预约演示

更新于:2025-05-07

Endometrial Hyperplasia

子宫内膜增生

更新于:2025-05-07

基本信息

别名 ENDOMETRIAL HYPERPLASIA、ENDOMETRIUM, HYPERPLASIA、Endometrial Hyperplasia + [30] |

简介 Benign proliferation of the ENDOMETRIUM in the UTERUS. Endometrial hyperplasia is classified by its cytology and glandular tissue. There are simple, complex (adenomatous without atypia), and atypical hyperplasia representing also the ascending risk of becoming malignant. |

关联

7

项与 子宫内膜增生 相关的药物靶点 |

作用机制 GLP-1R激动剂 |

在研机构 |

原研机构 |

非在研适应症 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2017-12-05 |

作用机制 ERα激动剂 [+1] |

在研机构 |

原研机构 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2013-10-03 |

靶点 |

作用机制 ERs调节剂 |

原研机构 |

在研适应症 |

最高研发阶段批准上市 |

首次获批国家/地区 欧盟 [+3] |

首次获批日期2009-04-17 |

110

项与 子宫内膜增生 相关的临床试验NCT06904274

A Multi-center, Open Label, Randomized Parallel Group Study Evaluating the Proportion of Post-menarchal Women With Complete Resolution of Nonatypical Endometrial Hyperplasia Treated With Mirena or Oral Progestin for 6 Months

Researchers are looking for a better way to treat women with nonatypical endometrial hyperplasia (NAEH).

Endometrial hyperplasia is a condition where the lining of the uterus (called the endometrium) becomes too thick. Nonatypical means that the condition is not cancerous. It is often caused by hormone imbalances in women. Symptoms can include abnormal vaginal bleeding or irregular periods. If this condition is not treated, then it may lead to cancer.

Currently, oral progestins (OP) which are progesterone (female hormone) capsules taken by mouth, are used to treat NAEH. However, there is still a need for other treatments due to unmet needs.

The study treatment, Mirena (also known as BAY 865028), is already available as a type of birth control device. It is inserted into the uterus where it gradually releases progesterone.

In this study, researchers want to find out if Mirena works for women with NAEH. They believe it can help by keeping hormone levels balanced in the body.

The main purpose of this study is to learn how well Mirena works compared to oral in NAEH in women who have started their periods.

For this, the researchers will compare the number of participants with benign endometrium after 6 months of treatment with Mirena or oral progestins.

The study participants will be randomly divided equally into one of two treatment groups. Based on their group, participants will receive Mirena, which is inserted into the uterus at the start of the study, or they will take progestins once daily by mouth for 6 months.

Each participant will be in the study for around 10 months with up to 5 visits to the study clinic/site.

Participants will visit the study clinic:

* once before the treatment starts

* 3 times with a gap of 3 months between the visits during the treatment

* then 1 more time after the treatment ends

During the study, the doctors and their study team will:

* check participant's health by performing tests such as blood and urine tests

* perform vaginal ultrasound and hysteroscopy. Hysteroscopy is a minor surgical procedure where a thin camera will be inserted into the womb to check for any abnormality. Sampling of the endometrial lining (cells in the womb) will be done with a thin tube at the same time.

* take samples of womb (endometrial) lining

* ask the participants questions about how they are feeling and what adverse events they are having

An adverse event is any medical problem that a participant has during a study. Doctors keep track of all adverse events, irrespective if they think it is related or not to the study treatment.

Endometrial hyperplasia is a condition where the lining of the uterus (called the endometrium) becomes too thick. Nonatypical means that the condition is not cancerous. It is often caused by hormone imbalances in women. Symptoms can include abnormal vaginal bleeding or irregular periods. If this condition is not treated, then it may lead to cancer.

Currently, oral progestins (OP) which are progesterone (female hormone) capsules taken by mouth, are used to treat NAEH. However, there is still a need for other treatments due to unmet needs.

The study treatment, Mirena (also known as BAY 865028), is already available as a type of birth control device. It is inserted into the uterus where it gradually releases progesterone.

In this study, researchers want to find out if Mirena works for women with NAEH. They believe it can help by keeping hormone levels balanced in the body.

The main purpose of this study is to learn how well Mirena works compared to oral in NAEH in women who have started their periods.

For this, the researchers will compare the number of participants with benign endometrium after 6 months of treatment with Mirena or oral progestins.

The study participants will be randomly divided equally into one of two treatment groups. Based on their group, participants will receive Mirena, which is inserted into the uterus at the start of the study, or they will take progestins once daily by mouth for 6 months.

Each participant will be in the study for around 10 months with up to 5 visits to the study clinic/site.

Participants will visit the study clinic:

* once before the treatment starts

* 3 times with a gap of 3 months between the visits during the treatment

* then 1 more time after the treatment ends

During the study, the doctors and their study team will:

* check participant's health by performing tests such as blood and urine tests

* perform vaginal ultrasound and hysteroscopy. Hysteroscopy is a minor surgical procedure where a thin camera will be inserted into the womb to check for any abnormality. Sampling of the endometrial lining (cells in the womb) will be done with a thin tube at the same time.

* take samples of womb (endometrial) lining

* ask the participants questions about how they are feeling and what adverse events they are having

An adverse event is any medical problem that a participant has during a study. Doctors keep track of all adverse events, irrespective if they think it is related or not to the study treatment.

开始日期2025-06-02 |

申办/合作机构 |

NCT05829460

Primary Prevention and Uterine Preservation in Premenopausal Women With Obesity and Endometrial Hyperplasia

The investigators hypothesize that combined treatment with the GLP-1R agonist semaglutide 2.4 mg and levonorgestrel intrauterine device (LNG-IUD), compared to LNG-IUD alone, will result in improved likelihood of uterine preservation, sustained weight loss, improved endometrial and metabolomic response to progestin, and improved quality of life in premenopausal women with endometrial hyperplasia who desire uterine preservation.

开始日期2025-04-30 |

申办/合作机构 |

NCT06784024

Topical Lidocaine vs. Traditional Management in Manual Vacuum Aspiration Pain Management, for Endometrial Thickness. Randomized Double-blind Clinical Trial.

The main objective of this study is to evaluate the effect of lidocaine versus placebo according to the visual analog pain scale, during manual uterine aspiration in patients with endometrial thickening, by means of a prospective, randomized, double-blind, placebo-controlled clinical trial, taking into account women with a diagnosis of endometrial thickening, requiring MVA, which will be performed in the emergency area of Obstetrics and Gynecology of the Hospital Materno Infantil, by resident physicians of the second year of the residency of said postgraduate course supervised by specialist physicians. A sample of 126 participants will be studied, divided into 2 groups of 63 patients each (control and intervention), the first group will be given placebo and the second group will be given lidocaine 10%, 20 sprays, in addition to the pre-established pain management for MVA, and the pain perception before, during and after the procedure will be evaluated by means of the visual analog pain scale. The data will be tabulated and analyzed in Redcap (software) using descriptive statistics.

开始日期2025-01-15 |

100 项与 子宫内膜增生 相关的临床结果

登录后查看更多信息

100 项与 子宫内膜增生 相关的转化医学

登录后查看更多信息

0 项与 子宫内膜增生 相关的专利(医药)

登录后查看更多信息

4,032

项与 子宫内膜增生 相关的文献(医药)2025-06-01·Acta Histochemica

Immunohistochemistry and machine learning study of DNA replication-associated proteins in uterine epithelial tumors and precursor lesions

Article

作者: Ishii, Keiko ; Kimura, Fumikazu ; Ikehata, Koyo ; Urata, Takumi ; Ohshima, Kengo ; Yamaguchi, Masahiro

2025-06-01·Redox Biology

GPX4 deficiency-induced ferroptosis drives endometrial epithelial fibrosis in polycystic ovary syndrome

Article

作者: Liu, Xiyao ; Wang, Ruiqi ; Ye, Zhenhong ; Leng, Yueqi ; Zhou, Ping ; Pan, Heng ; He, Yilei ; Cheng, Ming ; Wang, Yue ; Li, Rong ; Peng, Tianliu ; Qin, Xunsi ; Zhao, Yue ; Lian, Weisi

2025-04-18·JCEM Case Reports

Adrenocortical Carcinoma With 2 Distinct Syndromes From Secretion of Insulin-Like Growth Factor 2 and Steroid Hormones

Article

作者: O’Sullivan, Adrian ; Lonergan, Eibhlín Marie ; O’Halloran, Domhnall ; Kanazaki, Keizo ; Morita, Miwa ; Tan, Lok Yi Joyce

14

项与 子宫内膜增生 相关的新闻(医药)2025-03-31

买科研服务(代计算、代测试、超算机时),送老李校长“科研理工男士情感课”第一性原理计算解决50年悬而未决难题:半导体中铜为何扩散更快?Ab initio及第一性原理入门参考书介绍《海贼王》告诉你,做科研为什么不能闭门造车……985博导亲测:用DeepSeek写国自然本子,3天完成30天工作量来自公众号:新智元本文以传播知识为目的,如有侵权请后台联系我们,我们将在第一时间删除。 新智元报道 编辑:英智【新智元导读】医学变革风暴来袭!ECgMPL模型如同医学领域的超级侦探,从细胞和组织微观图像里精准揪出癌症踪迹,诊断子宫内膜癌准确率近100%,远超医生平均水平。逆天!新型AI识别癌症,近100%精准度碾压医生。AI在医学领域越来越厉害啦!有一种新研发的AI,诊断癌症的本事比专业医生还牛。在不久的将来,用AI识别癌症或许会成为常见的事。包括澳大利亚Charles Darwin大学(CDU)在内的国际科研团队,搞出一个叫ECgMPL的模型。论文链接:https://www.sciencedirect.com/science/article/pii/S2666990025000059?via%3DihubECgMPL专门分析细胞和组织的微观图像,用来查子宫内膜癌。子宫内膜癌是常见的生殖系统肿瘤之一,而这个AI模型的准确率高达99.26%!研究人员还发现,这个模型经过调整,还能诊断很多其他疾病,如结直肠癌、口腔癌。CDU的Asif Karim博士参与了这项研究,他表示,ECgMLP模型的准确率高达99.26%,比现在用的那些诊断方法都强,计算速度还特别快。通过消融研究、自注意力机制,再加上高效的训练,这个模型在很多组织病理学数据集上都能很好地发挥作用,是临床诊断子宫内膜癌的得力助手。这个经过大量数据训练的AI模型,在查看微观扫描图像(也就是组织病理学图像)的时候,能把图像变得更清晰,这样就能发现癌症早期的症状。有些微小变化医生用眼睛很难发现,但AI模型一下子就能找到。现在,医生诊断的准确率大概在78.91%到80.93%之间。子宫内膜癌如果能早点发现,是可以治疗的,患者的五年预后效果也不错。但要是癌细胞扩散到子宫外面,治疗起来就麻烦了。所以,及时诊断对挽救患者生命特别重要。训练所用数据集的样本图像,展示了正常子宫内膜(NE)、子宫内膜息肉(EP)、子宫内膜增生(EH)和子宫内膜腺癌(EA)现在,美国已经有超过60万人得过子宫内膜癌。科学家发现,ECgMLP的用途可不只是诊断子宫内膜癌。澳大利亚ACU的副教授Niusha Shafiabady表示,用同样的办法,还能又快又准地查其他病,这样病人就能得到更好的治疗。他们用这个模型测试了好多不同的组织病理学图像数据,发现它查结直肠癌的准确率能达到98.57%,查乳腺癌的准确率是98.20%,查口腔癌的准确率也有97.34%。不过,这个AI模型可不是要抢医生的「饭碗」。它是和癌症专家一起合作,帮医生更准确地诊断病情,还能看看治疗的效果好不好。用这个模型诊断癌症,速度更快、容易实现,成本也更低。Shafiabady补充道,这项研究的AI模型可以作为软件系统的大脑,协助医生进行癌症诊断的决策。研究人员强调:「早点发现、准确诊断子宫内膜癌,对治疗和控制病情非常关键。用深度学习算法分析组织病理学图像,在诊断子宫内膜癌方面,不管是准确率还是处理速度,表现都特别好。」构建ECgMLPECgMLP模型的构建离不开高质量的数据集。研究团队收集了新鲜的子宫内膜标本,由三位具有十多年病理学实践经验的病理学家在光学显微镜下仔细检查组织学切片,一致选择具有诊断结果的代表性苏木精-伊红(H&E)切片。这些切片通过Mixotic扫描仪数字化,以10倍或20倍放大倍数捕获为高分辨率图像,再用Olympus ImageView从原始全切片图像中提取病变或健康组织的组织病理学区域。最终形成的数据集包含3302张jpeg格式的图像,分为子宫内膜腺癌、子宫内膜增生、子宫内膜息肉和正常子宫内膜4类,每类又包含不同数量的图像和亚型。这个数据集为模型的训练和优化提供了坚实的基础。图像预处理图像预处理是 ECgMLP 模型的重要环节,它直接影响到后续分析的准确性。研究采用了多种预处理技术,包括归一化、α-β变换和非局部均值(NLM)去噪算法。归一化通过将图像的像素值缩放到0到1之间,使不同图像具有可比性,便于从不同光照条件下捕获的图像中一致地提取特征。其公式为,这种标准化为后续的分析提供了的基础。α-β技术则通过调整像素值来优化视觉对比度。α参数控制图像的对比度,β参数控制亮度。在本研究中,α值设为1.0,β值设为2,这一设置显著增强了组织和细胞结构边界的可见性,同时保持了可接受的信号质量,PSNR值始终高于33dB。NLM去噪技术通过比较图像中的小像素块并找到相似块,用相似块的平均值替换噪声块,有效地去除了噪声,同时保留了关键的边缘信息和组织纹理。其公式为,这一技术为后续的准确分析提供了清晰的图像数据。图像分割图像分割是从图像中提取感兴趣区域(ROI)的关键技术,ECgMLP模型采用了基于分水岭算法的多步骤分割方法。该过程从二值阈值化开始,通过最小化前景和背景两类的类内方差确定阈值,将像素分为前景和背景。接着进行形态学闭运算,使用2×2内核去除前景区域中的小孔和间隙;然后进行距离变换,获得每个像素到最近背景像素的距离图;再进行膨胀操作,扩展前景区域。应用阈值处理,确定前景区域;通过从确定背景中减去确定前景得到未知区域;将原始图像和标记与分水岭算法结合,实现图像的精准分割。光度增强为了提高模型的泛化能力,研究对训练集和验证集应用了光度增强技术。通过对图像进行亮度、对比度、色调、饱和度的变化以及模糊处理等多种修改,创建了具有不同视觉特征的原始图像的新版本。总共应用了10种光度增强技术,例如调整亮度水平、改变对比度、利用CLAHE增强图像特征、调整色调和饱和度以及应用高斯模糊等。这样增加了训练数据的多样性,提高了模型的泛化能力。创新的ECgMLP架构ECgMLP模型基于gMLP架构构建,gMLP架构结合了MLP和Transformer的优势。每一层由一个MLP块和一个门控机制组成,门控机制调节信息流,使模型能够选择关注不同的输入组件,MLP块则负责提取高级特征。ECgMLP模型在此基础上进行了针对性的优化。形状为[64×64×3]的图像首先输入到输入层,经过数据增强层增加训练样本数量并减少过拟合,增强后的数据由形状为[128×128×3]的补丁组成。补丁通过补丁层重塑为[256×192],再经过全连接层提取特征。模型包含多个顺序的gMLP 层,gMLP层由多个子层组成,子层混合使用MLP和门控机制生成有信息的表示。每个gMLP层的输出作为下一层的输入,经过层归一化和全局平均池化1D层处理后,最后通过具有4个输出单元的全连接层进行最终预测,对应子宫内膜癌的四个类别。在训练过程中,使用AdamW优化器,包括权重衰减正则化,并采用稀疏分类交叉熵损失和准确率指标进行评估,还使用了学习率调度来提高收敛性。此外,在gMLP层中使用ELU激活函数代替ReLU,提高了模型的稳定性。ECgMLP的卓越性能消融研究通过改变网络的层架构、训练参数和超参数,如图像大小、权重衰减、批量大小、随机失活率等,深入研究不同因素对模型准确率的影响。研究发现,6个ECgMLP模块实现了98.61%的最佳准确率,但出于实际原因选择4个模块,此时准确率为98.52%。全局最大池化的准确率达到98.74%,高于全局平均池化的98.52%。AdamW作为优化器表现最为准确,准确率为98.52%;激活函数中ELU的准确率最高,达到99.26%;学习率为 0.003时选择准确率最高。多指标评估使用多种指标对ECgMLP模型的性能进行评估,结果显示该模型表现卓越。学习曲线展示了模型训练过程中的良好表现,随着训练的进行,损失下降且准确率上升,表明模型有效地从数据中学习,没有过拟合的迹象,预测性能不断增强。Confusion Matrix显示整个数据集中只有少数图像被误分类,这意味着模型能够很好地对图像进行正确分类,准确识别不同类别的子宫内膜组织。ROC曲线下面积(AUC)为完美的1.00,表明模型区分不同类别的能力极强,在不同的分类标准下都表现出色。通过10折交叉验证,模型的准确率在不同的数据分割中保持在98.99%至99.26%之间,证明了模型的稳定性和泛化能力,在不同类型的数据上都能表现出持续的高性能。泛化能力验证为了评估ECgMLP模型的泛化能力,研究团队在多个涵盖不同癌症类型的外部组织病理学图像数据集上进行测试。结果显示,模型在这些数据集上都实现了较高的准确率(>97%),证明了其对不同组织学图像分布具有可靠的泛化能力。即使在原始领域之外,ECgMLP模型也具有先进的性能,这为其在更广泛的医学领域应用奠定了坚实的基础。参考资料:https://newatlas.com/cancer/ai-cancer-diagnostic/

诊断试剂

2024-12-12

REDWOOD CITY, Calif.--(

BUSINESS WIRE

)--Corcept Therapeutics Incorporated (NASDAQ: CORT), a commercial-stage company engaged in the discovery and development of medications to treat severe endocrinologic, oncologic, metabolic and neurologic disorders by modulating the effects of the hormone cortisol, today announced that the primary endpoint was met in the treatment phase of CATALYST, a randomized, double-blind, placebo-controlled study of Korlym

®

in patients with hypercortisolism (Cushing’s syndrome) and difficult-to-control type 2 diabetes.

CATALYST is a prospective, Phase 4 study with two parts. The first part assessed the prevalence of hypercortisolism by screening 1057 patients with difficult-to-control type 2 diabetes, defined as hemoglobin A1c greater than 7.5 percent despite receiving optimal therapies, including GLP-1 agonists. Of these patients, 23.8 percent were identified as having hypercortisolism and were eligible to enter CATALYST’s treatment phase, in which 136 patients were randomized, 2:1, to receive either Korlym or placebo for 24 weeks. The primary endpoint was the reduction in hemoglobin A1c between these groups.

CATALYST met its primary endpoint. Patients who received Korlym exhibited a clinically meaningful and statistically significant improvement in hemoglobin A1c, with a decrease from baseline of 1.47 percent as compared to a decrease of 0.15 percent in patients who received placebo (placebo-adjusted reduction of 1.32 percent; p-value: < 0.0001). The safety profile of Korlym in this study was consistent with the medication’s label and no new side effects or adverse events were identified.

Complete results from CATALYST will be presented at a medical conference next year.

“CATALYST’s first part showed that hypercortisolism is much more common than previously assumed. The results announced today show that Korlym is a safe and effective treatment option,” said Ralph DeFronzo, MD, chief of the Diabetes Division and professor of medicine at UT Health San Antonio and CATALYST study investigator. “Reductions in hemoglobin A1c of this magnitude are of great clinical benefit. They are particularly compelling, given that the patients in CATALYST had been receiving our best therapies – but continued to experience serious disease. These findings should prompt expanded screening for hypercortisolism, more effective treatment and better health outcomes for patients who are struggling today.”

“The results of the CATALYST study will enable physicians to more accurately diagnose and treat patients with hypercortisolism - a serious and deadly disease,” said Bill Guyer, PharmD, Corcept’s Chief Development Officer. “One in four patients with difficult-to-control type 2 diabetes have hypercortisolism and Korlym, a cortisol modulator, was highly effective in controlling hyperglycemia in this patient population.”

About Hypercortisolism (Cushing’s Syndrome)

Hypercortisolism is caused by excessive activity of the hormone cortisol. Symptoms vary, but most patients experience one or more of the following manifestations: hypertension, central obesity, elevated blood sugar and difficult-to-control type 2 diabetes, severe fatigue and weak muscles. Irritability, anxiety, depression and cognitive disturbances are common. Hypercortisolism can affect every organ system and can be lethal if not treated effectively.

Important information about Korlym follows, and

full Prescribing Information, including

BOXED WARNING

,

and a

Medication Guide

are available at

www.korlym.com

.

IMPORTANT SAFETY INFORMATION

INDICATIONS AND USAGE

Korlym (mifepristone) is a cortisol receptor blocker indicated to control hyperglycemia secondary to hypercortisolism in adult patients with endogenous Cushing’s syndrome who have type 2 diabetes mellitus or glucose intolerance and have failed surgery or are not candidates for surgery.

IMPORTANT LIMITATIONS OF USE

Do not use for the treatment of type 2 diabetes mellitus unrelated to endogenous Cushing’s syndrome.

BOXED WARNING: TERMINATION OF PREGNANCY

Mifepristone is a potent antagonist of progesterone and cortisol via the progesterone and glucocorticoid (GR-II) receptors, respectively. The antiprogestational effects will result in the termination of pregnancy. Pregnancy must therefore be excluded before the initiation of treatment with Korlym and prevented during treatment and for one month after stopping treatment by the use of a nonhormonal medically acceptable method of contraception unless the patient has had a surgical sterilization, in which case no additional contraception is needed. Pregnancy must also be excluded if treatment is interrupted for more than 14 days in females of reproductive potential.

DOSAGE AND ADMINISTRATION

Obtain a negative pregnancy test prior to initiating treatment with Korlym in females of reproductive potential, or if treatment is interrupted for more than 14 days.

Administer once daily orally with a meal. The recommended starting dose is 300 mg once daily. Renal impairment: Do not exceed 600 mg once daily. Mild-to-moderate hepatic impairment: Do not exceed 600 mg once daily. Do not use in severe hepatic impairment. Based on clinical response and tolerability, the dose may be increased in 300-mg increments to a maximum of 1200 mg once daily. Do not exceed 20 mg/kg per day.

Concomitant use of Korlym with a strong CYP3A inhibitor resulted in a 38% increase in mean plasma concentration of mifepristone. For patients already being treated with a strong CYP3A inhibitor, start with a Korlym dose of 300 mg per day and titrate to a maximum of 900 mg per day if clinically indicated. When a strong CYP3A inhibitor is administered to patients already receiving Korlym, adjust the dose as follows: for patients receiving a daily dose of 600 mg, reduce dose to 300 mg. For patients receiving a daily dose of 900 mg, reduce dose to 600 mg. For patients receiving a daily dose of 1200 mg, reduce dose to 900 mg. Titrate if clinically indicated and do not exceed a Korlym dose of 900 mg in combination with a strong CYP3A inhibitor.

CONTRAINDICATIONS

Pregnancy; patients taking simvastatin or lovastatin and CYP3A substrates with narrow therapeutic ranges; patients receiving systemic corticosteroids for lifesaving purposes; women with a history of unexplained vaginal bleeding or endometrial hyperplasia with atypia or endometrial carcinoma; patients with known hypersensitivity to mifepristone or to any of the product components.

WARNINGS AND PRECAUTIONS

Adrenal insufficiency:

Patients should be closely monitored for signs and symptoms of adrenal insufficiency.

Hypokalemia:

Hypokalemia should be corrected prior to treatment and monitored for during treatment.

Vaginal bleeding and endometrial changes:

Women may experience endometrial thickening or unexpected vaginal bleeding. Use with caution if the patient also has a hemorrhagic disorder or is on anticoagulant therapy.

QT interval prolongation:

Avoid use with QT interval-prolonging drugs, or in patients with potassium channel variants resulting in a long QT interval.

Use of strong CYP3A inhibitors:

Concomitant use increases mifepristone plasma levels. Adjust Korlym dose as described in

Dosage and Administration

. Use only when necessary and do not exceed a Korlym dose of 900 mg.

ADVERSE REACTIONS

Most common adverse reactions in Cushing’s syndrome (≥20%): nausea, fatigue, headache, decreased blood potassium, arthralgia, vomiting, peripheral edema, hypertension, dizziness, decreased appetite, endometrial hypertrophy.

DRUG INTERACTIONS

Drugs metabolized by CYP3A:

Administer drugs that are metabolized by CYP3A at the lowest dose when used with Korlym.

CYP3A inhibitors:

Caution should be used when Korlym is used with strong CYP3A inhibitors. Adjust Korlym dose as described in

Dosage and Administration

. Use only when necessary, and do not exceed a Korlym dose of 900 mg.

CYP3A inducers:

Do not use Korlym with CYP3A inducers.

Drugs metabolized by CYP2C8/2C9:

Use the lowest dose of CYP2C8/2C9 substrates when used with Korlym.

Drugs metabolized by CYP2B6:

Use of Korlym should be done with caution with bupropion and efavirenz.

Hormonal contraceptives:

Do not use with Korlym.

USE IN SPECIFIC POPULATIONS

Lactation: Mifepristone is present in human milk, however, there are no data on the amount of mifepristone in human milk, the effects on the breastfed infant, or the effects on milk production during long term use of mifepristone.

About Corcept Therapeutics

For over 25 years, Corcept’s focus on cortisol modulation and its potential to treat patients with a wide variety of serious disorders has led to the discovery of more than 1,000 proprietary selective cortisol modulators. Corcept is conducting advanced clinical trials in patients with hypercortisolism, solid tumors, ALS and liver disease. In February 2012, the company introduced Korlym, the first medication approved by the U.S. Food and Drug Administration for the treatment of patients with endogenous hypercortisolism. Corcept is headquartered in Redwood City, California. For more information, visit Corcept.com.

Forward-Looking Statements

Statements in this press release, other than statements of historical fact, are forward-looking statements based on our current plans and expectations and are subject to risks and uncertainties that might cause our actual results to differ materially from those such statements express or imply. These risks and uncertainties are set forth in our SEC filings, which are available at our website and the SEC’s website.

In this press release, forward-looking statements include those concerning the full results of CATALYST and the date and manner of their publication; changes in medical practice, including in the frequency and clinical outcome of screening patients for hypercortisolism; the adoption of Korlym as a treatment for patients with hypercortisolism and difficult-to-control diabetes; and Korlym’s commercial prospects. We disclaim any intention or duty to update forward-looking statements made in this press release.

临床结果临床3期上市批准临床2期

2024-09-10

Bayer touted more detailed data from a Phase 3 trial for elinzanetant, a non-hormonal drug candidate that it’s investigating as a treatment for menopause symptoms like hot flashes and night sweats.

The OASIS 3 trial hit the primary endpoint of demonstrating a statistically significant reduction in the frequency of moderate to severe vasomotor symptoms from baseline to week 12 compared to placebo, according to results set to be presented Tuesday at The Menopause Society’s annual meeting in Chicago.

After 12 weeks of treatment, the number of vasomotor symptoms was reduced to 1.6 in the elinzanetant group and 3.4 in the placebo group, with the reductions in symptoms maintained throughout the 52-week study. Patients on Bayer’s drug self-reported improvements in sleep as well.

Based on positive results from this trial and two other late-stage studies called

OASIS 1 and 2

, Bayer submitted an NDA to the FDA for elinzanetant in August, and it plans to file applications to other regulatory agencies. The company told investors this summer that it’s aiming to launch the drug in 2025. Bayer first

released topline data

for OASIS 3 in March.

The most common treatment-emergent adverse events in the elinzanetant arm were headaches and Covid-19, and Bayer noted there were no signs of liver toxicity or incidences of endometrial hyperplasia or endometrial malignant neoplasms.

James Simon, study author and clinical professor of obstetrics and gynecology at George Washington University in Washington, DC, told

Endpoints News

that longer-term studies like OASIS 3 are “really, really important,” especially for this drug class. Elinzanetant is a dual neurokinin-1 and -3 receptor antagonist, which Bayer says is the first drug of its kind in late-stage development for the treatment of menopausal vasomotor symptoms associated with menopause. It’s given orally once a day.

“In this particular case, safety has been brought more to the forefront, because drugs in this class, the neurokinin modulators, some of them have failed and been very problematic for safety, and have never really come to become clinically tested,” Simon said. “Others already on the market have some minor or mild safety signals, which have elevated the FDA to make changes in and restrictions in their labeling that are safety-related.”

JoAnn Pinkerton, the study’s author and division director of Midlife Health Center at UVA Health in Charlottesville, VA, said that Bayer’s drug could be a new treatment option for menopausal women with these symptoms who can’t or don’t want to take hormone therapies.

She also noted that another ongoing Phase 3 trial called OASIS 4 is investigating the drug in women who either are at high risk for breast cancer or who have had breast cancer. These patients are also on a therapy and endocrine therapy either to prevent or treat breast cancer.

“When you look at the populations of women who can’t take hormone therapy or choose not to, it’s women that are at risk for breast cancer, or have had breast cancer, stroke or blood clots, migraines. Those are women that need help, and we haven’t had effective treatment to date,” Pinkerton said.

临床3期申请上市临床结果

分析

对领域进行一次全面的分析。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

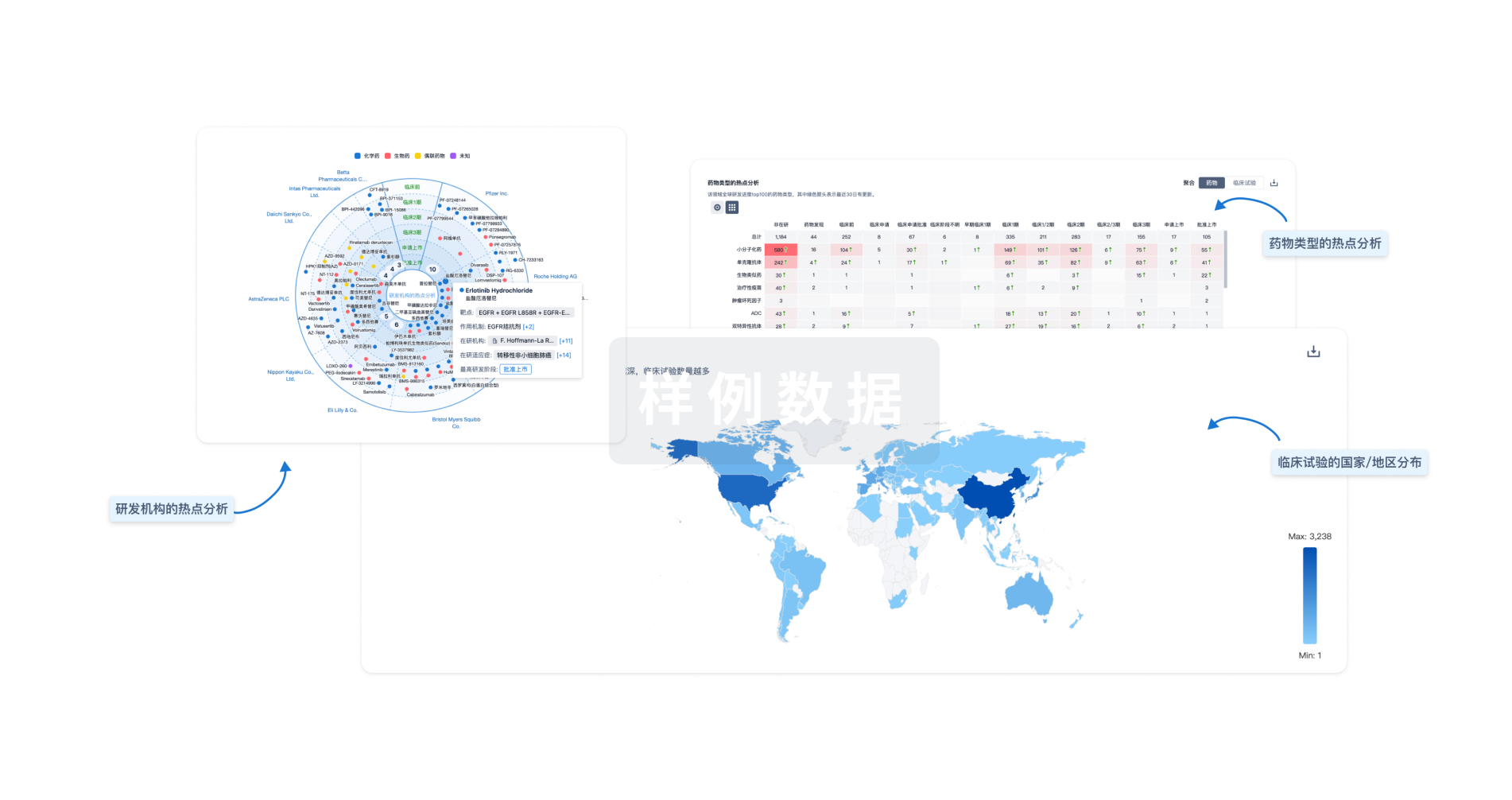

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用