预约演示

更新于:2025-05-07

Granulomatosis With Polyangiitis

肉芽肿伴多血管炎

更新于:2025-05-07

基本信息

别名 GPA、GRANULOMATOSIS WITH POLYANGIITIS、GRANULOMATOSIS, NECROTIZING RESPIRATORY + [56] |

简介 A multisystemic disease of a complex genetic background. It is characterized by inflammation of the blood vessels (VASCULITIS) leading to damage in any number of organs. The common features include granulomatous inflammation of the RESPIRATORY TRACT and KIDNEYS. Most patients have measurable autoantibodies (ANTINEUTROPHIL CYTOPLASMIC ANTIBODIES) against MYELOBLASTIN. |

关联

38

项与 肉芽肿伴多血管炎 相关的药物靶点 |

作用机制 CFB抑制剂 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2023-12-05 |

靶点 |

作用机制 C5a抑制剂 |

在研机构 |

原研机构 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2023-04-04 |

靶点 |

作用机制 C5AR1拮抗剂 |

非在研适应症 |

最高研发阶段批准上市 |

首次获批国家/地区 日本 |

首次获批日期2021-09-27 |

139

项与 肉芽肿伴多血管炎 相关的临床试验NCT06226662

A Phase II, Randomized, Double-Blind, Placebo-Controlled Study of NM8074 in Patients with Anti-Neutrophil Cytoplasmic Antibody (ANCA)-Associated Vasculitis (AAV)

This is a Randomized, Double-Blind, Placebo-Controlled Study designed to assess safety, tolerability, and efficacy of NM8074 in AAV patients when used in combination with Standard of Care (SOC) cyclophosphamide/azathioprine or rituximab plus corticosteroids.

开始日期2026-06-01 |

申办/合作机构 |

NCT06940661

Obinutuzumab for Remission Induction in Patients With Relapsing PR3-ANCA Granulomatosis With Polyangiitis (Wegener's). Phase 2 Prospective, Open-label Study

The purpose of this study is to evaluate the efficacy and safety of obinutuzumab to induce clinical and serological remission in patients with relapsing PR3-ANCA granulomatosis with polyangiitis.

开始日期2025-06-01 |

NCT06887985

An Early Exploratory Clinical Study of the Safety, Tolerability, and Initial Efficacy of JY231 Injection for the Treatment of Refractory Autoimmune Diseases (ADs)

This study is an investigator-initiated single center, single arm clinical study with a target population of patients with Refractory Autoimmune Diseases (ADs). It is an early exploratory clinical study of the safety, tolerability and initial efficacy of JY231 injection in the treatment of Refractory Autoimmune Diseases (ADs).

开始日期2025-03-31 |

申办/合作机构 |

100 项与 肉芽肿伴多血管炎 相关的临床结果

登录后查看更多信息

100 项与 肉芽肿伴多血管炎 相关的转化医学

登录后查看更多信息

0 项与 肉芽肿伴多血管炎 相关的专利(医药)

登录后查看更多信息

9,010

项与 肉芽肿伴多血管炎 相关的文献(医药)2025-08-01·Seminars in Arthritis and Rheumatism

Interstitial lung disease in patients with antineutrophil cytoplasmic antibody-associated vasculitis: chest CT patterns and correlation with survival

Article

作者: Casal Moura, Marta ; Tandon, Yasmeen K ; Baqir, Misbah ; Hartman, Thomas E ; Ryu, Jay H

2025-05-01·American Journal of Ophthalmology

The Global Epidemiology of Scleritis: A Systematic Review and Meta-analysis

Review

作者: Cifuentes-González, Carlos ; Rojas-Carabali, William ; Rosenbaum, James T ; Agrawal, Rupesh ; Cruz-Reyes, Danna Lesley ; Mejía-Salgado, Germán ; Diez-Bahamón, Luis Alejandro ; Tovar-Tirado, Josué ; Bernal-Valencia, María Andrea ; Pavesio, Carlos E ; DE-LA-Torre, Alejandra ; McCluskey, Peter ; Muñoz-Vargas, Paula Tatiana

2025-05-01·Rheumatic Disease Clinics of North America

Upper Respiratory Microbiome in Vasculitis

Review

作者: Nikolai von Krusenstiern, A ; Cohen, Noam A ; Rhee, Rennie L

88

项与 肉芽肿伴多血管炎 相关的新闻(医药)2025-04-29

·抗体圈

这篇文章于2022年发表在ImmuneNetw.,主要总结了自身免疫性疾病靶向免疫治疗最新进展。摘要: 在过去的几十年里,靶向炎性细胞因子、免疫细胞和细胞内激酶的生物药物和小分子抑制剂已成为治疗自身免疫性疾病的标准护理。抑制TNF、IL-6、IL-17和IL-23彻底改变了类风湿性关节炎、强直性脊柱炎和银屑病等自身免疫性疾病的治疗。使用抗CD20mAb的B细胞耗竭疗法在神经炎症性疾病患者中显示出有希望的结果,抑制B细胞存活因子被批准用于治疗系统性红斑狼疮。靶向Ag呈递细胞和T细胞上表达的共刺激分子也有望通过调节T细胞功能在自身免疫性疾病中具有治疗潜力。 最近,靶向JAK家族(负责多个受体信号转导)的小分子激酶抑制剂在自身免疫和血液疾病领域引起了极大的兴趣。然而,在治疗效果和安全性方面仍存在未满足的医疗需求。新兴疗法旨在使用先进的分子工程技术在不影响免疫功能的情况下诱导免疫耐受。【NO.1】背景介绍 自身免疫性疾病是以自身抗原炎症失调为特征的病理性疾病,影响3%-10%的普通人群。自身免疫性疾病的常规治疗方法抑制了一般免疫功能以调节不受控制的炎症。然而,这些治疗方法在异质性患者群体中并未完全成功,其疗效以牺牲副作用为代价,特别是感染风险增加,通常来自非选择性免疫抑制。为了克服传统疗法的局限性,目前的治疗方法旨在更选择性地抑制炎症信号,同时最大限度地减少对稳态免疫功能的破坏。 最近在了解疾病发病机制和新药制造技术方面取得的进展导致靶向免疫疗法广泛用于治疗自身免疫性疾病。此外,先进的分子工程技术催生了靶向可溶性介质或细胞表面标志物的重组蛋白治疗药物,如mAb和receptor-Ab融合蛋白。自1990年代首次批准靶向TNF的选择性蛋白质疗法用于类风湿性关节炎(RA)以来,靶向免疫疗法已成为治疗自身免疫性疾病的游戏规则改变者。根据全球药品市场报告,阿达木单抗多年来一直是全球最畅销的药物,其次是其他靶向免疫疗法,如pembrolizumab、ibrutinib和ustekinumab。 随着对疾病发病机制的了解迅速增加,许多靶向炎症信号通路的生物药物正在开发中,以治疗顽固性炎症性疾病。在成功引入生物疗法治疗自身免疫性疾病后,分子靶点已扩展到细胞内激酶。小分子激酶抑制剂阻断收敛信号在治疗效果和长期安全性方面具有重要意义。 本文总结了目前针对自身免疫性疾病发病机制中涉及的信号通路的治疗方法,并介绍了旨在诱导免疫耐受的新兴免疫疗法。由于靶向免疫疗法市场正在迅速增长,因此我们专注于已获得临床批准用于治疗自身免疫性疾病的药物。【NO.2】自身免疫性疾病中的炎症 炎症是生物体修复组织损伤并防止外来物质侵害的自然过程。然而,针对自身抗原的免疫反应失调会导致免疫耐受丧失和自身免疫性疾病的发展。自身免疫源于耐受性检查点的中枢和外周缺陷以及不耐受免疫细胞的激活。自身抗原可通过从免疫特权位点释放自身抗原、产生新自身抗原以及自身蛋白与外来物质的分子模拟来诱导。 自身免疫的临床表现多种多样,从存在自身抗体的无症状疾病到导致危及生命的器官损伤的暴发性自身免疫性疾病。自身免疫性疾病的发展可由遗传易感个体的环境因素触发。环境触发因素,包括压力、吸烟和感染,会诱导先天免疫的促炎功能,并促进适应性免疫的病理反应。 尽管自身免疫的传统概念是适应性免疫系统的失调,但越来越多的证据表明,先天免疫系统对自身免疫性疾病的发生和发展也至关重要。作为先天免疫的关键参与者,巨噬细胞和树突状细胞(DC)对于抗原呈递和促炎细胞因子(如TNF、IL-1β、IL-6、IL-23、B细胞激活因子(BAFF,也称为Blys或TNFSF13B)和增殖诱导配体(APRIL,也称为TNFSF13A)的产生至关重要。1型IFN与系统性红斑狼疮(SLE)及其相关疾病的发病机制密切相关,主要由浆细胞样DC(pDC)产生,浆细胞样DC是DC的一个特殊亚群。巨噬细胞/DC和T细胞/B细胞之间的相互作用进一步促进了自身免疫性炎症。 初始CD4+Th细胞根据细胞因子环境分化为不同的T细胞亚群。T细胞通过自身抗原识别、细胞因子产生和增强的细胞毒性,在自身免疫性疾病的发病机制中发挥关键作用。近几十年来,产生IL-17和FOXP3+Tregs的Th17细胞已被强调为自身免疫性疾病的治疗靶点。 自身反应性B细胞是适应性免疫的另一个主要组分,它产生病理性自身抗体,并通过Ag呈递和细胞因子产生激活T细胞。自身抗体的产生是各种自身免疫性疾病(包括RA和SLE)的标志。RA中的抗瓜氨酸肽抗体和SLE中的抗dsDNA抗体是导致临床表现和疾病活动度的代表性致病性自身抗体。由于B细胞在自身免疫中的重要作用,B细胞表面分子是各种自身免疫性疾病的治疗靶点。 来自活化免疫细胞的可溶性介质通过与它们的同源受体结合来转导炎症信号。一旦被炎性细胞因子结合,受体就会激活JAK家族,以诱导STAT的磷酸化、二聚化和核转位。STAT的基因转录促进细胞增殖和分化以及多种炎症介质的产生,进一步加剧自身免疫性炎症。 尽管每种自身免疫性疾病的病理生理机制不同,但几种常见的炎症途径可能是免疫治疗的治疗靶点。基于我们目前对自身免疫性炎症发病机制的理解,治疗自身免疫性疾病的关键治疗靶点如图1所示。表1、2、3列出了已批准用于自身免疫性疾病或正在临床开发的靶向免疫疗法,具体如下。本文重点介绍靶向免疫治疗在免疫介导的炎症性疾病领域的临床应用。图1.自身免疫性疾病发病机制中的关键治疗靶点表1.用于治疗自身免疫性疾病的细胞因子靶向疗法靶细胞因子结构药物临床应用正在调查中(IIb或III期)TNF-ɑsTNFR2-IgG1Fc依那西普RA、pJIA、AS、银屑病、PsA抗TNF单克隆抗体英夫利昔单抗RA、AS、银屑病、PsA、UC、CD超说明书使用:BD、结节病阿达木单抗RA、pJIA、AS、银屑病、PsA、UC、CD、化脓性毛突炎、葡萄膜炎超说明书使用:BD戈利木单抗RA、AS、PsA、UC赛妥珠单抗RA、AS、银屑病、PsA、CDIL-1IL-1R拮抗剂阿那白滞素RA、大写字母川崎病(NCT04656184)超说明书使用:AOSD、sJIA、痛风、复发性心包炎等IL-1R1-IgGFc利洛西普CAPS、DIRA、复发性心包炎超说明书使用:AOSD、痛风等IL-1β抗体抗卡纳单抗AOSD、sJIA、CAPS、TRAPS、HIDS/MKD、FMFCOVID19相关CRS(12)超说明书使用:痛风和许多其他IL-6(英语)IL-6单克隆抗体抗体西鲁尤单抗RA(13,14)*奥洛珠单抗RA(15)(NCT02760407,NCT02760433,NCT03120949)克拉扎奇珠单抗RA(NCT02015520)PsA(16)COVID19相关CRS(NCT04343989)西妥昔单抗CAR-T相关CRS(NCT04975555)IL-6R抗体抗体托珠单抗RA、sJIA、pJIA、SSc相关ILD、巨细胞动脉炎、CRSPMR(NCT02908217)超说明书使用:AOSD、Takayasu动脉炎NMOSD(17)COVID19肺炎(18,19)(NCT04409262)沙利尤单抗RA类COVID19相关CRS(20)(NCT04315298)沃巴利珠单抗RA(NCT02518620)IL-17(英语)IL-17单克隆抗体抗体依奇珠单抗银屑病、PsA、轴向SpA苏金单抗AS、银屑病、PsA系统性红斑狼疮(NCT04181762)轴向SpA(21)(NCT04156620,NCT04732117)Hiradenitissupprativa(NCT03713619,NCT03713632,NCT04179175)巨细胞动脉炎(NCT04930094)Grave眼病(NCT03713619)IL-17R抗体溴达利尤单抗牛皮癣轴向SpA(22)PsA(23)不锈钢(NCT03957681)IL17A/F抗体比莫珠单抗AS(NCT03928743)轴向SpA(NCT03928704,NCT04436640)银屑病(24,25)(NCT03598790,NCT03766685)PsA(NCT03895203、NCT03896581、NCT04009499NCT04109976)Hiradenitissuppruativa(NCT04242446,NCT04242498,NCT04901195)IL-23抗p40mAb抗体乌司奴单抗银屑病、PsA、UC、CD特发性炎性肌炎(NCT03981744)高安动脉炎(NCT04882072)抗p19mAb抗体古塞利尤单抗银屑病,PsAUC(NCT04033445)CD(NCT03466411,NCT04397263)瑞沙珠单抗牛皮癣PsA(26,27)UC(NCT03398135,NCT03398148)CD(NCT03104413、NCT03105102、NCT03105128NCT04524611)替尔拉奇珠单抗牛皮癣PsA(NCT03552276、NCT04314544、NCT04314531NCT04991116)米利珠单抗银屑病(NCT03482011、NCT03535194NCT03556202)UC(NCT03518086、NCT03519945NCT03524092)CD(NCT03926130,NCT04232553)1型IFN抗IFNR1单克隆抗体Anifrolumab系统性红斑狼疮备注:该表包括具有一种或多种已批准自身免疫性疾病适应症的药物。该适应症仅涵盖自身免疫性疾病领域。pJIA,多关节幼年特发性关节炎;UC,溃疡性结肠炎;CD,克罗恩病;BD,白塞病;sJIA,系统性幼年特发性关节炎;DIRA,IL-1受体拮抗剂缺乏;TRAPS,TNF受体相关周期性综合征;HIDS/MKD、高免疫球蛋白D综合征/甲羟戊酸激酶缺乏症;FMF,家族性地中海热;CRS,细胞因子释放综合征;CAR-T,嵌合Ag受体-T细胞;SSc相关ILD、系统性硬化症相关间质性肺病、PMR、风湿性多肌痛、NMOSD、视神经脊髓炎谱系疾病;中轴型SpA,中轴型脊柱关节炎。*尽管III期临床试验取得了积极结果,但由于安全性问题,FDA并未推荐将sirukumab用于治疗RA。表2.用于治疗自身免疫性疾病的细胞靶向疗法靶细胞结构药物临床应用正在调查中(IIb或III期)B细胞抗CD20mAb抗体利妥昔单抗RA类寻常型天疱疮(28)GPA、MPA超说明书使用:MS、免疫性血小板减少症奥瑞珠单抗女士奥法木单抗女士乌布利妥昔单抗MS(NCT03277261、NCT03277248NCT04130997)抗CD19mAb抗体因比利珠单抗NMOSDIgG4RD(NCT04540497)重症肌无力(NCT04524273)抗BAFF单克隆抗体贝利尤单抗系统性红斑狼疮抗BAFF-R单克隆抗体伊那单抗系统性红斑狼疮(NCT05126277)pSS(29)T细胞CTLA4-IgG1Fc阿巴西普RA,pJIApSS(NCT02067910,NCT02915159)PsA(30)特发性炎性肌炎(NCT02971683)GPA(NCT02108860)CD40mAb抗体伊斯卡利单抗pSS(NCT03905525)备注:该表包括已批准用于自身免疫性疾病或基于II期试验的积极结果正在临床开发的药物。GPA,肉芽肿性多血管炎;MPA,显微镜下多血管炎;NMOSD,视神经脊髓炎谱系疾病;IgG4RD,免疫球蛋白G4相关疾病;pJIA,多关节幼年特发性关节炎。表3.用于治疗自身免疫性疾病的激酶靶向疗法靶标激酶结构药物临床应用正在调查中(IIb或III期)杰克JAK1/3抑制剂托法替布RA类贾(31)(NCT01500551,NCT03000439)PsAAS(32))UC(英语)JAK1/2抑制剂巴瑞替尼RA类系统性红斑狼疮(NCT03843125,NCT03616912,NCT03616964)JIA(NCT03773965,NCT03773978)sJIA(NCT04088396)特应性皮炎(33,34)葡萄膜炎(NCT04088409)JAK1选择性抑制剂乌帕替尼RA类CD(NCT03345823、NCT03345836NCT03345849)PsA加州大学(35)(NCT03006068,NCT03653026)轴向SpA(NCT04169373)特应性皮炎(36,37)(NCT03661138,NCT04195698)高安动脉炎(NCT04161898)巨细胞动脉炎(NCT03725202)非戈替尼RA(由EMA和日本提供)统一(38)(NCT02914535)CD(NCT02914561,NCT02914600)TYKTYK2选择性抑制剂Deucravacitinib银屑病(NCT03624127,NCT03611751)PsA(NCT04908189,NCT04908202)BTK公司BTK抑制剂Evobrutinib(依布替尼)MS(NCT04338022,NCT04338061)托布替尼MS(NCT04410978、NCT04410991、NCT04411641NCT04458051)重症肌无力(NCT05132569)非布替尼MS(NCT04544449、NCT04586010NCT04586023)利扎布替尼寻常型天疱疮(NCT03762265)免疫性血小板减少症(NCT04562766)备注:该表包括已批准用于自身免疫性疾病或基于II期试验的积极结果正在临床开发的药物。UC,溃疡性结肠炎;sJIA,系统性幼年特发性关节炎;CD,克罗恩病;中轴型SpA,中轴型脊柱关节炎。【NO.3】细胞因子靶向治疗肿瘤坏死因子(TNF) TNF是一种主要由髓系细胞和活化T细胞产生的促炎细胞因子。RA滑膜中TNF表达的增加和TNF转基因小鼠中关节炎的发展表明TNF在慢性炎症中的致病作用。抗TNF治疗的成功彻底改变了RA患者的治疗策略。自1998年英夫利昔单抗和依那西普首次获批以来,已有4种单克隆抗体(英夫利昔单抗、阿达木单抗、戈利木单抗和赛妥珠单抗)和1种受体-Fc融合蛋白(依那西普)获批,目前可用于治疗慢性免疫介导的疾病,包括RA、幼年特发性关节炎(JIA)、强直性脊柱炎(AS)、银屑病和银屑病关节炎(PsA)。这种mAb也适用于治疗炎症性肠病和非感染性葡萄膜炎。 尽管TNF具有促炎作用,但它是一种多效性细胞因子,依赖于TNF受体(TNFR)的结合。TNFR1在几乎所有有核细胞上组成性表达,主要负责TNF的炎症功能,而TNFR2仅在特定细胞类型上表达,例如髓源性抑制细胞、Treg细胞和单核细胞,与TNF的调节功能相关。源自TNFR1和TNFR2的不同信号转导通路已在其他地方进行了综述。目前可用的抗TNF疗法同时抑制TNFR1和TNFR2。由于TNF的调节方面,TNF阻断可能反常地诱导Th1/Th17细胞扩增和IFN反应失调,这可以解释抗TNF治疗期间治疗失败、自身抗体生成和反常银屑病的原因。因此,正在研究抑制TNFR1和增强TNFR2的更多选择性治疗。IL-1 IL-1α和IL-1β是IL-1家族的成员,是促炎细胞因子,与先天免疫反应密切相关。尽管IL-1α和IL-1β通过与IL-1受体1(IL-1R1)结合而具有共享生物学功能,但IL-1α与IL-1β的几个特征是不同的。在间充质细胞中组成型表达的pro-IL-1α具有生物活性,而巨噬细胞产生的pro-IL-1β需要被caspase-1切割才能成为活性IL-1β。pro-IL-1β的Caspase-1依赖性裂解是通过激活包含核苷酸结合结构域成员和包含亮氨酸富集重复序列的[NLR]蛋白家族(例如NLR家族含pyrin结构域的[NLRP]1、NLRP3、NLR家族CARD结构域4)或包含PYRIN-HIN-200结构域的蛋白家族成员(例如,在黑色素瘤2中不存在)的炎性小体激活来介导的)。此外,与IL-1β相反,IL-1α在体循环中未检测到,这表明IL-1α在自身免疫性疾病中的致病作用是局部的,而不是全身的。目前,IL-1β被认为比IL-1α与多种风湿性疾病更密切相关,包括全身性JIA、成人发病斯蒂尔病(AOSD)和痛风,以及与遗传性自身炎症性疾病的相关性,例如冷热蛋白相关周期性综合征(CAPS)和家族性地中海热。 被IL-1α或IL-1β占据后,IL-1R1与IL-1R3形成异源三聚体复合体,以募集髓样分化初级反应基因88(MYD88),从而触发随后的激酶级联反应(IL-1R相关激酶[IRAK]、IκB激酶、IκB和NF-κB),从而促进促炎状态。IL-1的这种炎症活性受来自同一IL-1家族的天然IL-1R拮抗剂(IL-1Ra)的调节。IL-1Ra占据IL-1R1导致构象变化,阻碍异源三聚体复合物与IL-1R3的形成,从而阻碍IL-1介导的炎症过程。 目前,已有3种蛋白质疗法被批准用于抗IL-1疗法:canakinumab,一种抗IL-1βmAb;anakinra,一种重组IL-1受体拮抗剂;和rilonacept,一种IL-1R1-Fc融合蛋白。根据它们的分子结构,所有3种药物都阻断IL-1β,阿那白滞素和利洛西普也抑制IL-1α。作为一种抑制IL-1信号转导的新治疗方法,口服NLRP3抑制剂,包括达潘舒腈(OLT177),正在研究中。 在早期临床开发中,阿那白滞素被测试为RA的治疗方法。尽管阿那白滞素在RA患者中的治疗效果已得到证实,但由于其成本效益低,因此不推荐将阿那白滞素作为一线生物疗法。抗IL-1疗法更广泛地用于自身炎症性疾病,如全身性JIA、AOSD和CAPS。其他具有高炎症负荷的疾病,例如痛风和复发性心包炎,也可通过IL-1靶向治疗进行控制。由于IL-1在炎症性疾病中的广泛作用,IL-1阻断有望在治疗顽固性自身免疫性疾病(包括SLE和系统性硬化症)以及控制过度的促炎反应(如细胞因子释放综合征和巨噬细胞激活综合征)方面提供临床益处。IL-6 IL-6是一种多效性细胞因子,由各种细胞类型在感染、炎症和恶性肿瘤的情况下产生。IL-6最初被鉴定为T细胞分泌的“B细胞分化因子”或“B细胞刺激因子”。尽管抗IL-6疗法在B细胞成熟中起着关键作用,但其对多发性骨髓瘤患者的治疗效果不佳。然而,托珠单抗(第一种抗IL-6R阻断单克隆抗体)的IL-6靶向治疗被证明在RA中具有显着的临床益处,甚至在疗效上优于阿达木单抗。托珠单抗目前被批准用于治疗RA、JIA、AOSD、巨细胞动脉炎和细胞因子释放综合征,因为它能够调节全身性过度炎症。最近,已研究抗IL-6疗法在SLE、视神经脊髓炎和系统性硬化症中的治疗应用。 IL-6在生理和病理条件下具有多种生物学功能。在生理状态下,IL-6负责巨噬细胞分化为M2状态,通过成骨细胞上RANK配体表达的增加进行破骨细胞生成,以及通过肝脏中的JAK-STAT通路进行急性期反应。在病理(炎症)条件下,IL-6通过调节FOXP3、RORC和IL-23R表达,关键参与Th17分化。IL-6对滤泡辅助性T细胞的发育和B细胞的成熟也很重要。 IL-6信号转导通过IL-6R和糖蛋白130(gp130)的复合物转导。gp130二聚化依次激活多个信号转导通路,包括JAK-STAT、MAPK、PI3K和YES相关蛋白1,这些蛋白转位到胞核并控制与细胞生长、增殖和炎症相关的基因转录。为了干扰IL-6信号通路,抗IL6疗法可以靶向IL-6、IL-6R、gp130、JAK和STAT3。然而,对副作用的担忧限制了gp130和STAT3作为治疗靶点的潜力。因此,抗IL6mAb、抗IL-6RmAb和JAK抑制剂已被用于阻断IL-6信号转导,并且使用可溶性gp130抑制IL-6/IL-6R复合体的可能性正在研究中。IL-17 IL-17A,通常称为IL-17,是CD4+T细胞Th17亚群的标志性细胞因子,但它也由CD8+T细胞(Tc17)、γδT细胞、自然杀伤T细胞、第3组先天性淋巴细胞和中性粒细胞产生。在生理状态下,Th17细胞通过募集中性粒细胞、宿主对细菌和真菌的防御以及皮肤和粘膜部位的组织修复来促进先天免疫。在病理条件下,IL-17A与TNF和其他炎性趋化因子协同作用,促进自身免疫。炎症性关节炎和神经炎症的动物模型表明,Th17细胞而不是Th1细胞在这些疾病的发展中起主要作用。 Th17细胞在IL-1β、IL-6和TGF-β存在下,通过抑制FOXP3并激活STAT3和RORC来源于初始CD4+初始T细胞。随后,IL-23稳定致病性Th17细胞的增殖和存活。与IL-17A结合后,IL-17R亚基A(IL-17RA)和亚基C(IL-17RC)的称为SEF/IL-17R的独特胞质结构域募集接头蛋白Act1,从而触发TNF受体相关因子(TRAF)6的泛素化,随后激活NF-κB、MAPK和激活蛋白1(AP1)通路和C/EBP转录因子。 来自动物和人类研究的越来越多的证据表明,IL-23/IL-17轴是多种自身免疫性疾病(如AS、PsA和RA)的极好治疗靶标。目前的抗IL-17疗法包括IL-17A(苏金单抗和依奇珠单抗)和IL-17RA(brodalumab)的mAb。正如预期的那样,抗IL-17疗法在银屑病、PsA和AS中产生了显著的反应。出乎意料的是,这种方法在RA(一种Th17依赖性疾病)患者中未能显示出显着的临床疗效。这种不令人满意的结果可以通过疾病本身的异质性或IL-17A的不同致病作用来解释,具体取决于RA分期(例如早期与晚期)。IL-23 IL-23是一种由DC和活化的巨噬细胞分泌的促炎细胞因子。作为IL-12家族的一员,IL-23是一种异二聚体,由IL-12共有的p40亚基(IL-12/IL-23p40)和IL-23特有的p19亚基(IL-23p19)组成。尽管IL-12和IL-23共享一个结构亚基,但IL-23更重要、更广泛地参与自身免疫性疾病的发病机制。最重要的是,IL-23通过维持Th17特征基因、抑制抑制因子、上调IL-23R表达和诱导效应基因来稳定Th17细胞的致病特征。它还作为自分泌因子促进DC和巨噬细胞的促炎功能。 IL-23与由IL-12Rβ1(与IL-12/IL-23p40结合)和IL-23R(与IL-23p19结合)组成的受体复合体相互作用,它们分别与酪氨酸激酶(TYK)2和JAK2结合。TYK2和JAK2的激活导致STAT的磷酸化和核转位,主要是STAT3。通过靶向抑制IL-12/IL-23p40或IL-23p19,可以阻断IL-23信号传导。作为一种抗IL-12/IL-23p40mAb,乌司奴单抗可阻断IL-12和IL-23,而抗IL-23p19mAb(guselkumab、tildrakizumab、risankizumab和mirikizumab)仅抑制IL-23。 与抗IL-17治疗类似,IL-23抑制可有效治疗银屑病和PsA。然而,与抗IL17治疗相比,靶向p40和p19亚基的mAb均未能改善AS的临床病程。尽管IL-23在AS的临床前模型中具有明显的致病作用,但这种意外结果表明,IL-23在人类自身免疫性疾病的组织和时间依赖性环境中发挥着不同的作用。在克罗恩病中,乌司奴单抗成功改善了临床结局,抗IL-23p19mAb的临床试验正在进行中(表1)。1型IFN 1型IFN,包括IFN-α、IFN-β、IFN-ε、IFN-κ和IFN-ω,最初被鉴定为可溶性抗病毒因子。随后的研究表明,IFN-α在自身免疫性疾病,尤其是SLE的发病机制中起着至关重要的作用。SLE患者的临床数据显示1型IFN特征的表达显著增加。重组IFN-α治疗后SLE样综合征的发展也表明1型IFN在自身免疫性疾病中的病理作用。 虽然大多数有核细胞可以产生1型IFN,但主要的细胞来源是pDC。含核酸的细胞外刺激,例如分别与抗RNA和DNA自身抗体复合的RNA和DNA,与pDC中的Toll样受体7(TLR7)和TLR9相互作用,以募集MYD88并激活IRAK和TRAF,从而导致IFN调节家族(IRF)7易位并导致IFN-α转录)。1型IFN与由IFNAR1和IFNAR2组成的IFN-α/β受体(IFNAR)结合。与1型IFN结合后,IFNAR1和IFNAR2分别激活JAK1和TYK2,从而导致STAT1和STAT2磷酸化和核转位。在胞核中,STAT1/STAT2与IRF9一起诱导IFN刺激基因的表达。在SLE中,IFN-α通过刺激髓系DC、Th1细胞和B细胞以及抑制Treg来促进促炎反应。 IFN-α在SLE中的病理生理学意义导致了1型IFN靶向免疫治疗的发展。在SLE中测试了Rontalizumab和sifalimumab中和干扰素α的单克隆抗体,但未能控制疾病活动。尽管IFN-α以外的IFN的作用尚不清楚,但仅抑制IFN-α而保持IFN-β和IFN-κ活性可能解释了SLE治疗效果不足的原因。最近,anifrolumab是一种靶向IFNAR1以阻断所有1型IFN生物学功能的人单克隆抗体,已被批准用于中度至重度SLE。Anifrolumab在减少疾病活动、口服皮质类固醇使用和年化发作方面显示出一致的临床益处。然而,狼疮性肾炎和神经精神性狼疮患者被排除在临床试验之外。 几种阻断1型IFN的新治疗方法正在研究中。为了减少1型IFN的产生,药物靶向pDC和信号转导分子,如TLR、MyD88和IRAK4。激酶抑制剂也正在临床开发中,用于治疗各种自身免疫性疾病,具体取决于它们抑制IFNAR下游信号通路的能力。【NO.4】细胞靶向治疗B细胞 随着我们对B细胞功能的理解不断扩大,B细胞被认为是自身免疫性疾病的积极参与者。有趣的是,B细胞耗竭疗法在RA和多发性硬化症(MS)中的成功突出了B细胞在自身免疫中的病理意义。除了在Ab产生中发挥作用外,B细胞还通过Ag呈递、三级淋巴组织的形成和细胞因子(如IL-6、TNF、IFN-γ和GM-CSF)的产生积极参与自身免疫。B细胞的Ab非依赖性功能解释了RA和MS中B细胞耗竭疗法的治疗效果,尽管没有自身抗体减少。 B细胞在骨髓中产生,并在外周组织中依次分化为Ag特异性B细胞。B细胞分化通过体细胞超突变和免疫球蛋白的类别转换重组,伴随着B细胞表面标志物的变化,继续增加对Ag的亲和力。CD20仅在从前B细胞到记忆B细胞的B细胞谱系中表达,但不在浆细胞中表达(图1)。在过去的几十年里,抗CD20疗法一直是B细胞耗竭的主要工具。利妥昔单抗是一种嵌合抗CD20mAb,可将CD20再分布到脂筏中,然后激活补体依赖性细胞毒性和Ab依赖性细胞毒性(ADCC)。利妥昔单抗有效消除CD20+B细胞会耗尽分泌Ab的浆母细胞的细胞来源,并阻止不依赖Ab的B细胞功能,从而减轻自身免疫性炎症。随着利妥昔单抗在RA和MS中的临床成功,已经开发了具有不同结合表位、不同给药途径和先进治疗效果的多种抗CD20疗法。Ocrelizumab和ofatumumab是人源化抗CD20mAb,已被批准用于复发性MS,其他抗CD20mAbobinutuzumab和ublituximab的临床试验正在进行中(表2)。 但是,利妥昔单抗在治疗SLE方面并未完全成功,SLE是刻板的B细胞介导的疾病之一。除了SLE患者的异质性外,利妥昔单抗治疗失败还可能由于存在自身反应性CD20−(但CD19+)长寿命浆细胞、外周血和组织中B细胞不完全耗竭或B细胞重建过程中的疾病发作。为了广泛抑制对抗CD20治疗耐药的B细胞,B细胞耗竭疗法靶向CD19,CD19在CD20+B细胞以及CD20-浆母细胞和一些浆细胞上表达。人源化抗CD19mAbinebilizumab被批准用于治疗视神经脊髓炎谱系疾病,并且正在进行临床试验以治疗其他炎症性神经系统疾病(表2)。 抑制B细胞的另一种方法是阻断B细胞存活因子,特别是BAFF和APRIL。BAFF与其3种不同受体连接后,与B细胞成熟和存活密切相关:1)BAFF受体(BAFF-R,称为TNFRSF13C),在除浆细胞外的大多数B细胞亚群上表达;2)跨膜激活剂、钙调节剂和亲环蛋白配体相互作用剂(TACI;称为TNFRSF13B),在边缘区B细胞、记忆B细胞和浆细胞上表达;3)B细胞成熟Ag(BCMA;称为TNFRSF17)在浆母细胞和浆细胞上表达。与BAFF-R不同,TACI和BCMA也与APRIL结合,这对Ab类别转换和浆细胞存活很重要。 鉴于B细胞成熟、增殖和存活的重要作用,BAFF/APRIL系统被认为是SLE及其相关自身免疫性疾病中一个有前途的治疗靶点。贝利尤单抗是一种人源化抗BAFFmAb,是FDA批准用于SLE的第一个靶向免疫疗法。然而,贝利尤单抗并不总是对所有SLE患者具有普遍的治疗益处。Ianalumab是一种抗BAFF-R的单克隆抗体,在原发性干燥综合征(pSS)患者的II期试验中显示出有希望的结果。作为B细胞耗竭疗法,ianalumab有2种作用模式:通过增强ADCC裂解B细胞和阻断BAFF信号传导。Telitacicept是一种TACI-Ig融合蛋白,基于其对BAFF/APRIL系统的抑制作用,也正在临床开发中。T细胞 作为适应性免疫的关键调节因子,T细胞在自身免疫的发生和发展中起着关键作用。T细胞效应器功能需要TCR的Ag识别和共刺激受体的额外参与。因此,已经研究了这些共刺激分子的调节用于自身免疫性疾病和恶性肿瘤的T细胞靶向治疗。 CD28信号转导是通过激活MAPK、AKT和NF-κB通路进行T细胞激活和分化的一种众所周知的共刺激通路。CD4+T细胞上表达的CD28与Ag呈递细胞上的CD80或CD86结合,CTLA-4作为CD28的抑制性对应物共享。基于CD28和CTLA-4的反调节,开发了一种由CTLA4胞外结构域和IgGFc区(CTLA4-Ig)组成的融合蛋白,通过占据CD80和CD86来抑制CD28信号传导。第一个CTLA4-Ig阿巴西普被批准用于治疗RA和JIA,已证实对控制炎症性关节炎有效。随后,另一种与CD80和CD86结合改善的CTLA4-Igs(包括belatacept和MEDI5256)已被研究用于临床应用。尽管贝拉西普于2011年被批准用于肾移植受者,但贝拉西普在基于钙调磷酸酶抑制剂的常规方案之外的额外临床益处存在争议。 CD40通路是T细胞效应器功能的主要激活信号。CD40L与CD40连接后,CD80和CD86表达上调。当活化T细胞上的CD40L与靶细胞上的CD40结合时,多个激酶级联反应会激活转录因子,如NF-κB和AP1,以诱导细胞存活、增殖和分化。CD40信号转导对于参与T细胞依赖性Ab反应、生发中心形成和记忆B细胞分化的B细胞-T细胞相互作用尤为重要。由于其在B细胞功能中的关键作用,靶向CD40信号转导的治疗潜力已在临床前和临床研究中得到研究。iscalimab(一种人源化抗CD40mAb)最近的II期试验显示pSS患者的临床改善,随后的III期试验正在进行中(表2)。 靶向其他共刺激信号转导的免疫疗法,如诱导型T细胞共刺激因子(ICOS)和OX40通路,也正在开发中,以抑制自身免疫性疾病中的T细胞效应功能。作为在活化的CD4+T细胞上表达的共刺激分子,ICOS和OX40参与T细胞的存活、分化和活化。【NO.5】激酶靶向治疗 如前所述,将可溶性炎症介质与其同源受体结合通过激活细胞内激酶(通常是JAK家族)来转导信号。JAK家族由JAK1、JAK2、JAK3和TYK2组成,与细胞因子受体(包括IL-2R、IL-4R、IL-5R、IL-6R、IL-13R和1型IFN)、生长激素和促红细胞生成素有关。JAK家族的激活导致STAT的磷酸化、二聚化和核转化。在细胞核中,STAT有助于参与细胞分化、增殖和存活、细胞因子产生和血管生成的基因转录。 由于JAK在造血中的关键作用,JAK抑制剂首次被评估用于治疗血液病,尤其是骨髓增生性肿瘤。自ruxolitinib(一种JAK1和JAK2抑制剂)于2011年首次被批准用于治疗骨髓纤维化以来,许多激酶抑制剂已被批准或研究用于治疗血液系统恶性肿瘤和炎症性疾病。几种JAK抑制剂已根据其经证实的临床疗效被批准用于RA、PsA和溃疡性结肠炎。每种JAK抑制剂对JAK的选择性不同,但尚未证明JAK抑制剂之间的治疗效果存在差异。Tofacitinib和baricitinib分别主要靶向JAK1/3和JAK1/2。Upadacitinib和filgotinib是第二代JAK抑制剂,可选择性抑制JAK1。 与上述调节细胞外间隙细胞激活信号的免疫疗法相比,JAK抑制剂靶向细胞内间隙的信号通路。JAK靶向治疗会抑制来自多个细胞因子受体的收敛信号,并破坏反馈回路。因此,即使部分阻断选定的激酶也可以有效地下调多种炎症信号通路,减轻自身免疫性炎症。应该注意的是,在一项头对头的随机对照试验中,巴瑞替尼显示出比抗TNFmAb阿达木单抗更好的临床反应。 除JAK抑制剂外,选择性TYK2抑制剂deucravacitinib正在等待临床批准,作为银屑病的首个口服靶向治疗。TYK2介导源自IL-12、IL-23和1型IFN的细胞内炎症信号。根据对PsA、炎症性肠病和SLE患者的机制见解,目前正在研究deucravacitinib在PsA、炎症性肠病和SLE患者中的治疗潜力(表3)。 布鲁顿酪氨酸激酶(BTK)抑制剂也有望通过调节B细胞功能来改善自身免疫性炎症。目前正在研究BTK抑制剂在各种自身免疫性疾病中的应用,包括RA、MS、pSS和SLE。最近一些使用BTK抑制剂的II期试验在复发性MS患者中显示出有希望的结果。 激酶抑制的未来方向是基于先进的分子技术开发更具选择性的抑制剂,具有最小的脱靶效应和更高的器官特异性。此外,应广泛研究由不受调节的细胞行为引起的除改善炎症以外的靶向效应。最近的证据表明,接受托法替布治疗的患者面临心脏事件、恶性肿瘤、血栓形成和死亡的风险增加,FDA已决定修改JAK抑制剂的黑框警告。自身免疫性疾病的慢性病程引发了对长期药物使用的安全性担忧,这会严重影响患者和医生的药物选择。【NO.6】新兴免疫疗法 随着对自身免疫性疾病免疫发病机制的更好理解和生物技术的不断进步,许多具有新治疗靶点和先进疗效的药物不断被开发出来,显示出有希望的疗效。尽管如此,仍然存在未满足的医疗需求,例如异质性治疗效果和免疫抑制引起的不良事件。为了克服当前治疗的局限性,炎症性疾病的治疗方法已经多样化和个体化。在这里,我们简要介绍了由先进分子工程技术实现的靶向免疫治疗的新视角。嵌合抗原受体(CAR)T细胞疗法 CART细胞疗法的基本概念是施用含有基因工程TCR的自体T细胞,以捕获肿瘤特异性Ag并通过增加细胞毒性来消除肿瘤细胞。在弥漫性大B细胞淋巴瘤患者治疗成功后,CD19CART细胞疗法被批准用于治疗B细胞淋巴瘤和急性淋巴细胞白血病。 CAR是由胞外Ag识别结构域、跨膜结构域和胞内T细胞激活结构域组成的工程化受体。细胞外结构域,也称为单链Fv,被设计为单克隆抗体的可变重链和轻链。细胞外结构域对Ag的识别会激活细胞内结构域上基于免疫受体酪氨酸的激活基序,导致细胞因子的产生和靶细胞的裂解。为了提高治疗效果,细胞内结构域由一个激活结构域CD3ζ和一个共刺激结构域(如CD28)组成。 尽管CART细胞最初被引入肿瘤学领域,但它们消除病理细胞的治疗潜力延伸到自身免疫性炎症性疾病的治疗。最近,Mougiakakos等人报道了自体CD19CART细胞疗法在常规治疗难治性SLE患者中的快速临床缓解。在该患者中,单次给药后7周内可在外周血中检测到输注的CD19CART细胞,抗dsDNA抗体快速且持续下降。这是一个有希望的结果,因为目前抗CD20mAb的B细胞耗竭需要定期注射并注意免疫原性以维持初始治疗效果。 随着工程T细胞疗法的发展,嵌合自身抗原受体(CAAR)T细胞和CARTreg疗法作为自身免疫性疾病的新型治疗策略而受到关注。CAART细胞的胞外结构域表达一种自身抗原,该抗原可与Ag特异性自身反应性B细胞和T细胞相互作用。CAART细胞疗法可能对具有已知自身抗原的自身免疫性疾病有效。CARTreg细胞的设计也期望产生Ag特异性免疫调节反应,而输注多克隆Treg细胞无法充分实现这种反应。然而,这种针对自身免疫性疾病的工程化T细胞疗法尚未得到广泛研究。此外,尽管工程化T细胞疗法具有假设的治疗效果,但细胞因子释放综合征和神经毒性可能会限制对细胞疗法在自身免疫性疾病中使用的热情,尤其是在高炎症微环境中。低剂量IL-2疗法 IL-2是Treg细胞分化、激活和存活的关键细胞因子,主要由活化的CD4+T细胞产生。Treg定义为CD4+FOXP3+CD25+CD127低表达,通过分泌抗炎细胞因子(IL-10、肿瘤生长因子-β和IL-35)、DC诱导免疫抑制酶(吲哚胺2,3-双加氧酶)、效应T细胞和NK细胞失活以及对CD8+T细胞和NK细胞的直接细胞毒性。Treg细胞缺陷和/或功能障碍常见于RA、SLE、pSS和AS等各种自身免疫性疾病。 除了激活Treg细胞外,IL-2还诱导效应T细胞的存活和增殖,并抑制Th17细胞分化。基于其对常规T细胞的刺激作用,大剂量IL-2疗法首次被批准用于转移性肾细胞癌和转移性黑色素瘤。然而,后来的研究表明,IL-2的主要作用是通过在Treg细胞上表达的高亲和力IL-2R介导的。IL-2R以单体、二聚体和三聚体变体表达,三聚体IL-2R的亲和力高于单体和二聚体形式。由于Treg细胞在高水平上组成性表达三聚体IL-2R,因此Treg细胞对IL-2比效应记忆CD4+T细胞高度敏感。因此,已在自身免疫性疾病中评估了低剂量IL-2疗法(0.3至300万国际单位/天),预计它将通过Treg刺激诱导免疫耐受,同时对效应T细胞的影响最小。 在自身免疫性疾病(包括SLE、PsA和丙型肝炎病毒诱导的冷球蛋白血症血管炎)患者中,低剂量IL-2疗法改善了临床结果,这与Treg细胞的增加一致。在临床试验中,低剂量IL-2具有可耐受的安全性,并且与感染风险增加无关。此外,在小鼠中,低剂量IL-2长期治疗不会损害对疫苗接种、感染和癌症的免疫反应。 良好的临床试验结果导致开发了氨基酸序列改变的工程化IL-2蛋白(IL-2突变蛋白),以提高选择性并减少不良反应。IL-2与生物疗法(如TNF和IL-6抑制)的组合也正在研究中。免疫耐受诱导 在不破坏免疫系统其他部分的情况下诱导对自身抗原的免疫耐受是治疗自身免疫性疾病的理想方法。在这方面,可以诱导Ag特异性免疫耐受的口服耐受性已经研究了一个多世纪。肠道相关淋巴组织(GALT)是最大的免疫器官,可维持对大量食物和共生微生物的耐受性。鉴于GALT在肠道稳态和全身调节中的作用,饲喂Ags对系统性自身免疫性疾病的耐受性影响已在临床前和临床试验中得到广泛研究。在动物模型中,发现口服耐受诱导可有效预防甚至治疗各种炎症性疾病,包括炎症性关节炎、实验性自身免疫性脑炎、糖尿病和葡萄膜炎。根据Ag的剂量,低剂量的Ag会促进分泌IL-4、IL-10和TGF-β的Treg细胞的产生,而高剂量的Ag会促进特定T细胞的克隆缺失或无反应。然而,这种免疫耐受机制并不排斥,可以重叠。 口服耐受诱导的早期试点试验和II期试验也显示出对RA、MS和葡萄膜炎患者有希望的结果,而没有治疗相关的毒性。然而,在RA和MS患者中进行Ag喂养的III期试验显示治疗效果不佳。尽管Ag喂养具有实验效果和可接受的安全性,但仍需要解决未解决的问题才能成功诱导免疫耐受:(1)Ag喂养方案(Ag的剂量和类型、粘膜佐剂的使用和给药频率);(2)与常规免疫抑制药物联合治疗;(3)反映口服耐受性发展有效性的生物和免疫标志物;4)选择适合诱导口服耐受的患者(年龄、疾病发作和脱敏史)。 抗原特异性耐受性的另一种方法是递送自身抗原的耐耐受性疫苗。致耐受性疫苗已成功诱导Ag特异性Treg细胞,并在自身免疫性疾病的动物模型中促进自身反应性T细胞无反应和细胞凋亡。已经研究了几种耐受性原疫苗平台,包括基于蛋白质/肽、纳米颗粒、细胞和DNA/RNA的疫苗,以增强MS临床前和临床研究中的免疫原性。尽管使用肽疫苗的III期试验未能显示出临床益处,但仍在使用MS患者的多种疫苗平台对耐受性方法进行研究。 最近,Krienke等人报道了在髓鞘少突胶质细胞糖蛋白(MOG35-55)诱导的实验性自身免疫性脑脊髓炎小鼠模型中,使用基于非炎性mRNA的疫苗成功诱导免疫耐受。尽管双链RNA分子在细胞外环境中具有固有的促炎性,但用1-甲基假尿苷(m1Ψ)取代尿苷会降低其促炎性质。MOG35-55编码m1Ψ修饰的单链mRNA疫苗可预防小鼠疾病的发展和进展。致耐受性疫苗诱导MOG35-55特异性FOXP3+Treg细胞并抑制MOG33-35特异性Th1和Th17细胞。PD1和CTLA4等抑制分子在Ag特异性细胞上的表达上调,疫苗的保护作用被PD1和CTLA-4靶向检查点抑制剂消除。 尽管如此,耐受性疫苗的开发具有挑战性,因为哪些自身抗原对自身免疫性疾病具有特异性尚无定论且存在争议,并且多种自身抗原可能涉及大多数自身免疫性疾病。【NO.7】结论 过去几十年来靶向免疫治疗的进步彻底改变了自身免疫性疾病患者的治疗和临床结果。目前的靶向免疫疗法通过阻断炎性细胞因子、细胞表面分子和细胞内激酶来抑制主要的促炎信号通路。尽管靶向治疗在自身免疫性疾病中取得了巨大成功,但在药物疗效和长期安全性方面仍未满足医疗需求。除了阻断炎症信号通路外,未来的疗法还旨在诱导长期的免疫耐受,同时保持保护性免疫功能。希望生物技术的进步和疾病知识将为开发具有更高治疗效果和最小不良反应的新药提供机会。此外,考虑到炎症介质和免疫细胞的多方面作用,需要开发更具选择性和特异性的药物,同时更精确地了解疾病发病机制。识别微信二维码,添加抗体圈小编,符合条件者即可加入抗体圈微信群!请注明:姓名+研究方向!本公众号所有转载文章系出于传递更多信息之目的,且明确注明来源和作者,不希望被转载的媒体或个人可与我们联系(cbplib@163.com),我们将立即进行删除处理。所有文章仅代表作者观点,不代表本站立场。

免疫疗法

2025-04-01

·梅斯医学

2025年1月,胡琼依副研究员在 The British Medical Journal【93.7,Q1】杂志在线发表题名为“Atrophic ear.”——萎缩耳的病例报告研究成果。瑞金医院风湿免疫科胡琼依副研究员为论文的通讯作者;陈珑芳博士研究生为论文的第一作者。doi:10.1136/bmj-2024-081185.2025年1月9日,胡琼依副研究员在国际权威期刊The British Medical Journal【93.6,Q1】杂志发表题名为“Atrophic ear”——萎缩耳的病例报告研究成果。本文报道了一名严重的复发性多软骨炎女性患者,该患者双耳及多关节肿痛3月余,并伴有反复发热、咳嗽。体格检查示双侧耳廓萎缩、鞍鼻畸形及多关节压痛。实验室检查示CRP、ESR升高,ANA 1:160,余自身抗体均阴性。PET-CT提示多软骨的炎症,无血管炎及恶性肿瘤依据。基于McAdam 诊断标准,确诊为复发性多软骨炎,并接受了激素联合环磷酰胺治疗,症状显著改善。随访8个月,患者在激素逐渐减量的维持治疗下病情稳定。耳软骨炎常见于复发性多软骨炎、肉芽肿性多血管炎、VEXAS综合征、感染性软骨炎以及创伤性耳血肿,如此典型且严重的病例少见。复发性多软骨炎是一种罕见的免疫介导的系统性疾病,主要影响软骨和结缔组织,特别是耳、鼻、喉、气管和支气管软骨,严重者可引发气管塌陷或急性肾衰竭,需早期诊断与干预。该疾病临床表现异质性大,且缺乏特异的实验诊断指标,极易漏诊、误诊、延诊。该病例报道系统性梳理了耳软骨炎的鉴别诊断,包括复发性多软骨炎、肉芽肿性多血管炎、VEXAS综合征、感染性软骨炎以及创伤性耳血肿等,为临床医生提供了诊断思路,尤其在复发性多软骨炎这一罕见病的诊治上具有指导意义。同时,通过该病例报道,提醒临床医生关注复发性多软骨炎等罕见病,特别是在耳廓萎缩、鞍鼻畸形等特征性表现的早期识别和鉴别诊断,提高诊断率,减少误诊和漏诊。作者介绍胡琼依 副研究员,主治医师,硕士生导师,上海交通大学医学院附属瑞金医院风湿免疫科科副主任,上海风湿病学青委副主委,中华预防医学会风湿病专委会青委;研究方向:自身免疫和自身炎症性疾病的基础和临床研究。陈珑芳 博士研究生,上海交通大学医学院附属瑞金医院风湿免疫科,研究方向:自身免疫和自身炎症性疾病的基础和临床研究。

2025-02-16

·医脉通

其实这种程度的病变,很难达到叶女士现在的不适,其中是否另有隐情呢?

来源 | 医脉通

作者 | 昼辞

01

腰痛,几乎每个人都有过类似的经历,尤其是那些年纪较大的劳动人民,最为常见。

这不,骨科门诊外早已聚集了一波波候诊求医的患者,我们今天故事的主人公——叶兰(化名)女士也在其中。

“疼,疼得睡不着的那种……虽然不是很剧烈,但吃了止疼药之后仍会一直持续存在。最近一个多月来,我因为腰腿疼都没有睡好。”叶女士和医生描述着自己的病情,愁眉紧锁,面露难色。

医生为叶女士快速查体后,发现其脊柱无明显畸形,腰椎过伸活动疼痛受限,双下肢感觉异常,四肢肌力和肌张力正常;双侧腿后外侧皮肤浅感觉减退;双侧直腿抬高试验阴性,关节反射及病理征均阴性;双侧足背动脉波动可及,肢端皮温、血运良好。

为了进一步检查,骨科门诊医生将叶女士收治入院。

02

腰痛虽然常见,但对于临床医生来说,越常见越不能忽视细节,更需要仔细鉴别。那么,什么是腰痛的原因呢?

常见的腰腿疼痛大致可分为三种类型:肌肉型腰腿疼痛、脊柱型腰腿疼痛以及病理性腰腿疼痛。

肌肉型腰腿疼痛即是由于肌肉原因引发的腰腿不适,这一类腰腿疼痛是生活中最常见的一种腰腿不适,包括腰肌劳损、股四头肌紧张等。

而脊柱型腰腿疼痛则是由于脊椎或椎间盘等脊柱内结构引发的腰腿不适的总称,包括腰椎间盘膨出、突出、游离等。

最后一类病理性腰腿疼痛则是由于疾病因素导致的腰腿不适,比如风湿、膝骨关节炎等。而还有一种腰腿型不适就是“神经型腰腿痛”,即坐骨神经损伤所致。

“我平时就是干点农活儿,搬搬抬抬的,前段时间开始腰疼之后才干得少了。”关于活动变化,叶女士这样回答。

由于叶女士自述常年从事重体力劳动,因此医生考虑的主要因素还是前两类,在予以止痛处理的同时,予以完善关节磁共振明确诊断。

结果如下:关节影像学提示双侧骶髂关节及邻近软组织、肌间隙病变,考虑感染性病变;胸腰椎也有不同程度的退行性改变;胸片、心脏彩超等检查未见异常。

其实这种程度的病变,很难达到叶女士现在的不适,其中是否另有隐情呢?

就在等待完善检查期间,叶女士开始出现了咳嗽、咳痰、流涕,她说,“也许是昨天空调开得有些低,可能是着凉感冒了吧。”

年轻医生顺着这个思路,嘱患者服用感冒药,但细心的主治医师却要求给患者再查一下胸部CT,并在影像学结果回报后请呼吸科医生会诊。

03

果不其然,叶女士的胸部CT提示:左肺下叶背段占位,伴左肺下叶背段支气管变窄,另双肺多发占位,部分伴小空洞形成,先考虑为感染性病变,金葡菌感染及肺克菌感染皆有可能,其他感染性病变不能排除,为肺癌伴肺内转移或均为转移瘤待除。

看到这一长串的字眼,既有“感染”,还有“肿瘤”,不免增加了患者的焦虑和心理负担。

图源:作者提供

而呼吸科医生会诊后建议给患者做纤支镜检查,必要时活检加以明确,毕竟病理才是“金标准”。

同时,叶女士也被转到了呼吸科,医生继续予以莫西沙星抗感染治疗,辅以止痛、消肿等处理,这也不禁让管床医生细细思考:如果真的是肺部感染造成的肺部空洞等,那么病人也没有发热等急性中毒症状,呼吸道症状也比较轻微,更无法解释肺内的其他占位性病变。

而其他的抽血检查,譬如肿瘤标记物、感染性指标、血常规等,这些依据都不足以支持目前的症状体征。

主任查房时,再次仔细阅片,发现叶女士肺部占位的结节浸润影,又伴有空洞,既不像单纯的感染,又不似只有肿瘤。难道是兼而有之,或是另有乾坤?

此时,自身免疫性疾病的可能性便陡然上升了!

于是,医生又给叶女士加查了自身免疫全套、ANCA相关性抗体、抗蛋白酶抗体等血检项目。结果显示,抗蛋白酶3抗体IgG及抗核抗体阳性,考虑韦格氏肉芽肿相关血管炎可能;而且复查胸部CT,其团块影也较前增大。

没想到,众里寻她千百度,病因竟指向这个问题。

04

当然,这样的结果还需要穿刺活检的病理才是最有力的证明。在和病人及家属充分沟通病情后,获得了同意。

风湿免疫科医生给出的意见是:

1.建议骶髂关节穿刺、组织培养、NGS检查;

2.继续贵科抗感染治疗,等感染控制后复查抗蛋白酶3抗体IgG。

同时与骨科原经管医生沟通,考虑目前骶髂关节病灶程度轻,暂不需穿刺。综合权衡之下,最终建议先行CT引导下肺组织穿刺送检相关病理、病原检测,患者及家属表示同意。

而后肺穿刺组织NGS回报:人疱疹病毒4型(BB病毒)序列数:344,人疱疹病毒6B型序列数:19。

病理提示纤维素性坏死及肉芽组织,间质大量急慢性炎症细胞浸润,未见肿瘤细胞,MGS未见细菌、真菌、结核证据。

目前仍考虑韦格氏肉芽肿相关血管炎可能,医生予以甲泼尼龙抗炎、洛索洛芬钠、氟比洛芬酯止痛、乙哌立松缓解肌紧张等处理。

05

就在众人都以为叶女士病情就要好转时,她双侧臀部再发疼痛,腰痛也有所加剧,并出现了发热症状,体温高达38.1℃,医生考虑莫西沙星抗感染效果欠佳,根据病情升级抗生素为利奈唑胺。

复查胸部CT可见病灶内部分空洞已经愈合,但其他病灶更多了,特殊感染亦不能排除,尤其是真菌性感染。

由于上一次的肺组织活检取材结果不够满意,因此需要再次安排气管镜检查,送检了肺泡灌洗液病原学和肺组织病理检查,结果真的证实了真菌性感染以及肉芽肿性炎症。

那么,这个韦格纳肉芽肿病究竟是何方神圣呢?竟然让患者辗转三个科室才最终确诊。

这是一种原因不明的累及全身多个系统的疾病,其标志性病理改变为坏死性、肉芽肿性血管炎,典型临床特征为累及上呼吸道、肺脏和肾脏的“三联征”。近年来本病又被称为肉芽肿性多血管炎(GPA)。

韦格纳肉芽肿病的病因至今尚不明确,目前认为其发病可能与遗传、感染和免疫因素有关。该病无喘息样症状,外周血嗜酸粒细胞增高不明显,主要是c-ANCA和(或)抗PR3-ANCA阳性,X线胸片特征性表现包括结节、空洞,且表现为多形、多变,活检组织病理可见少量嗜酸粒细胞。这也与叶女士的部分症状“不谋而合”。

轻型或局限型早期病例可单用糖皮质激素治疗,若疗效不佳应尽早使用环磷酰胺;有肾受累或下呼吸道病变者,开始治疗即应联合应用糖皮质激素与环磷酰胺;危重症可用大剂量甲泼尼龙冲击治疗。

对环磷酰胺不能耐受者可选用甲氨蝶呤,维持至病情缓解;上述治疗效果不佳者可试用环孢素、硫唑嘌呤、麦考酚吗乙酯、雷公藤总苷等,也可考虑应用生物制剂如利妥昔单抗等。

最终,经过系统评估及用药治疗后,叶女士的病情才算有了明显改善。

医生感叹,所幸发现得早,没有让这隐秘的症状掩盖真实的病情。接下来的时间,定期随访和规范用药即可。

参考资料:

[1] Pagnoux C,Guillevin L.Treatment of granulomatosis with polyangiitis (Wegener’s)[J].Expert Review of Clinical Immunology,2015,11(3):339-348.

[2] 嗜酸性肉芽肿性多血管炎诊治规范多学科专家共识编写组.嗜酸性肉芽肿性多血管炎诊治规范多学科专家共识[J].中华结核和呼吸杂志,2018,41(7):514-521.

责编|米子 阿泰

封面图来源|视觉中国

重磅!中纪委发文:促进全国医疗服务价格项目统一规范 | 医脉政事儿

这36个科室的创意元宵祝福语太走心了,网友:有种诡异的吉祥感,怕不是想让医院倒闭吧

医脉通是专业的在线医生平台,“感知世界医学脉搏,助力中国临床决策”是平台的使命。医脉通旗下拥有「临床指南」「用药参考」「医学文献王」「医知源」「e研通」「e脉播」等系列产品,全面满足医学工作者临床决策、获取新知及提升科研效率等方面的需求。

☟戳这里,更有料!

分析

对领域进行一次全面的分析。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

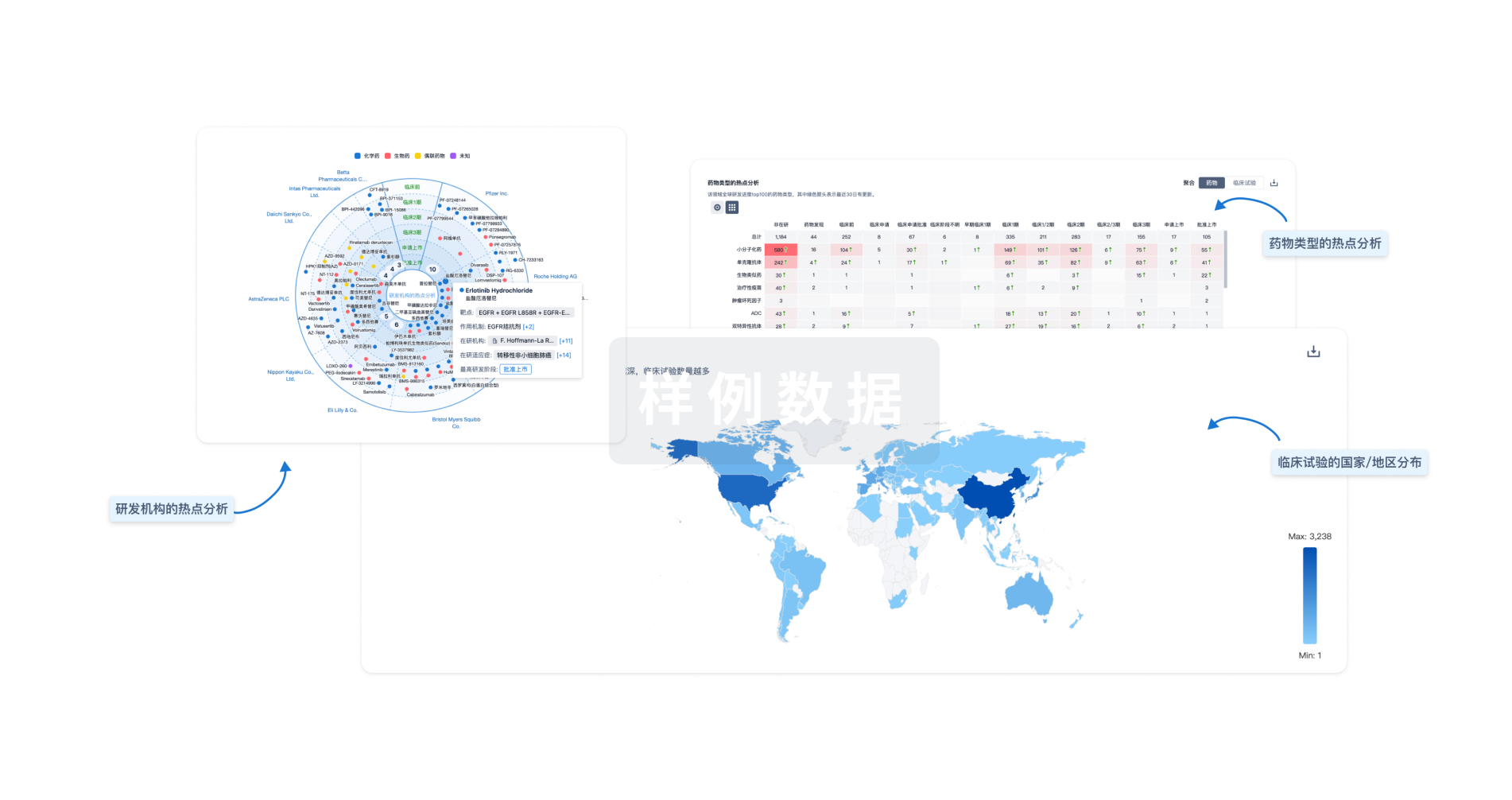

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用