respect to any of our ongoing studies or clinical trials, such as the completion of the multiple ascending dose study for SAGE-319, including as a result of slower than expected site initiation, slower than expected enrollment, the need or decision to expand the trials or other changes, that may impact our ability to meet our expected timelines and may increase our costs; success in earlier non-clinical or clinical trials of any of our product candidates may not be repeated or observed in ongoing or future studies, and ongoing and future clinical trials may not meet their primary or key secondary endpoints, which may substantially impair development; unexpected concerns may arise from additional data, analysis or results from any of our completed studies; decisions or actions of the FDA or the timing of meetings with the FDA may affect the timing, design, size, progress, and cost of clinical trials or the timing of data readouts or our ability to proceed with further development or may impair the potential for successful development or the timing or success of filing for and gaining regulatory approval; we may encounter adverse events at any stage that negatively impact further development and the potential for approval of our product candidates or the potential for successful commercialization of any of our products or that require additional non-clinical and clinical work, which may not yield positive results; the need to align with our collaborators may hamper or delay our development and commercialization efforts for the products or product candidates that are part of the collaboration or increase our costs; the anticipated benefits of our ongoing collaborations, including the receipt of payments or the successful development or commercialization of products and generation of revenue, may never be achieved at the levels or timing we expect or at all; our business may be adversely affected and our costs may increase if any of our key collaborators fails to perform its obligations or terminates our collaboration; the internal and external costs required for our ongoing, planned, and other future activities, and the resulting impact on expenses and use of cash, may be higher than expected, which may cause us to use cash quicker than expected or change or curtail some of our plans or both; our expectations as to expenses, cash usage, potential revenue, funding from collaborations, including milestones, cash runway, and cash needs may prove not to be correct for other reasons, such as changes in plans or actual events being different than our assumptions; we may not achieve anticipated cost savings from our October 2024 reorganization and pipeline prioritization efforts at the levels we expect; we may be opportunistic in our future financing plans even if available cash is sufficient; we may not be successful in our efforts to gain regulatory approval of products beyond ZURZUVAE; we may not achieve revenues from our products that may be successfully developed in the future at levels we expect; our exploration of strategic alternatives could result in substantial costs and be a distraction to management and other employees, which could have an adverse effect on our business; the strategic alternatives review process may not result in any transaction or strategic outcome; if we determine to engage in a transaction as a result of our exploration and evaluation of strategic alternatives, our future business, prospects, financial position and operating results could be significantly different than those in historical periods or projected by our management; additional funding may not be available on acceptable terms when we need it, or at all, which could hamper our development and commercialization activities; any of the foregoing events could impair the drivers and value creation opportunities for our business; and we may encounter technical and other unexpected hurdles in the development and manufacture of our product candidates or the commercialization of any current or future marketed product, which may delay our timing or change our plans, increase our costs or otherwise negatively impact our business; as well as those risks more fully discussed in the section entitled "Risk Factors" in our most recent annual or quarterly report filed with the Securities and Exchange Commission , as well as discussions of potential risks, uncertainties, and other important factors in our subsequent filings with the Securities and Exchange Commission . In addition, any forward-looking statements represent our views only as of today and should not be relied upon as representing our views as of any subsequent date. We explicitly disclaim any obligation to update any forward-looking statements.

Financial Tables

$

423,854

$

504,418

469,669

547,222

59,821

82,133

409,848

465,089

2025

2024

$

-

$

1,690

-

-

13,827

6,212

236

-

14,063

7,902

655

1,269

22,759

71,734

57,591

52,574

513

-

81,518

125,577

(67,455

)

(117,675

)

5,223

9,204

18

(12

)

$

(62,214

)

$

(108,483

)

$

(1.01

)

$

(1.80

)

61,857,573

60,136,198

SELECT IMPORTANT SAFETY INFORMATION FOR ZURZUVAE

ZURZUVAE (zuranolone) CIV, is a neuroactive steroid gamma-aminobutyric acid (GABA) A receptor positive modulator indicated for the treatment of postpartum depression in adults.

This does not include all the information needed to use ZURZUVAE safely and effectively. See full prescribing information for ZURZUVAE.

ZURZUVAE may cause serious side effects, including decreased awareness and alertness, which can affect your ability to drive safely or safely do other dangerous activities. Do not drive, operate machinery, or do other dangerous activities until at least 12 hours after taking each dose. You may not be able to tell on your own if you can drive safely or tell how much ZURZUVAE is affecting you. ZURZUVAE may cause central nervous system (CNS) depressant effects including sleepiness, drowsiness, slow thinking, dizziness, confusion, and trouble walking. Taking alcohol, other medicines that cause CNS depressant effects such as benzodiazepines, or opioids while taking ZURZUVAE can make these symptoms worse and may also cause trouble breathing. ZURZUVAE is a federally controlled substance schedule IV because it contains zuranolone, which can be abused or lead to dependence. Tell your healthcare provider right away if you become pregnant or plan to become pregnant during treatment with ZURZUVAE. You should use effective birth control (contraception) during treatment with ZURZUVAE and for 1 week after the final dose. ZURZUVAE and other antidepressant medicines may increase the risk of suicidal thoughts and actions in people 24 years of age and younger. ZURZUVAE is not for use in children. The most common side effects of ZURZUVAE include sleepiness or drowsiness, dizziness, common cold, diarrhea, feeling tired, weak, or having no energy, and urinary tract infection.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250428466645/en/

Investor Contact Ashley Kaplowitz Ashley.Kaplowitz@sagerx.com

Media Contact Francesca Dellelci Francesca.Dellelci@sagerx.com

Source: Sage Therapeutics, Inc.

临床1期财报上市批准引进/卖出

分析

对领域进行一次全面的分析。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

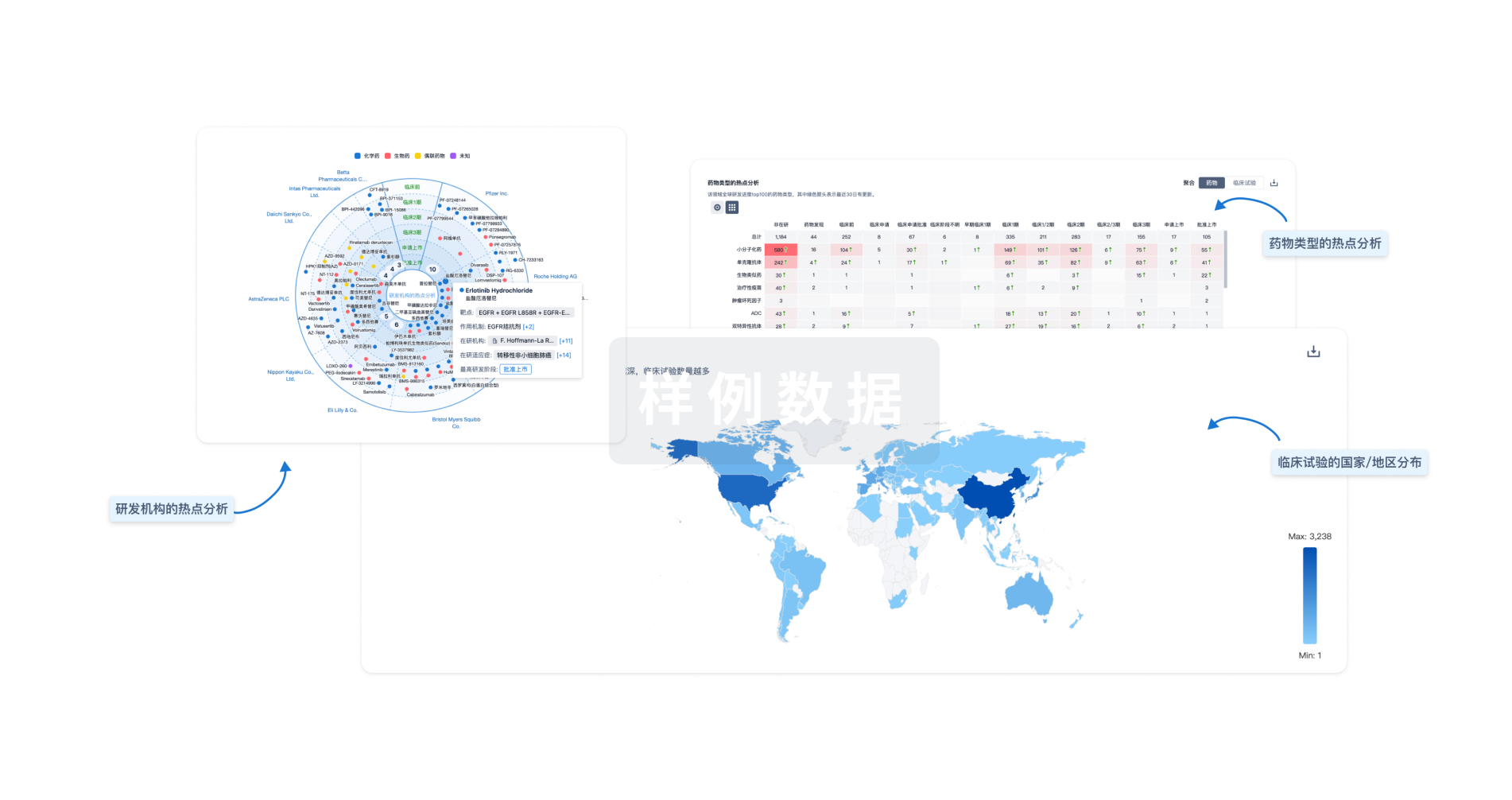

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用